This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

S&P Higher by 1.5%; Barclays, Altria, Lumen Price $ Bonds; ChemChina, Symgenta, Sinochem Intl Upgraded

August 5, 2025

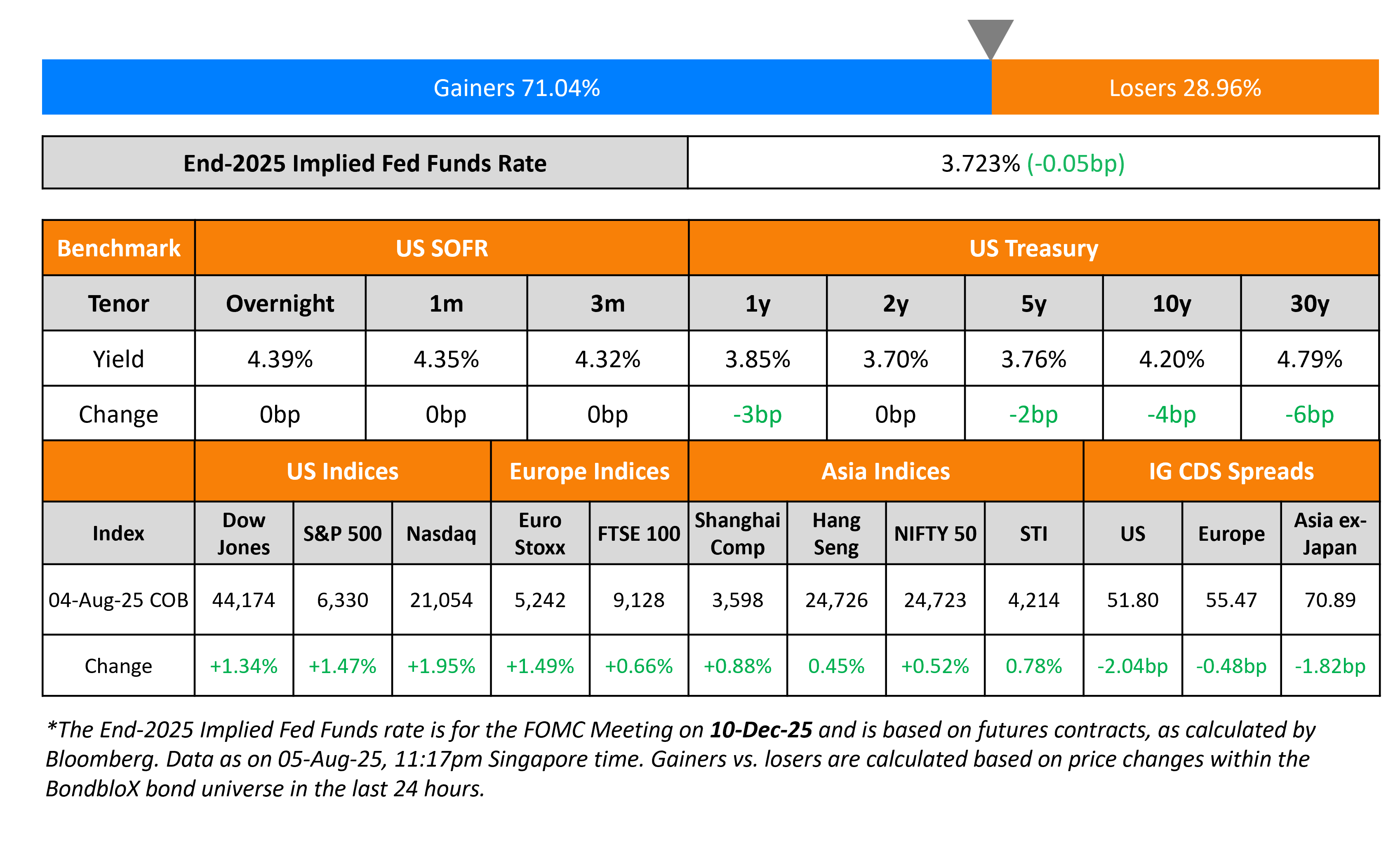

US Treasury yields eased further on Monday, led by the long-end. The 10Y and 30Y yields fell by 4bp and 6bp respectively. Factory Orders fell by 4.8%, in-line with expectations. The final Durable Goods Orders print for June saw a 9.4% drop, slightly lower than expectations of a 9.3% drop. San Francisco Fed President Mary Daly said that the time for rate cuts was nearing, adding that “the more likely thing is that we might have to do more than two” cuts. She cited the softening jobs market, adding that there were no signs of persistent tariff-driven inflation.

Looking at US equity markets, the S&P and Nasdaq closed higher by 1.5% and 2.0% respectively. US IG CDS spreads were 2bp tighter and HY CDS spreads tightened by 10.1bp. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads tightened by 0.5bp and 4.2bp respectively. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were 1.8bp tighter.

New Bond Issues

Barclays raised $3.25bn via a three-trancher. It raised:

- $500mn via a 4.25NC3.25 FRN at SOFR+108bp vs initial guidance of SOFR equivalent area

- $1.5bn via a 4.25NC3.25 bond at a yield of 4.47%, 27bp inside initial guidance of T+110bp area

- $1.25bn via a 21NC20 bond at a yield of 5.86%, 35bp inside initial guidance of T+145bp area

The senior unsecured notes are rated Baa1/BBB+/A. Proceeds will be used for general corporate purposes of the group and its subsidiaries, and to further strengthen their capital base.

Altria raised $1bn via a two-part offering. It raised $500mn via a 5Y bond at a yield of 4.6%, 25bp inside initial guidance of T+110bp area. It also raised $500mn via a 10Y bond at a yield of 5.322%, 28bp inside initial guidance of T+140bp area. The senior unsecured notes are rated A3/BBB+/BBB. Both notes have a change of control put at 101. Proceeds will be used for general corporate purposes. The new 10Y bond is priced at a new issue premium of ~10bp over its existing 5.625% 2035s that currently yield 5.22%.

Lumen raised $2bn via an 8.5NC3 bond at a yield of 7%, in-line with initial guidance. The senior secured first lien bond is rated B1/B+. The issuer is Level 3 Financing. The deal was upsized to $2bn from $1.25bn. Proceeds, together with cash on hand, will be used to partially redeem $1.075bn in aggregate principal of its 11% first lien notes due 2029, including payment of redemption premium. Lumen also reported its earnings, narrowing its losses and lifting its free cash flow forecast by over 60%.

Rating Changes

-

Fitch Upgrades Sinochem International to ‘A-‘; Outlook Stable

-

Fitch Revises Stellantis’ Outlook to Negative; Withdraws Ratings

Term of the Day: Change of Control Put

A change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On Burned Credit Investors Finding Relief in Cleaner, Reworked Debt

Rishi Goel, Aegon Asset Management

“We’re substantially focusing our time on post-LME structures we haven’t been involved with…A lot of our new investments are coming from that pool.”

Holly Kim, Glendon Capital

“In a lot of situations, participating in the LME is a consolation prize, trying to salvage some value from a loss-making position…But the investment becomes a lot more interesting, if you don’t have to lose money first.”

Wariz Anifowoshe, Fortress Investment Group

“Only people who really understand credit documents will be able to add all of the necessary protections to them”

On US Dollar Seen at Risk From Trump’s Moves to Pick Policymakers

Robert Bergqvist, SEB AB

“we are witnessing new serious attempts to concentrate more and more power in the hands of the White House…All of this justifies increased risk premiums for holding different US assets.”

Elias Haddad, Brown Brothers Harriman

“Trump’s effort to pressure Powell and his colleagues to lower rates undermines the Fed’s independence while McEntarfer’s dismissal risks damaging perception of US economic data integrity”

On Corporate Credit Markets Flashing Signs of Complacency – Matthew Mish, UBS

“US and European markets display a mix of optimism and underlying risks that could lead to potential vulnerabilities, but the US looks more complacent…While US credit markets have historically proven resilient to labor market hiccups, more recent examples show spreads can widen by as much as 20bp in high grade and 75 bp in high yield”

Top Gainers and Losers- 5-Aug-25*

Go back to Latest bond Market News

Related Posts: