This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Rothesay, AIB Group, Piraeus Price Bonds

November 26, 2025

US Treasury yields eased by 2-3bp again, with reports emerging that White House Economic Council Director Kevin Hassett is the front-runner to be the next Fed chairman. This was considered to be a dovish signal given that the current US administration is keen on interest rate cuts. On the data front, Retail Sales for September came in weaker at 0.2% MoM vs. expectations of 0.4%. Core Retail Sales rose 0.1% vs. expectations of 0.3%. The Conference Board Consumer Confidence Index fell to 88.7 in November, missing estimates of 93.3, marking its lowest print since April. Separately, US Headline and Core PPI for September came-in at 2.7% and 2.6% YoY respectively, with the headline reading marginally beating expectations and the core reading missing.

Looking at the equity markets, the S&P and Nasdaq closed higher by 0.9% and 0.7% respectively. US IG and HY CDS spreads were tighter by 0.7bp and 3.9bp respectively. European equity indices ended higher too. The iTraxx Main CDS and Crossover CDS spreads were 0.8bp and 3.4bp tighter respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were 0.8bp tighter.

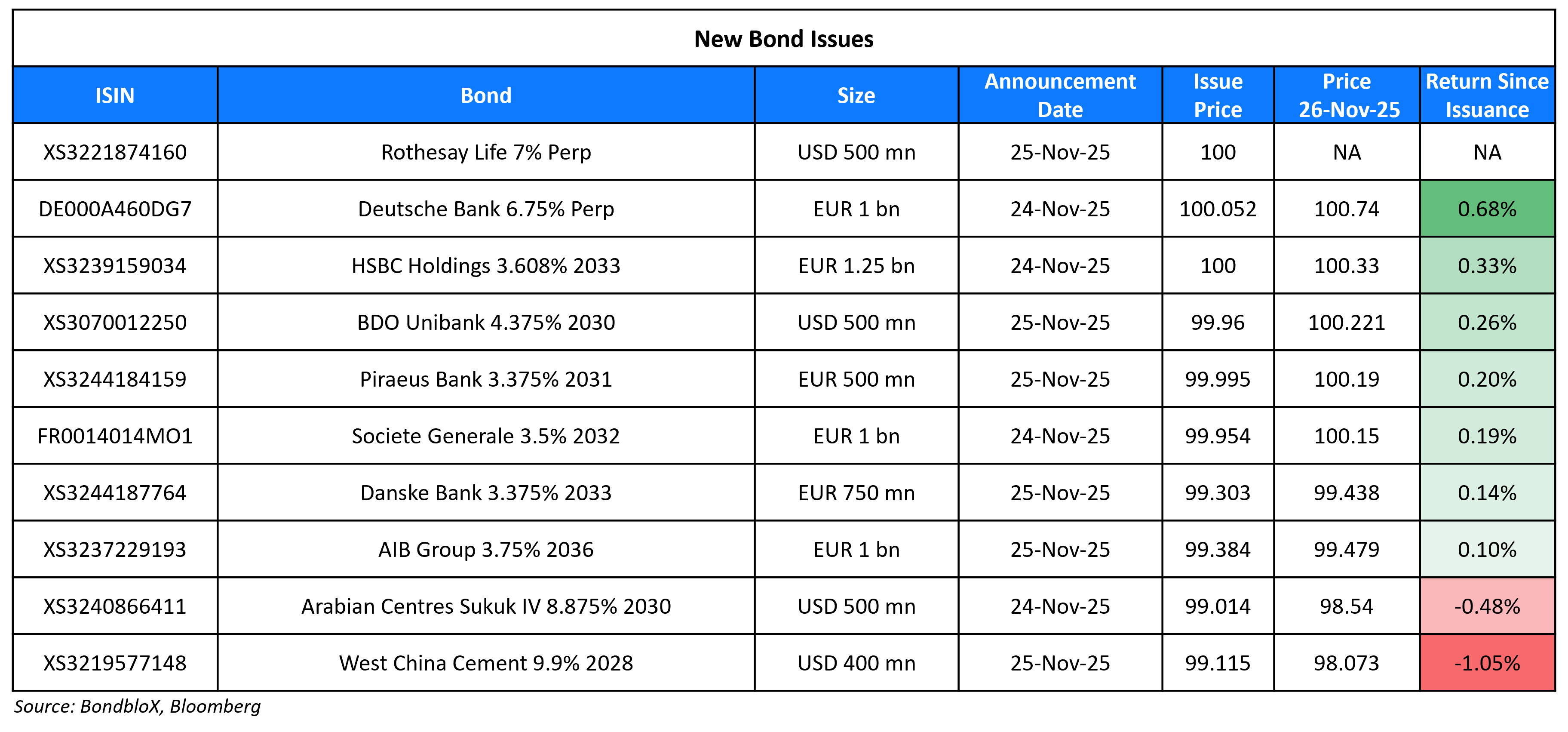

New Bond Issues

- China Orient Asset Management $ 3Y T+140bp area

- China Huaneng Group $ green PerpNC3 at 4.7% area

Rothesay Life raised $500mn via a PerpNC10 RT1 bond at a yield of 7.0%, 50bp inside initial guidance of 7.5% area. The subordinated note is rated BBB (Fitch), and received orders of over $3bn, 6x issue size. If not called by 3 December 2035, the coupon will reset to the 5Y CMT plus 299.1bp. The note does not have a coupon step-up. Proceeds will be used for general commercial and corporate activities.

AIB Group raised €1bn via a 11NC6 green Tier-2 bond at a yield of 3.867%, 30bp inside initial guidance of MS+170bp area. The subordinated note is rated Baa1/BBB, and received orders of over €2.9bn, 2.9x issue size. Proceeds will be used towards an eligible green loan portfolio under its framework.

West China Cement raised $400mn via a 3NC2 bond at a yield of 10.25%, 12.5bp inside initial guidance of 10.375% area. The senior unsecured note is rated B/B (S&P/Fitch). Proceeds will be used to repurchase, redeem or repay existing debt, including its 2026s under its tender offer, for working capital, and for current liabilities purposes.

BDO Unibank raised $500mn via a 5Y bond at a yield of 4.384%, 30bp inside initial guidance of T+110bp area. The senior unsecured note is rated Baa2. Proceeds will be used for general corporate purposes.

Danske Bank raised €750mn via an 8NC7 green bond at a yield of 3.489%, ~22.5bp inside initial guidance of MS+115/120bp area. The senior non-preferred note is rated Baa1/A-/A+, and received orders of over €1.25bn, 1.7x issue size.

Piraeus Bank raised €500mn via a 6NC5 green bond at a yield of 3.376%, 27bp inside initial guidance of MS+125bp area. The senior preferred note is rated Baa2, and received orders of over €1.65bn, 3.3x issue size. Proceeds will be used to finance and/or refinance, in whole or in part, eligible green assets under its framework, and to further strengthen its MREL base.

Rating Changes

- Moody’s Ratings takes rating actions on 17 Italian financial institutions

- Fitch Upgrades Eurobank Limited to ‘BBB’; Outlook Stable

- New Fortress Energy Inc. Upgraded to ‘CCC-‘ From ‘SD’ Amid Restructuring; Ratings Placed On CreditWatch Negative

- Fitch Upgrades Bank of Cyprus to ‘BBB’; Outlook Stable

- Moody’s Ratings upgrades Boparan’s CFR to B2 from B3 on improved operating performance; outlook changed to stable

- Moody’s Ratings upgrades Assicurazioni Generali S.p.A’s IFSR to A2, stable outlook

- Bahrain Mumtalakat Holding Rating Lowered To ‘B’ From ‘B+’ After Similar Rating Action On Sovereign; Outlook Stable

- Moody’s Ratings has downgraded Celanese to Ba2; Outlook negative

- Moody’s Ratings downgrades Canacol’s ratings to C on filing for chapter 15; outlook stable

- Fitch Downgrades BRB ‘s LT IDRs to ‘CCC’, Maintains Negative Watch; Withdraws SSR

- Under Armour Inc. ‘BB-‘ Ratings Placed On CreditWatch Negative On Performance Trends And Expanded Restructuring Plan

Term of the Day: Leveraged Loan

A leveraged loan is a loan extended to a company that has short-term or long-term debt on its books and that has a poor credit rating. S&P classifies a loan as leveraged if the issuer’s credit rating is junk (BB+ or lower) or if the rating is investment grade (BBB- or higher) but has a spread >= Libor+125bp and is secured by a first or second lien.

US leveraged loan sales are said to be under pressure due to decreasing demand for risky debt, amid policy uncertainty, AI-related concerns and growth fears.

Talking Heads

On Wall Street’s Macro Traders Eyeing Biggest Haul in 16 Years

Nikhil Choraria, Goldman Sachs

“Central bank rates are normalizing policy rates and their balance sheets but what hasn’t normalized is the sheer amount of issuance”

Michael Karp, Options Group

“Expectations versus reality will be a mismatch”

Moritz Westhoff, Nomura Holdings

“With all the infrastructure and AI-type investment, how much of that could be rates hedged over time? They tend to be very large investments and they have to be financed.

On Fidelity International, Amundi Seeing at Least Two ECB Cuts

Salman Ahmed, Fidelity’s

“Once the Fed becomes more dovish under the new chair, the ECB won’t be able to hold… We are playing the first leg of the trade. That’s the way the pressure comes on ECB to cut.”

Amaury d’Orsay, Amundi

“Our view is that there is a high likelihood that the ECB will resume cuts… For me, this is a pressure on prices in the long-term”

On Funds Trimming UK Bonds Exposure Ahead of Budget

Laura Cooper, Nuveen

Spike in government bond yields “captures the need for them to take that very credible, unpopular stance… Maybe that’s a bit more of a wake-up call to what is actually needed to avoid another Liz Truss moment”

Fahad Kamal, Coutts & Co.

“Slow growth and ongoing inflation progress mean we expect interest rate cuts to support gilt markets moving forward”

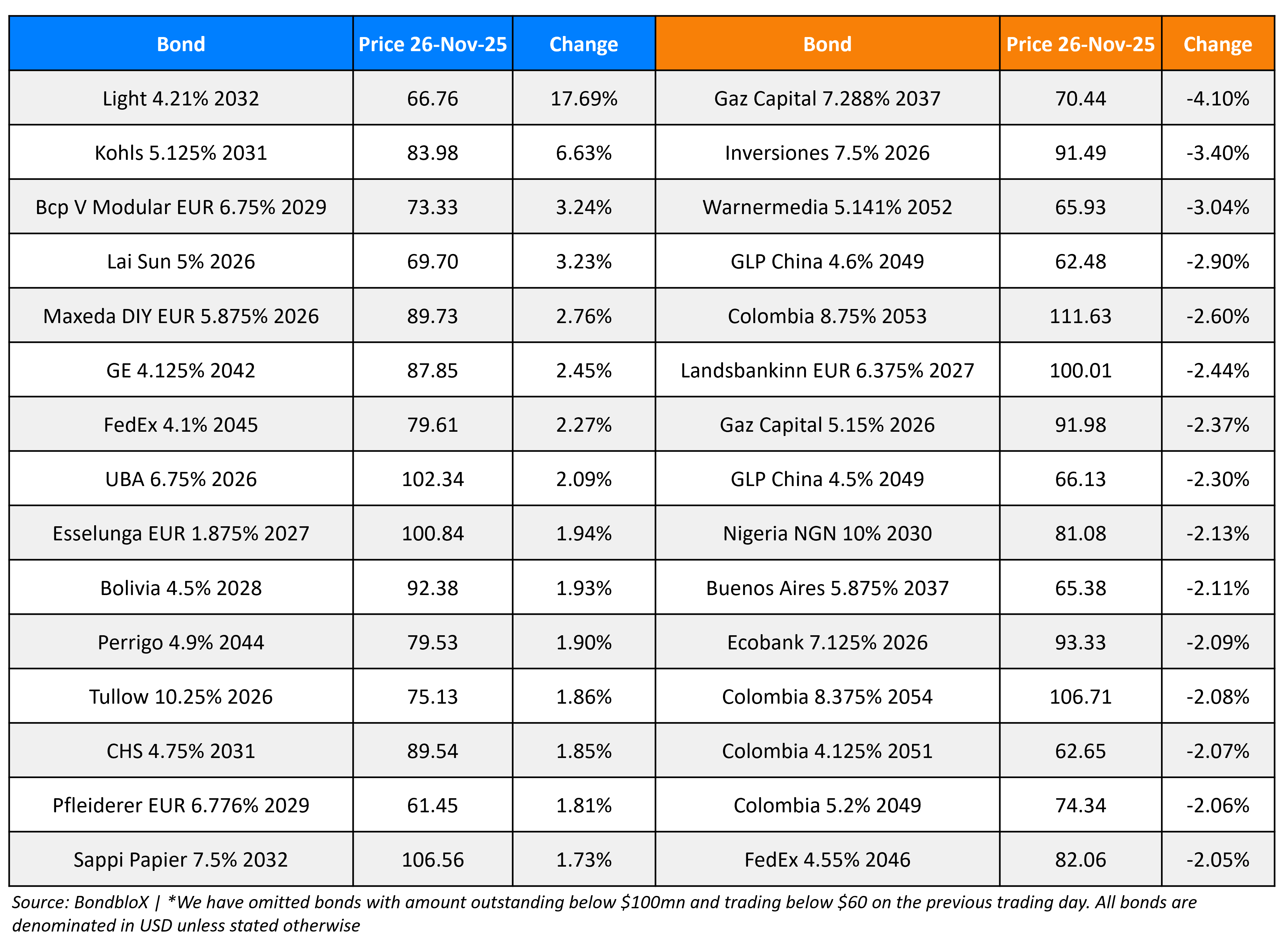

Top Gainers and Losers- 26-Nov-25*

Go back to Latest bond Market News

Related Posts: