This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Russia-Ukraine Crisis: Impact on Bonds & CDS Spreads

September 28, 2022

Timeline and Latest Updates

- September 28, 2022: Russia’s gas producer Gazprom said that its EBITDA for 1H 2022 more than doubled to RUB 3tn ($52.5bn) and average exporting gas prices increased more than 3.5x YoY. The company said that it reported a record net profit of RUB 2.5tn ($41.8bn) in 1H 2022 and its board recommended paying interim dividends of RUB 1.2tn ($20.3bn) after skipping the annual payout for 2021 for the first time in the last 24 years. Gazprom announced yesterday that it would halt gas deliveries to Europe via its Nord Stream 1 pipeline for three days due to maintenance requirements while also suspending flows to French utility Engie from Thursday, due to a payment dispute.

- September 23, 2022: Russia’s state-owned gas producer Gazprom raised its 2022 investment program by RUB 222bn ($3.6bn) to RUB 2tn ($33.4bn). Capital expenditures increased by RUB 319.1bn ($5.2bn) to RUB 1.75tn ($28bn) due to additional funds for development of gas producing centres in the Yamal Peninsula and eastern Russia.Gazprom’s dollar bonds were trading stable at 51-57 cents on the dollar.

- September 20, 2022: Russia’s Gazprom said that its subsidiary Gazprom Capital will issue new local RUB-denominated bonds in order to replace its GBP-denominated 4.25% 2024s with an amount outstanding of £850mn ($970.02mn). This comes after a proposal by their central bank, where they allowed companies to issue “replacement bonds” as a substitute for Eurobonds as Russian corporate were not able able to repay them due to sanctions. Gazprom’s dollar bonds were trading stable at 51-57 cents on the dollar.

- September 19, 2022: Asset manager PIMCO has bought over $1.4bn of Russian government bonds as part of an auction to settle CDS trades. The purchases of these bonds were made to replace the exposure it had by selling CDS contracts to investors to protect them against defaults by the Russian government. PIMCO already had about $900mn of Russian bond exposure before the new bid. Given that the auctions settled at 56.125 cents on the dollar, higher than it would have several months ago (at ~20 cents on the dollar), Bloomberg noted that PIMCO would likely make a gain. The company would now pay around $176mn due to the delay in the settlement of the auctions, instead of a potential erstwhile $320mn to its CDS buyers. Separately, Russia’s Rosneft raised RMB 15bn ($2.15bn) via a yuan-denominated bond issuance. The bond’s tenor was 10Y with a 3.05% coupon to be paid annually. Russian companies have been tapping into the yuan bond market to cut their reliance on USD amid international sanctions.

- September 13, 2022: CDS auctions on Russia’s offshore bonds have determined a settlement price of 56.125 cents on the dollar, implying that CDS holders will now receive a payout of 44 cents on the dollar (44%) for every dollar of protection they bought. The payout is lower than what was determined during the first round of the auction where the CDS settlement price was seen at 48.375 cents on the dollar.. IFR notes that while the payout is fairly substantial, it was much lower than the levels at which Russian bonds were trading after the war. At that time, they were trading at about 20 cents on the dollar, suggesting a potential 80% payout on its CDS. The auction began after the Credit Derivatives Determinations Committee ruled that Russia was in default on its external debt after US sanctions rendered the country incapable of making good on its bond payments. Athanassios Diplas, a former Deutsche Bank executive said, “This time, the physical settlement request was sizeable and the imbalance between buyers and sellers of bonds was enough to push the final CDS settlement price several points away from the initial midpoint and lower the payout somewhat”.

- September 12, 2022: Russia’s dollar bonds have risen by over 15% in the last couple of trading sessions. While there has been no specific news causing the rally, Russian dollar bonds have more than doubled post mid-July. This happened after the US Treasury opened a three-month window for banks to help investors holding Russian bonds to wind down their positions. Last week, the Russian government planned to resume sales of its local bonds known as OFZ (Federal Loan Obligations) to finance its federal budget, as per Interfax. The government will tap existing issues for RUB 10-20bn ($160-330mn) issuance in its first auction. The government intends to test the market for the next few weeks with limited volume issuances. Separately Ukraine’s state-owned energy firm Naftogaz initiated a new arbitration proceeding against Russia’s Gazprom after it did not pay for the rendered service of gas transportation through Ukraine.

- September 1, 2022: Naftogaz’s bondholders approved a partial debt restructuring seeking a two-year extension for the company’s debt payments. Holders of its 2024s had agreed for push-back payments with a 77% voting agreement. However, bondholders of its 2026s refused the proposal with only 43% of the votes in favor vs. the requirement of 75% agreement. The Ukrainian state-owned firm is already in default as it missed $1bn in debt payments in the last month. CEO Vitrenko said, “Yields are too high, market values are too low compared to the nominal value, so that’s why it’s not an easy sell… The support of the European Bank for Reconstruction and Development, a major holder of the 2024 bonds, had been critical in ensuring that positive outcome.”

Naftogaz’s 7.625% 2026 currently trading at levels of around 23 cents to the dollar.

- August 22, 2022: Ukraine was upgraded to CCC+ from SD by S&P following the completion of Ukraine’s Eurobond restructuring. The sovereign restructured about $22.6bn in sovereign Eurobonds and about $1.5bn of state-guaranteed Eurobonds after receiving majority bondholders’ consent to extend principal and interest payments by 24 months. Ukraine has strong and committed international financing support and the restructuring has helped ease its burden until September 2024. Thus S&P notes that near-term risks to liquidity and ability to pay debts are “manageable”. The above rating action comes after Fitch, which also upgraded Ukraine last week to CC from RD on the same grounds.

Separately, The Credit Derivatives Determinations Committee (CDDC) said that it expects to hold an auction to settle Credit Default Swaps (CDS) related to Russia’s defaulted debt in the first half of September.

- August 18, 2022: European banks have restarted the trading of Russian bonds by their clients after the US Treasury’s nod in July for investors to wind down positions. The US Treasury’s Office of Foreign Assets Control (OFAC) opened a three-month window on July 22 for banks to help investors with Russian bonds to wind down their positions after having imposed sanctions on the trading of Russian debt. Those like UBS, Barclays and Deutsche Bank have now resumed allowing clients to sell their Russian debt holdings, akin to that by JPMorgan Chase, Bank of America, Jefferies and Citigroup in the US. However, Credit Suisse and HSBC have not yet restarted the same, with sources noting that their lower risk tolerance was the factor.For the full story, click here

Ukraine was upgraded to CC from Restricted Default (RD) by Fitch following its consent solicitation on August 11 to restructure its external debt, which won 75% of bondholders’ consent. This would help defer $6bn in principal and interest payments for two years, thereby easing its debt servicing pressure. Fitch adds that a broader restructuring is probable with the timing being uncertain as they expect the war to extend into 2023 and the sovereign’s public debt to surpass 100% of GDP. Thus, despite the upgrade, the rating agency notes that debt sustainability risks continue to linger and weigh on the country. This has further been exacerbated by its international reserves falling by $5.7bn to $22.4bn in the four months ending July, driven by financial account outflows. Ukraine is rated at Selective Default (SD) by S&P, while Moody’s currently rates it at Caa3.

Ukraine’s dollar bonds were trading slightly weaker with its 9.75% 2028s down 0.3 points to 26 cents on the dollar.

Naftogaz’s proposal to suspend its debt payments for 2 years was rejected for the second time by bondholders. The Ukrainian state-owned oil and gas company had missed coupon payments on its debt maturities last month, in light of Russia’s invasion. It is trying to follow suit on Ukraine’s debt freeze, however less than 20% of the holders of its 2022s had voted in favor of the sweetened proposal. For its 2024 and 2026 notes, not enough bondholders had voted so the consent solicitation process was postponed to August 31. Reuters notes that Naftogaz strongly urges “noteholders to support the proposals to be considered at the adjourned meetings”.

Kondor’s bonds are currently trading at levels of around 23-24 cents to the dollar.

- August 15, 2022: Ukraine was downgraded to Selective Default (SD) from CC by S&P. Ukraine had received the required consent of the majority of its Eurobond holders to defer debt service payments by 24 months. S&P views the above transaction as distressed and tantamount to default. The rating agency said that once the foreign currency debt restructuring gets implemented and the amendments to the bonds’ terms and conditions become legally effective, the nation could receive an upgrade. While the local currency ratings were also cut to CCC+ from B-, S&P added that it could further lower them if there are signs that UAH-denominated payments could suffer default or restructuring.

Separately, Ukraine’s Chief Economic Adviser, Oleg Ustenko, said that the nation was in touch with the IMF for an ~18-month fresh financing as an anchor for a larger package of $15-20bn to help the country weather its crisis.

- August 12, 2022: Russia’s state-owned Gazprom’s financing arm Gaz Capital requested holders of its $750mn dollar-denominated 4.95% 2027s to allow the naming of a new trustee after its original trustee Deutsche Bank resigned in May, citing EU sanctions. Additionally, Gaz Capital also requested that the new trustee will have the power to appoint a co-trustee in case its new trustee gets caught in sanctions. The Russian oil firm also requested the grace period to be extended to 30 business days.

- August 11, 2022: Ukraine’s international bondholders have broadly supported its request to defer any payments on its $20bn of offshore bonds for the next two years. It managed to garner approval from 75% of its bondholders and more than 50% for each issue to change the terms of its debt. Stuart Culverhouse, chief economist at London-based research firm Tellimer said, “The two-year debt freeze makes sense because even if the war ends soon, Ukraine’s situation is not going to improve overnight…Creditors were even surprised that the country decided to be current on the bonds until now.” With the debt freeze in place, Ukraine is expected to save about $5-6bn on payments, which will help the war-torn nation strengthen its economy and military. While the debt freeze supports Ukraine’s immediate financial and economic needs, a comprehensive debt restructuring is expected after the two years. Carlos de Sousa, emerging markets debt portfolio manager at Vontobel Asset Management said, “This will improve the foreign currency cash flow for Ukraine, but by itself it’s unlikely to be sufficient to stabilize FX reserves…it is unlikely that Ukraine will be able to regain market access in two years.” Ukraine’s reserves stand at $22.4bn in July, after dropping from $28.1bn in March.

- August 10, 2022: Russia’s current account surplus has tripled to almost $167bn since the start of the year, compared to $50bn in the same period last year. This is largely a result of a decline in imports amid sanctions imposed on them and surging revenues from energy and commodity exports. Meanwhile, Ukraine has gained the necessary approval from holders of its $2.6bn of outstanding GDP warrants to change its terms and conditions. Separately, the World Bank has said that it is moving to provide a $4.5bn grant for Ukraine from the US that will help the war torn nation meet its urgent needs, including healthcare, pension and social payments.

- August 05, 2022: Russia’s oil producer Lukoil is offering a discount of more than 20% as it seeks to repurchase $6.3bn of its outstanding bonds in order to avoid any block in payments to foreign holders that could result in a potential default, Bloomberg notes. Lukoil’s bonds rallied up to 9% after the announcement. If the company buys back all its outstanding notes at the stipulated prices offered, it can save up to $1.3bn in principal alone. The bonds for buyback include its 4.563% 2023s ($1.1bn, at 90% face value), 4.75% 2026s ($1bn, 78%), 2.8% 2027s ($1.1bn, 77%), 3.6% 2031s ($1.1bn, 73%) and 3.875% 2030s ($1.5bn, 73%). The financial performance of Lukoil is expected to improve on higher crude oil prices.

- August 04, 2022: S&P cut Belarus, Russia’s closest neighboring ally, from CC to D following its default on a $23mn coupon payment on its USD-denominated 7.625% 2027s that was due in June. On the repayment due date, the government tried to pay the coupon using Belarusian rubles, a currency not stipulated by the bond’s original terms. The Eastern European nation has been struggling to make payments on foreign-denominated debt ever since sanctions were imposed on it, cutting it out of global financial infrastructure. The bond in question is currently trading at 12.5 cents to the dollar, lower by 0.13 points.

Separately, Ukraine’s DTEK Energy, the largest private electricity and coal producer in the country, intends to fork out $29.5mn to pay out its coupon on its 7% 2027s. This will be the second consecutive quarter where it has made a full coupon payment, in stark contrast to other Ukrainian companies which are seeking debt freezes or amendment of debt terms. Its 7% 2027s are trading 2.5 points higher at 21.5.

- August 03, 2022: Post default, Naftogaz came out with a new debt-payment-freeze plan, which includes a two-year payment freeze and two-year deferral on the bonds, maturing in 2022, 2024 and 2026. The notes would pay additional interest while deferred interest would continue to accrue at the set rates of each note. The bonds under consideration are the $335mn 7.375% 2022s; the €600mn 7.125% 2024s and the $500mn 7.625%2026s. According to the document, “The consent solicitation was launched through financial arm Kondor Finance, in light of the prolonged circumstances affecting Ukraine as a result of the ongoing full scale military invasion, looks to facilitate preservation of available cash by Naftogaz to support Ukraine’s strategic priorities.” Proposal voting will end on August 12 and the meeting will be held on August 17. The Ukrainian government allowed Naftogaz to proceed with the restructuring process.

Separately, Russia’s oil producer Lukoil has initiated a buyback offer for $6.3bn of bonds to avoid any block to its payments to foreign holders, as it seeks to avert a potential default.

- August 01, 2022: After being downgraded by Fitch two weeks ago, Ukraine has been downgraded by S&P to CC from CCC+. The downgrade was prompted by Ukraine asking foreign creditors to delay bond payments on its sovereign debt.

- July 27, 2022: Ukraine is looking to secure a $15-20bn loan programme with the IMF by year-end to revive its economy, its central bank governor Kyrylo Shevchenko said. The country is facing a $5bn monthly fiscal shortfall and is highly dependent on Western partners for financing. Ukraine also aims to start a swap line with the Bank of England (BoE) within weeks.

Separately, Ukraine’s state-owned company Naftogaz is on track to default on international bonds after creditors have rejected its debt moratorium proposal. The grace period for its $335mn bonds ended on Tuesday. It will be the first Ukrainian state-backed entity to face a hard default. Ukraine’s government dollar bonds were trading at distressed levels of 20-21 cents on the dollar.

- July 26, 2022: Naftogaz is putting together a new debt relief plan after bondholders rejected its debt relief plan, which would freeze payments on about $1.4bn of bonds for two years. The Ukrainian state-owned oil and gas company currently has its hands tied, with the government restricting it from servicing its debt to conserve cash.

- July 25 , 2022: Ukraine was downgraded from CCC to C by Fitch. This is in light of the Ukrainian government’s consent solicitation to suspend debt repayments for the next 2 years. The rating agency views this as a distressed debt exchange where there is a material reduction in terms, and where it is necessary to avoid default. The embattled sovereign will be further downgraded to RD (Restricted Default) when all parties have agreed to the amendment of the terms on the bonds. Last week, Ukraine had already obtained preliminary support from creditors including USA, UK and Germany for the deferral of debt repayments.

- July 21 , 2022: Ukraine is in talks with major international financial institutions regarding ways to reduce debt payments as per Yuriy Butsa, Ukraine’s commissioner for public debt management. “It’s a little early to talk about the mechanics, but we discussed these issues with these creditors and our thinking is going in this direction… We are talking with the IMF and other partners about what the solutions might be. We need liquidity from the IMF to replace these outflows”, he said. The news comes just a day after Ukraine obtained a preliminary agreement from government creditors and bondholders to suspend debt repayments from August 1 until at least end-2023.

Separately, Ukraine devalued its currency, the Ukrainian Hryvnia by 25% against the US dollar to 36.5686 from 29.25. The step was taken to improve Ukraine’s export competitiveness and support its economy amid the war.

Also, a grain export agreement to revive crops trade from Ukraine’s Black Sea ports will be signed by both Ukraine and Russia, according to Turkey. Trade of crops had been blocked since the war began and its resumption may help alleviate food supplies globally, analysts note.

- July 21 , 2022: Ukraine has obtained a preliminary agreement from government creditors and bondholders to suspend debt repayments from August 1 until at least end-2023. Bilateral lenders including Germany, UK and USA on Wednesday said payments would be suspended from next month. They also encouraged private bondholders to do the same. Besides, Ukraine said that it will invite holders of its other offshore bonds also to agree to similar terms having already received “explicit indications of support” from investors like BlackRock, Fidelity International etc. The creditors said that the move would support the government and people in Ukraine amid the war-induced crisis it currently is facing.

- July 20, 2022: Some offshore creditors of Russia’s Gazprom said that they received payments on their bonds. As per Reuters, a maturity payment on its CHF 500mn bond and two other offshore bonds that were due on June 29 were received by some creditors. However, a $1bn dollar bond payment payment due on Tuesday did not reach investors.

- July 18, 2022: Ukraine’s central bank’s deputy governor said that they have sold 12% of its gold reserves, amounting to $12.4bn. She said that the move was taken in order to ensure that importers are able to buy necessary goods for the country and not for pushing their local currency higher.

- July 13, 2022: Ukraine received $1.7bn in international financial assistance from the International Development Association and the United States Agency for International Development. The money will be used for state budget costs for medical services.

Separately, state-owned gas company Naftogaz which accounts 17% of state revenue has asked its international creditors for a payment freeze on its all debt for two years. This has raised fears among investors that the government may follow with the same for its $1bn bonds due in September 2022. The company has a $335mn bond maturing and two interest payments due on July 19. Bondholders can vote till July 21 on the debt freeze. Naftogaz said, “The five-month-old war had resulted in a “significant economic and business decline in Ukraine” and that the missed bill payments had “negatively affected its liquidity position”. - July 06, 2022: Gazprom’s dollar and swiss franc bondholders are facing delays in the payment of coupons as Citigroup is checking whether the payments are compliant with sanctions. The payment amounts on the dollar and franc bonds are $15mn and CHF 7.7mn ($8mn) and were due on June 29 and 30.

Separately, Russian mining group Nornickel’s head Vladimir Potanin said that he was weighing a $60bn merger with aluminium producer Rusal. He said that the move could strengthen their defences against any possible Western sanctions.

- July 04, 2022: Citigroup is in talks with privately-owned Russian companies like Expobank, Rosbank and Reso-Garantia regarding a potential sale of its consumer and commercial businesses, as per FT. Gazprom’s shares fell over 25% after shareholders blocked its plans to pay a total dividend of RUB 1.2tn ($21.8bn) due to the current situation with sanctions being imposed. This is the the first time since 1998 that Gazprom has not paid a dividend.

- July 01, 2022: Ukraine is considering the possibility of a debt restructuring as the nation’s funding option is at risk of running out. As per Bloomberg, the country has at least $1.4bn in principal and interest payments due by September 1. Ukraine is exploring options such as a consent solicitation or using Russia’s frozen assets as collateral. The IMF is offering advice and analysis about debt and financial situation.

- June 27, 2022: Russia defaulted on its offshore debt for the first time since 1918 as the grace period on $100mn of coupons on its dollar bonds expired. Russia’s Finance Minister Anton Siluanov said, “Anyone can declare whatever they like… But anyone who understands what’s going on knows that this is in no way a default.” Most recently Russia made ~$400mn in interest payments on its offshore bonds in local currency although the terms of the bonds did not allow that. Bloomberg cites Siluanov noting that it makes little sense for creditors to seek a declaration of default through courts because Russia has not waived its sovereign immunity, and no foreign court would have jurisdiction.

- June 24, 2022: Russia’s finance ministry said that it transferred the ~$235mn in coupons on its 4.25% dollar bonds due 2027 and 5.25% dollar bonds due 2047 to Russia’s National Settlement Depository. It has another $159mn due on Friday on a bond maturing in 2028.

- June 23, 2022: President Vladimir Putin signed a decree on Wednesday to establish a temporary procedure to avoid default on its Eurobonds. The government has 10 days to choose banks to handle payments on its Eurobonds under a new scheme, where Russia will consider its dues as fulfilled when it pays the notes in rubles.

- June 21, 2022: Ukraine’s presidential economic adviser Oleh Ustenko said that the nation will have to start creditor discussions regarding an external debt restructuring if the war with Russia continues for a long time.

- June 14, 2022: Wall Street majors JPMorgan and Goldman Sachs have withdrawn from handling trades of Russian debt since the US Treasury said investors in the US aren’t allowed to acquire them. JPMorgan said that it “will no longer be conducting certain client-related market making activities regarding Russian entities”.

- June 10, 2022: Russia added RUB 551.4bn ($9.5bn) to its emergency reserve fund in an effort to protect the economy from the impact of sanctions. The government said that the measures taken will help maintain economic development stability. Reuters notes that the boost in reserves come on account of extra profits generated by Russia’s vital oil and gas exports.

- June 8, 2022: The US Treasury imposed sanctions barring the purchase of bonds issued by Russian corporates or the sovereign that trade in the secondary markets. The new update implies that US firms can hold or sell Russian debt, but cannot purchase it. Bloomberg reports that the latest move was a surprise to investors and is expected to make a dent on those funds holding Russian bonds

- June 6, 2022: Russia’s National Settlement Depositary (NSD) will suspend euro-denominated transactions after the EU added the NSD to its extended sanctions list. Analysts had said that the EU sanctions would block NSD’s accounts in euros as well as in Euroclear and Clearstream, making it ‘impossible to service forex denominated bonds issued by the state and Russian companies’. The NSD called the situation as an emergency and the latest update brings it closer to default on its euro-denominated bonds after initial risks surrounded its ability to pay on its dollar bonds.

- June 2, 2022: Russia failed to pay $1.9mn in interest payments on its dollar bonds and will trigger CDS payouts worth several billions of dollars, as per Bloomberg. A Credit Derivatives Determinations Committee (CDDC) overseeing Europe said, “It voted ‘yes’ to a question on whether a “failure to pay credit event” occurred with respect to Russia.” Currently, $2.54bn of net notional CDS outstanding is linked to Russia which includes $1.68bn on the country itself. Russia has around $40bn of international bonds outstanding and close to $2bn in payments due by end-2022. As per Bloomberg and documents for other Russian Eurobonds, a failure to pay $1.9mn is not sufficient to trigger a cross-default across other instruments. The minimum threshold is an amount of at least $75mn.

- May 31, 2022: The Kremlin’s spokesperson said that the finance ministry proposed to apply a scheme similar to its gas-for-rubles used with foreign gas buyers for Russian Eurobonds. Thus, while Russia said that it has cash and is willing to honor its external debts, if pushed into default due to sanctions, they are mulling repayment of their Eurobonds in rubles.

- May 30, 2022: Russia’s National Settlement Depositary (NSD) said that it successfully paid coupons in foreign currency on two Eurobonds. It said that the coupons on the Eurobonds maturing in 2026 and 2036 were due on May 27 and paid accordingly. As Reuters indicates, this is a move showing that Russia has again averted a default. Ukraine was downgraded to CCC+ from B- by S&P. The rating agency expects the conflict with Russia to be protracted, adding to macro instability. It expects the government’s capacity to meet its offshore debt to remain contingent on “the flow of donor support”. Ukraine’s real GDP is expected to contract by 40% on the back of “collapsing exports, consumption, and investment”. Estimates suggest a fiscal gap of $5bn per month, with an annual deficit of 25% of GDP for 2022.

- May 26, 2022:The Russian Finance Minister said that Russia would pay its dollar debts in rubles after the US let a key sanction waiver expire earlier this week. Russia had wired $71.25mn for a dollar bond and €26.5mn for an EUR-denominated bond just a few days ahead of a US waiver. It has $100mn in foreign debt payments due on Friday, May 26. The bonds’ contracts do not allow it to pay for in rubles, thereby triggering a 30-day grace period before Russia could be in default.

- May 25, 2022: The US has let a key sanctions waiver expire where US banks and individuals will be barred from accepting bond payments from Russia’s government after 12:01a.m. New York time on Wednesday. Bloomberg notes the move indicates that the US would force Russia into default than allow the latter to drain its coffers to the benefit of US investors. For the remainder of 2022, Russia owes about $1bn in coupon payments on offshore bonds. Separately, Russian lawmakers on Tuesday gave an initial approval to a bill allowing Russian entities to take over foreign companies that have left the Russia in reaction to the Ukraine war.

- May 23, 2022: Ukraine was downgraded to Caa3 from Caa2 by Moody’s due to increased risks on its government debt sustainability in the aftermath of the invasion by Russia. The elongated military conflict increases the chances of a debt restructuring and risks of private sector creditors losing out. While Ukraine is receiving financial support in the short-term, the “resulting significant rise in government debt is likely to prove unsustainable over the medium term”. Moody’s estimates financing needs of ~$50bn for 2022, i.e., 35% of expected 2022 GDP and forecasts government debt at ~90% of GDP from around 49% at end-2021. In the event of a default, Moody’s expects a recovery of about 65-80%.

Russia wired $71.25mn for a dollar bond and €26.5mn for an EUR-denominated bond just a few days ahead of a US waiver allowing such transfers expiring on May 25. While it is unclear if the funds would reach foreign holders, the update indicates Russia’s intention to avoid default.

- May 20, 2022: Russia’s Finance Minister Anton Siluanov emphasized that the nation will service its offshore debts in Rubles if all options are blocked. He stated, “We are not going to call any defaults, we have money – unless Western countries make it impossible to service our debts… We will be able to pay and will pay foreigners in rubles as a last resort option if Western [financial] infrastructure is closed for us”. Meanwhile Russia’s central bank eased restrictions for banks to sell foreign currency except USD and EUR without any restrictions from May 20. The restrictions on the above two currencies are set to remain in place until September 9.

- May 18, 2022: The US Treasury Department is set to fully block Russia’s ability to make good on its dollar bonds after a a temporary exemption lapses on May 25, as per sources. The sources note that the exemption allowed Russia avert default on its government debt. Russia’s next sovereign payment is a dollar bond coupon on June 24. Overall, Russia has over $490mn in foreign-currency bond payments owed to creditors by the end-June.

- May 12, 2022: Gazprom will repay $3bn of bonds early. While EU’s sanctions forbid dealing with Russian state companies, there is a carveout for transactions “strictly necessary” for purchasing or transporting oil, natural gas and other commodities. According to a filing on May 4, the above carveout does not apply to some of its bonds and can trigger an “illegality event” clause for its bonds due September 2022 and November 2023. Hence these bonds need to be redeemed early.

- May 09, 2022: Gazprom’s 4.375% dollar bonds due September 2022 rose 19%. While there was no specific news on the company paying its bonds, Reuters notes that the company wrote to its European clients seeking to reassure them that they can keep paying for gas without breaching sanctions. They noted that the update is the latest indication that Russia is trying to find a way to ensure that the gas flows through to the continent.

- May 04, 2022: Russia is set to avoid a default on its offshore bonds after sources said that overdue payments on two of its eurobonds were sent to creditors. Reuters cites a senior US official confirming that the payment was made without using reserves frozen in the US, adding that the ‘exact origin of the funds was unclear’. This comes after Russia was due to pay $650mn on April 4 with its 30-day grace period expiring on May 4. In May, Russia has coupon payments due on May 27 for a dollar bond and euro-denominated bond. The Russian Finance Ministry confirmed that it made the payments to the paying agent, Citibank, N.A., London Branch.

-

April 28, 2022: Russia’s Lukoil made an offshore coupon payment of $34.2mn on its bonds due April 2023 with Bloomberg reporting that some in investors received the funds. How exactly did the company make the payment is not known yet. Lukoil made the payment only days after the company said its sanctioned CEO and founder would resign. Russian companies have been seeking alternative ways to make payments on offshore bonds including investigating debt swap measures.

- April 25, 2022: In the latest effort to be able to make payments on offshore notes due to western sanctions, Russia’s Sovcombank PJSC will offer a bond swap to its eurobond. The company was due to make a $12mn interest payment on its notes on April 7, but instead paid the bond in rubles on April 21. PAO Sovcombank will now register a new issue of urgent local subordinated bonds and offer Eurobond holders to exchange them for the new ruble-denominated bonds. Through this, holders will now be able to receive payments directly in Russia, bypassing the international payment sanctions.

- April 21, 2022: Russia was judged to have breached terms of two bonds by the Credit Derivatives Determinations Committee (CDDC) given that it paid the bonds in rubles instead of dollars. The committee rules that it was a “Potential Failure-to-Pay” event for CDSs. The bonds’ grace period ends on May 4.

- April 20, 2022: The Russian central bank said that it decided to ease foreign exchange currency control measures for export-focused companies outside of the commodities and energy sectors. Under the new measures, the foreign currency that the companies receive on exports can now be sold and converted within 60 days instead of the prior 3 days.

- April 19, 2022: Russia’s business lobby, the Russian Union of Industrialists and Entrepreneurs (RSPP) is discussing alternative ways to pay its offshore bonds with the government and the Central Bank. One alternative is where bondholders decide to change the foreign paying agent and registrar to the onshore National Settlement Depository (NSD). Another alternative is to organize payments to non-residents on special accounts in Russian banks, along with a right to sell the notes to the Finance Ministry/its agent. Through the above, companies can avoid a situation where foreign creditors can claim a default due to payment delays and also stop an overseas asset freeze against the companies.

- April 18, 2022: Russia may be in default after trying to repay its dollar bonds in rubles due to sanctions, according to Moody’s. The grace period on the bonds end on May 4 and if not repaid appropriately, may be considered in default as the bond has “no provision for repayment in any other currency other than dollars”.

- April 13, 2022: The EMEA Credit Derivatives Determinations Committee (CDDC) on Tuesday accepted a request to look into Russia’s potential payment failure on its offshore bonds. The matter concerns CDS protection buyers’ payoff if a potential default occurs that could see billions of dollars in default insurance. JPMorgan said in a note that $3.43bn of net notional Russia CDS are currently to be settled. This comes after Russia made a payment due on April 4 on two sovereign bonds in roubles instead of dollars as US Treasury sanctions did not allow the payment.

On related lines, Russian Railways denied that it was in default, saying that it paid all its debt obligations but that intermediaries blocked payments. This comes after a derivatives panel ruled that it was in default because of a “failure to pay.’

- April 12, 2022: Russian Railways JSC was ruled to be in default by the Credit Derivatives Determinations Committee after its coupon due on March 14 did not reach investors by the end of a 10-day grace period. Bloomberg notes that the above could set a precedent for the Russian government and local companies that now are under a similar situation due to sanctions.

- April 11, 2022:

- Russia was cut to SD from CC by S&P after it made coupon and principal payments on its offshore bonds due 2022 and 2042 in rubles. This was after the US Treasury halted dollar payments from Russia’s accounts in US banks. S&P added that the default looks inevitable since it does not expect that investors or the government would be able to convert the payments into dollar equivalents before the bonds’ 30-day grace period. S&P subsequently withdrew its ratings on Russia due to the EU’s decision to ban ratings on Russian entities.

- Russia’s Finance Minister Anton Siluanov said, “We do not plan to go to the local market or foreign markets this year. It makes no sense because the borrowing cost would be cosmic”. CDS implied probability of default on Russian debt stood at 99% last week, as per Bloomberg. On related lines, the nation said that it will sue and take legal action if it is forced to default\ on its debt, given that it has displayed its efforts to pay in both foreign currency and rubles.

- On another note, Russia relaxed its temporary capital control measures which were take to limit the drop in the rouble. It will now allow individuals to buy cash foreign currency and also scrapped a 12% commission for buying forex through brokerages. Regarding the former, the maximum amount that can be withdrawn until September 9 is $10,000.

- Separately, Germany’s banking regulator said that Russia’s VTB Bank was removed from controlling its European subsidiary VTB Bank SE. Also, the Irish Times reported that Russia’s Sovcombank PJSC is the first among the nation’s banks to say it will miss a payment on its offshore bonds due to sanctions

- April 08, 2022: Belarus is set to pay its offshore debt in local Belarusian ruble, given the sanctions on its payments. In a statement, the Belarusian government said that it has been “forced” to use local currency to service loans owed to the World Bank, EBRD and the Nordic Investment Bank. TD analyst Cristian Maggio says that while it is not clear if Belarus would use its own currency for all or a part of the payments, in either case, they would be “default scenarios”.

Separately, Russian Finance Minister Anton Siluanov said, “We will do everything so creditors receive their invested money from the Russian Federation”. He added that the ministry would also recommend Russian banks not to pay dividends on their 2021 results.

- April 07, 2022: Russia said it has set aside rubles to pay its international dollar bondholders where payment was due on Monday, but blocked by the US Treasury.

- April 06, 2022: US and its allies are set to impose a fresh wave of sanctions on Russia amid mounting global accusations of Russian war crimes. With the US Treasury blocking Russia’s sovereign USD-denominated bond payment on Monday, Russia’s probability of default derived from it 5Y CDS rose from 77.7% to 87.7% as per Bloomberg. Separately, Russia’s VTB Bank paid coupons in rubles to holders of its subordinated bonds denominated in USD and EUR. It made a total payment of RUB 255.7mn ($3.1mn) for coupons on two EUR-denominated bonds and RUB 312.3mn ($3.7mn) on its USD-denominated bond.

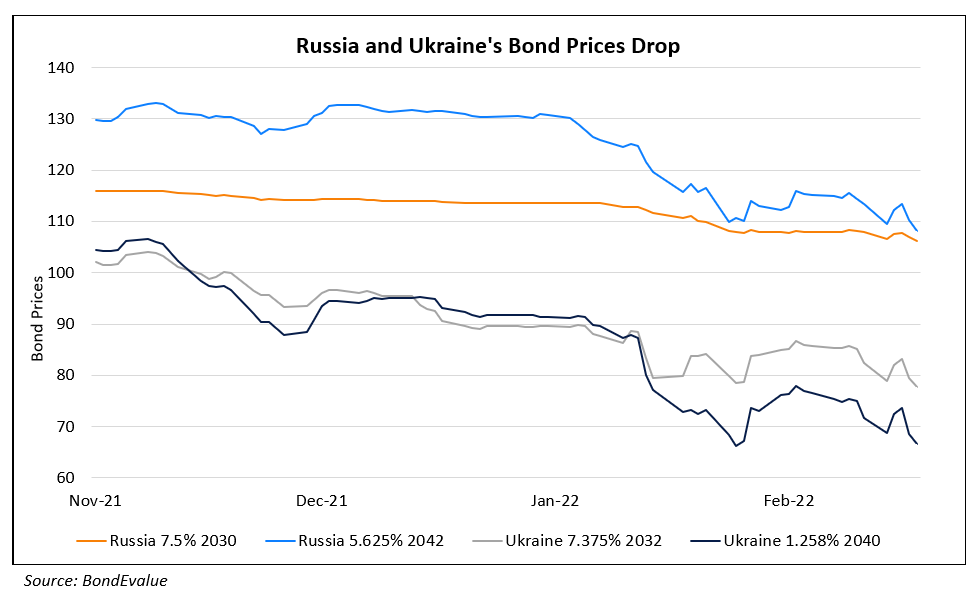

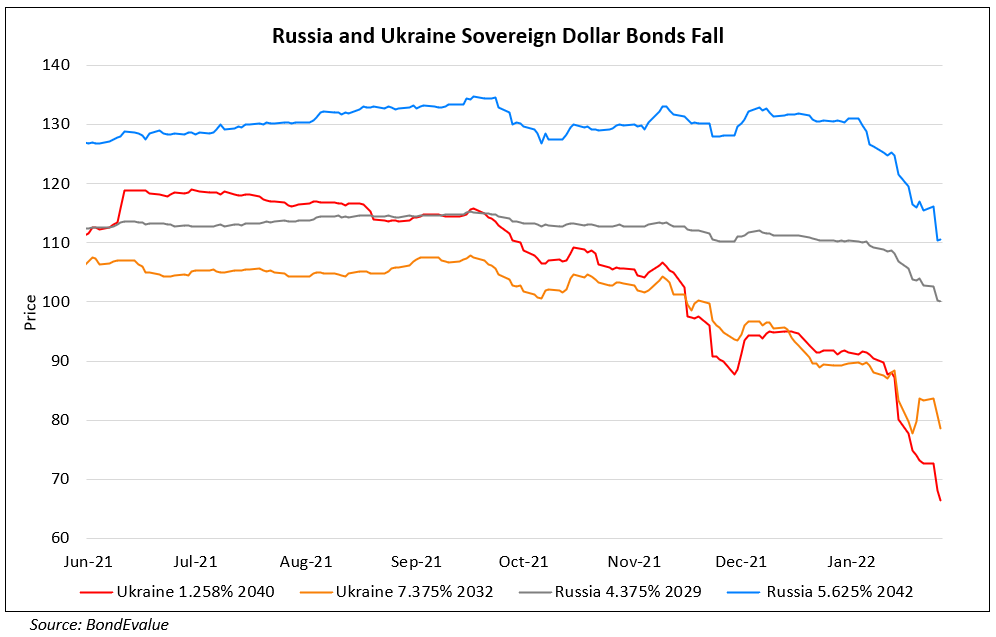

Both Ukraine and Russia’s bonds have been impacted the most, in particular the former’s bonds. Many of Ukraine’s and Russia’s bonds were trading close to par prior to the escalation of issues in November 2021. They are now trading at a discount, making their bonds among the top losers in the new year. Below is a chart with some of Ukraine’s and Russia’s dollar bonds for more perspective.

For the latest on Russia and Ukraine news and bond prices, sign up for a free trial here

US 10Y Treasury yields which initially crossed 2% for the first time since July 2019, retreated sharply to 1.85% on the back of risk-off tensions. Gold, a well known haven asset touched a 13-month high. Commodity prices have risen with Brent Crude in particular seeing a sharp rally on fears of a supply disruption by Russia. Brent which began 2022 at just over $77/bbl, just stopped short of hitting $100/bbl on February 22. Other commodities like wheat and corn have risen, with the FAO food price index at a decade high as supply chain issues along the Black Sea could get impacted on sanctions. CDS spreads across Russia and Ukraine have widened considerably as shown in the chart below.

- April 05, 2022: The US Treasury has halted dollar debt payments from Russian government accounts at US banks including the correspondent paying bank JPMorgan, as per Bloomberg. A spokesperson for the Treasury’s Office of Foreign Assets Control said that the move forces Russia to choose among three options -- draining dollar reserves held in its own country, spending new revenue, or going into default. This move will also raise scrutiny on Russia's payments due on May 27 for interest owed on sovereign USD and EUR bonds due 2026 and 2036, says Bloomberg.

- April 01, 2022: Russia bought back $1.45bn equivalent (around 72%) of its $2bn 4.5% dollar bonds due April 4. The buyback was a step to ensure that local investors are repaid irrespective of sanctions. The repurchase now leaves only $552.4mn of its dollar bond to be redeemed in USD on the maturity date, where holders who did not participate in the buyback await their redemption. Russia also made its payment of $446.5mn - coupons of $87.5mn and a principal of $359mn, as per a Bloomberg source, who stated that JPMorgan (paying agent) processed the payment. Meanwhile Russian corporates like Russian Railways JSC, EuroChem and Chelyabinsk Pipe Plant have seen the grace period lapse on its euro bonds, thereby missing the deadline for coupon payments on their offshore bonds.

- March 31, 2022: Russia plans to pay its 4.5% dollar bonds due April 4 in USD, according to sources. However, the Finance Ministry also launched a buyback in rubles as expected, with Bloomberg noting that it would ensure local investors get paid. Russia has an $87.5mn coupon payment on its 7.5% 2030s due today.

- March 30, 2022: Russia's deputy defence minister said that the country has decided to 'radically' cut its military activity focused on Kyiv and Chernihiv after talks between Russian and Ukrainian negotiating teams in Turkey. This move has led to an easing of the risk-off sentiment surrounding the Russia-Ukraine crisis. Bondholders cheered the news, with Russia and Ukraine sovereign and select corporate shorter-tenor dollar bonds rallying on Tuesday. In related news, Russia offered to buyback its dollar bonds due April in rubles instead of dollars. It has a $2bn repayment on its 4.5% bonds due April 4. While the quantum of buyback was not mentioned, the Finance Ministry said it will buy them at a price of 100% of nominal value. Analysts say that while the payment in rubles will help local holders and the sovereign's hard currency repayment burden, it again rekindles default fears. This is because the $2bn bonds prescribe that repayment has to occur in dollars. The bonds have a 30-day grace period. Russia made recent Eurobond payments in March in hard currency and staved-off a default despite sanctions. On March 31, it has another $447mn payment due.

- March 29, 2022: According to filings with the National Settlement Depository (NSD), Russia is making coupon and principal payments on its bonds next month. The principal repayment is on $2bn of its 4.5% dollar bonds due April 4. The coupon is for $84mn on its 5.625% dollar bonds due 2042. While the payment on its dollar bonds went through last month after delays and hurdles due to sanctions, the upcoming payments could also face potential settlement issues.

Separately, Credit Suisse is being probed by US lawmakers with regard to compliance with sanctions. The bank was asked to hand over documents related to the financing of yachts and private jets owned by potentially sanctioned individuals.

- March 25, 2022: Moody's has followed S&P and Fitch in withdrawing from publishing ratings for Russian entities, after suspending commercial operations in Russia.

Separately, Bloomberg sources said that at least two international bondholders said that their accounts received $66mn in coupon payments in dollars from Russia's sovereign bonds. The payment, which was due on March 21 with a 30-day grace period, has been slowly moving through the financial system for the past three days, they note. The Russian Finance Ministry earlier said that it transferred the cash to the settlement depositary, thereby meeting its obligations “in full.”

- March 24, 2022: Fitch said that it will withdraw all its ratings on Russian entities and their subsidiaries in order to comply with European Union sanctions, on similar lines to that of S&P's withdrawal a day earlier. The withdrawal of ratings will take effect on April 15.

Russian steelmaker Severstal said that it would apply for a special licence to process a Eurobond coupon payment. Citibank did not process a payment Severstal sent last week to cover the coupon on its 2024 loan participation notes (LPN) and the grace period expired on Wednesday. A source said that Citibank recommended that Severstal ask the US Treasury's Office of Foreign Assets Control (OFAC) to provide a licence that would allow it to process the payment. Severstal's main shareholder, Alexey Mordashov, was placed under sanctions by the European Union and Britain but not by the US; Severstal too is not subject to US sanctions.

- March 23, 2022: Tinkoff Bank, Russia's biggest online lender paid coupons on its dollar bonds with some bondholders receiving the cash, as per sources. Bloomberg notes that while the company is not on the sanctions list, investors are keeping a close eye on coupon payments due to the large number of sanctions and penalties imposed globally onto Russia. Evraz Plc's $18.9mn bond coupon reached its paying agent BNY Mellon after it was temporarily frozen yesterday by SocGen NY, following its ties to sanctioned billionaire Roman Abramovich. Ukraine has raised another UAH 6.04bn ($206mn) via 1Y war bonds at a yield of 11%, its fourth such sale since the war began a month ago.

- March 22, 2022: S&P Global is withdrawing credit ratings of all Russian entities by April 15, after the European Union’s decision last week to ban firms from providing ratings to Russian companies.

Separately, a $18.9mn coupon payment of Russian steelmaker Evraz Plc was blocked due to its ties to sanctioned billionaire Roman Abramovich, Bloomberg reports. The company transferred the cash a week ago for the payment but its correspondent bank, Societe Generale New York, halted its transfer to paying agent BNY Mellon for compliance reasons. Abramovich holds 28.64% of the company’s equity. “Apart from malfunction of financial infrastructure, there are no reasons for a Potential Event of Default... The Issuer has sufficient liquidity to complete the coupon payments", Evraz said in a statement.

- March 18, 2022: Russia was downgraded to CC from CCC- by S&P due to "reported difficulties" meeting coupon payments on the due date on its dollar bonds due 2023 and 2043. This is due to the international sanctions that have reduced Russia's available forex reserves and restricted access to the global financial system. S&P also believes that funds transferred debt service payments on its domestic OFZs to Russian domestic accounts might not be available to some nonresident bondholders.

However, later in the day news emerged regarding the payment of the dollar bond coupons due March 16. Sources said that JPMorgan had processed funds that were earmarked for it and sent the money on to Citigroup. JPMorgan was the correspondent bank Russia used to send the payment to Citigroup and that it was done after seeking required approvals from US authorities . Citigroup is acting as the payment agent on the bonds, the sources note. Russian officials have said if the payment in dollars is blocked, it would pay back in rubles. Bloomberg notes that JPMorgan's processing of funds has lent optimism that the bonds may still be settled in dollars. Russia's dollar bonds have rallied up to 14 points on the update.

- March 17, 2022: Russia’s Finance Minister Anton Siluanov said that Russia had attempted to make interest payments on its two dollar-denominated government bonds in rubles. However, he said that it was up to the US to make sure that the payments go through. The two dollar bonds do not allow coupon payments to be made in rubles. In related news, Russia's state-owned energy company Gazprom repaying its Samurai bonds (denominated in Yen) in rubles is likely to be considered a default according to Tadashi Maeda, governor of state-affiliated Japan Bank for International Cooperation (JBIC).

- March 16, 2022: Rating agency Fitch said that if Russia does make the two dollar bond coupon payments due today (March 16) in rubles, it would constitute a sovereign default after a grace period expiration. It said that the ratings would be cut to D from C after the grace period expires, while Russia's long-term foreign currency rating would be set at Restricted Default.

Ukraine has raised another UAH 5.4bn ($185mn) via domestic hryvnia and dollar-denominated war bonds. It raised $12mn via 1Y dollar bonds at 3.7% while the local bonds yield 11%. This brings the total raised so far from so-called war bonds to $691mn. Timothy Ash, a senior emerging market sovereign strategist at BlueBay Asset Management called the issuance the "ultimate ESG play" adding, “If fund managers and pension funds want to support a number one ESG story, then surely this is it. This is a country fighting for democracy, human rights, European values and the war bond is to support that.”

- March 15, 2022: Russia's Finance Ministry issued an order to pay Eurobond holders $117mn in coupons while not mentioning whether the payment was in dollars or ruble. The bonds are denominated in dollars, but the finance minister has emphasized earlier that Russia will ultimately pay in rubles if sanctions do not allow dollar-based settlements. He said, "The freezing of foreign currency accounts of the Bank of Russia and of the Russian government can be regarded as the desire of a number of foreign countries to organize an artificial default that has no real economic grounds". Although some of Russia's foreign currency bonds have provisions to be paid in rubles, the Eurobonds linked to the $117mn coupons do not.

- March 11, 2022: Russia's Finance Minister Anton Siluanov commented about debt repayments. He said, “We will repay our external obligations in rubles, but we will carry out the conversion as our gold and foreign exchange reserves are unfrozen... In the past two weeks, western nations have effectively launched a financial and economic war against Russia. The West has defaulted on its financial obligations to Russia, frozen our gold and currency reserves, sought to halt our foreign trade, our exports, by all means possible, harming global trade in the process.”

- March 10, 2022: Ukraine and Russia agreed to a daylong ceasefire on Wednesday to allow civilians to escape the fighting via evacuation corridors. Separately, Russia's Dmitry Birichevsky, the director of the foreign ministry's department for economic cooperation said, "Russia's reaction will be swift, thoughtful and sensitive for those it addresses", regarding its response to sanctions.

- March 9, 2022: US and UK banned imports of oil and gas from Russia on Tuesday. The EU too announced that they plan to cut Russian gas imports by two-thirds in the span of a year. FT however notes that the ban will be 'far less disruptive to global markets than a full international embargo' as Russian shipments to both countries account for only up to 8%.

Russia was downgraded a further six notches to C from B by Fitch, just one notch above default, with the view of a sovereign default being imminent after the Presidential decree, ratcheting sanctions and other measures impacting the country. This comes just a week after an earlier six notch downgrade by Fitch on March 2 from BBB to B.

Ukraine's finance ministry on the other hand said that it will service its debt on time and in full. Ukraine has a total of $3.7bn in total debt due between March-December this year. Kyiv is expected to receive €300mn ($328mn) from the EU, $350mn from the World Bank and was offered $1bn of loan guarantees from the US. Besides, Ukraine also raised UAH 6.7bn ($229mn) via its second war bond auction at a yield of 11%.

-

March 7-8, 2022: Credit Default Swaps (CDS) that insure $10mn of Russia's bonds for five years now indicate a default probability of 80% as per ICE Data Services calculations. ICE said that the upfront cost of protection demanded from CDS sellers rose from $4mn last week to ~$5.8mn. Russia has $117mn in coupons due on March 16 which do not have an option to allow repayment in rubles, and thus do not fall under Putin's decree during the weekend.

JPMorgan Chase announced it will remove Russian debt from all of its fixed-income indices beginning March 31. This follows similar moves from MSCI, S&P Dow Jones and FTSE Russell. Russian bonds will be removed from JPMorgan’s “hard currency” corporate and sovereign indices as well as its index for debt in EM currencies, FT notes. Besides, their debt will also be removed from ESG indices. The sanctions have made their debt almost untradeable and illiquid thus not meeting the criteria that the indices have according to Pramol Dhawan, Pimco's head of EM portfolio management.

- March 5-6, 2022: According to a decree by Russian President Vladimir Putin On Saturday, March 5, Russia and Russian companies will be allowed to pay foreign creditors in rubles (RUB), in an effort to avert default. The Russian government will prepare a list of countries which it called, “countries that engage in hostile activities”, where temporary rules for sovereign and corporate debtors will be in place to make payments to creditors. Debtors can ask a Russian bank to create a special “C” RUB-denominated account in the name of foreign creditors for settlement. For countries that have not imposed sanctions, creditors will receive payment in the same currency that the debt is denominated provided the debtor gets a special permission to do so. On March 2, Russia paid coupons on its OFZs, but foreign holders were not paid as the Russian central bank barred foreign payments. Whether the event constitutes a default or not is subject to debate. On the other hand, some of Russia’s non-ruble denominated sovereign bonds do allow payments in rubles, which can impact holders of CDS protection. JPMorgan strategists note that the option to pay for in RUB “may render these bonds out of scope for CDS... This means that bonds with ruble fallback provisions can neither trigger CDS nor be delivered into CDS". Russia has $117mn in coupons on dollar bonds due March 16. JPMorgan strategists point out these bonds do not have an option to be paid in RUB - hence if Russia decides to pay in RUB, “that would be an event of default and would trigger CDS". The Russian finance ministry came out saying that the payment to foreign bondholders ultimately depends on the sanctions.

Separately, Ukraine was downgraded 2 notches to Caa2 from B3 by Moody's following the "intensification of Russia's (B3 review for downgrade) military invasion of Ukraine". The invasion's impact on Ukraine's economic and fiscal strength could hurt its sovereign debt repayments. According to Moody's, "Ukraine's buffers and forthcoming substantial international financial support will not be sufficient to fully offset liquidity risks". Moody's added that Ukraine's ratings remain on review for further downgrade. Russia was downgraded 4 notches to Ca from B3 by Moody's on expectations that capital controls by the Central Bank of Russia (CBR) will restrict cross border payments including debt service on government bonds. Sanctions, SWIFT payment restrictions and other measures have impacted macro-economic stability and Moody's expects real GDP to contract by 7% in 2022. Also, the weakening ruble is set to bring higher inflation.

- March 3-4, 2022: Russia was downgraded by a solid 8 notches to CCC- from BB+ by S&P following the imposition of measures and sanctions that are expected to substantially increase the risk of default. The measures have impacted its available forex reserves by as much as half, including foreign currency deposits and securities domiciled in the US, the EU, and Japan. Thus, Russia's external liquidity has been weakened significantly. Capital control measures are likely to restrict interest and/or principal payments on time for non-resident bondholders.

Separately, Ukraine has planned a second 'war bond' auction to fund its military and resist Russia’s invasion. This comes after it raised UAH 9.013bn ($300mn) via 1Y zero-coupon war bonds on March 1, 2022.

- March 2, 2022: Russia was downgraded six notches by Fitch, from BBB to B. The sanctions applied on Russia by EU and the US are expected to cause a severe shock to its credit fundamentals, hurting financial flexibility and increasing the uncertainty regarding the willingness to pay. Besides, sanctions are tightening rapidly, thereby impacting Russia more than previous sanctions in its history. Further banking sector sanctions are likely after those that have impacted banks like Sberbank and VTB. Heightened macro-financial risks weigh on the country with the ruble's depreciation, deposit outflows and lower trend GDP growth. Other financing flexibility constraints, fiscal risks, political and geopolitical risk and uncertainty have caused structural weakness.

- February 28-March 1, 2022: Russia's central bank banned coupon payments to foreign owners of RUB 3tn ($29bn) of local Ruble-denominated government bonds known as OFZs. The next coupon on OFZs are due on March 3, for bonds maturing in 2024. The Bank of Russia issued the above instruction alongside a freeze on local security sales by foreigners, to depositaries and registries. “Issuers have the right to make decisions on the payment of dividends and the making of other payments on securities and transfer them to the accounting system. However, the payments themselves will not be made by depositories and registrars to foreign clients. This also applies to OFZ", the central bank said. The central bank did not specify how long the ban will last.

Allianz, BlackRock and Vanguard are the three biggest holders of OFZs as per Bloomberg data with about $2.2bn, $1bn and $790mn equivalent in holdings. While Allianz and BlackRock did not comment on the coupon ban, Vanguard said it “is reviewing the various global sanctions and determining the impacts to our funds".

- February 25-27 2022: Ukraine was downgraded to B- from B by S&P and to CCC from B by Fitch following the military invasion by Russia. Its low external liquidity relative to sovereign external debt service, expected capital outflows and fall in domestic confidence, inflationary pressures and volatility are expected to weigh on the nation. Russia was cut to junk status of BB+ from investment grade ratings of BBB- by S&P. Strong international sanctions are expected to have both, direct and second-round effects on foreign trade, domestic/private sector confidence and financial stability. US and the European Union (EU) have also excluded some Russian banks from the SWIFT payment system, move that would cripple payments both to and from Russia.

- February 24-25, 2022: In the aftermath of the military operations by Russia in Ukraine, the US and UK imposed a slew of measures including sanctions on Russia alongside UK also announcing similar sanctions. Sanctions by the US included:

-

- Severing the connection to the US financial system for Russia’s largest financial bank, Sberbank, including 25 subsidiaries. Sanctions on Russia’s second-largest financial institution, VTB Bank, and its subsidiaries. Similar sanctions on Bank Otkritie, Sovcombank OJSC, and Novikombank and dozens of its subsidiaries

- New debt and equity restrictions on 13 critical Russian financial entities

- Additional full-blocking sanctions on Russian elites and their family members and individuals “who have enriched themselves at the expense of the Russian state”

- Russia’s military and defence ministry being restricted from buying nearly all US items and items produced in foreign nations using certain US-origin software, technology, or equipment.

- Sanctions on defence, aviation, and maritime technology aimed at choking off Moscow’s import of tech goods

- Licensing exemptions for countries that adopt export restrictions on Russia

-

- February 24, 2022: Russian President Vladimir Putin announced a "military operation" in Ukraine with explosions heard in capital city Kyiv and cities like Kharkiv. The military operations are part of demilitarizing Ukraine, and all Ukrainian servicemen who lay down arms would be able to safely leave the combat zone, Putin added. News agencies note that Putin mentioning the responsibility for bloodshed lying with the Ukrainian "regime" and that other countries with any attempt to interfere with the Russian action would lead to "consequences they have never seen". The announcement came at a time when the UN was in the middle of an emergency meeting discussing the Ukraine crisis. Putin noted that US and its allies were ignoring Russia's demand to prevent Ukraine from joining NATO and offer Moscow security guarantees. Just few hours prior to the attack, Ukraine had declared a state of emergency for 30 days.

- February 23, 2022: US President Joe Biden launched a streak of sanctions on Russia, calling that latter’s move into eastern Ukraine as “beginning of an invasion”. Some of the sanctions aimed at stopping western financing/trading of Russia’s new foreign debt securities and targeting two of Russia’s largest financial institutions, VEB and Promsvyazbank.

- February 22, 2022: Russian President Vladimir Putin, following a meeting with his Security Council, declared independent, two separatist eastern Ukraine regions, Donetsk and Luhansk. The decree allows them to sign treaties with the separatist regions and openly send troops and weapons there with western officials believing that Russia could invade Ukraine any moment using the decree as a pretext for an attack.

- February 21, 2022: In a last ditch effort towards diplomacy, French President Emmanuel Macron proposed to hold a summit for US and Russian leaders in with the latter two said to have “accepted the principle” of a summit on the condition that Russia does not invade Ukraine.

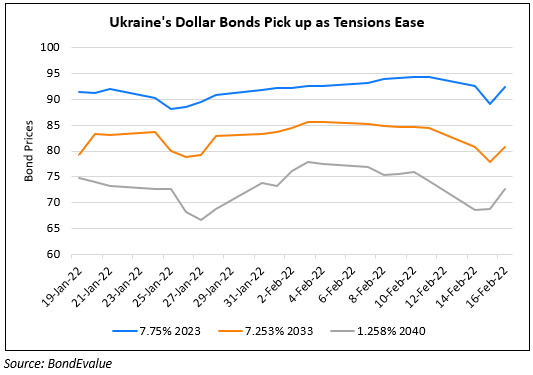

- February 16, 2022: Fears of Russia invading Ukraine eased as Moscow said that some of its troops were returning home. This was seen as a positive development, helping Ukraine's dollar bonds rally. However, the US President said that a Russian attack on Ukraine was “still very much a possibility”.

- February 14, 2022: Russia-Ukraine tensions escalate with US National Security Advisor Jack Sullivan saying that there’s “a distinct possibility that there will be major military action very soon.” US and Europe threatened Russia of economic repercussions in the event of an invasion.

- February 2-10, 2022: US sends 3,000 troops to protect NATO forces in eastern Europe in early February, later saying that Russian has 110,000 troops on Ukraine's border with 40,000 more set to arrive in a week

- January 24-26, 2022: NATO puts troops on standby and sends ships and fighter jets to help eastern Europe's defence. On January 25, Russia begins military exercises with 6,000 troops and 60 fighter jets in the south of Russia, near Ukraine and in Crimea. A day later, US says that Moscow's security demands are "unrealistic".

- January 17, 2022: US announces $200mn in security aid to Ukraine's Kyiv after Russian troops arrive in ex-Soviet Belarus for military drills.

- December 7, 2021: US President Joe Biden tells Russian President Vladimir Putin that they would hit them with "strong economic and other measures" if Russia invades Ukraine.

- November 2021: US reports movement of Russian troops near Ukraine's border, with Ukraine noting that ~92,000 Russian troops were set to assemble by end-January/February 2022. Moscow denies the claims saying Kyiv was conducting a military build-up. Russia also demanded a legal guarantee that Ukraine should be denied NATO membership.

Go back to Latest bond Market News

Related Posts:

Ukraine & Russia’s Dollar Bonds Slip on Escalating Tensions

January 26, 2022

Ukraine Bonds Rally as Russia Says Troops Pulled Back

February 16, 2022