This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Risk Assets Rally on Trump’s Clarifications

April 23, 2025

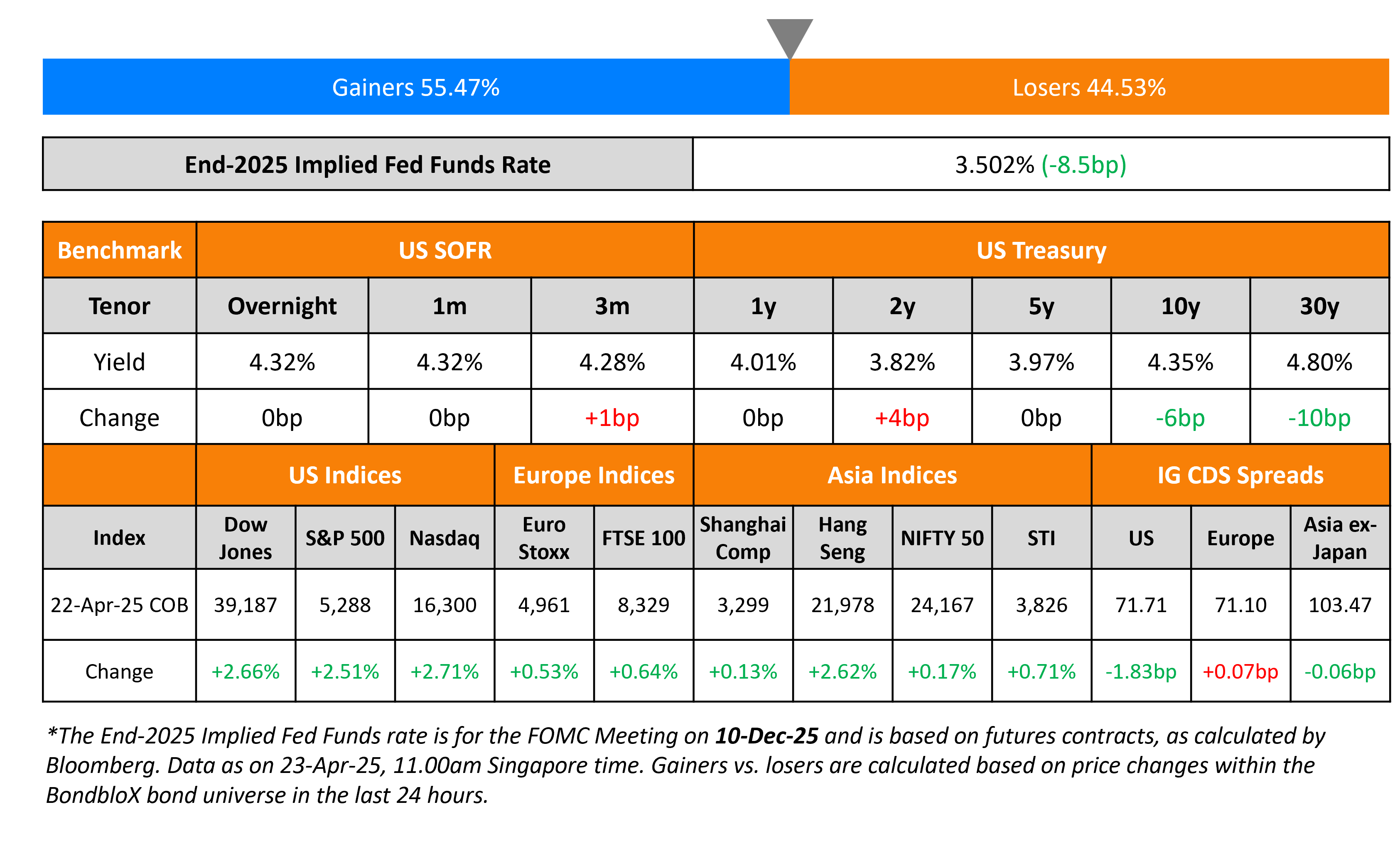

The US Treasury curve flattened, led by the drop in long-end yields that fell by over 6bp. US President Donald Trump told reporters that their tariffs on China will “come down substantially”. Additionally, he also said that he has no plans to fire Fed Chairman Jerome Powell.

Following this, the S&P and Nasdaq rallied sharply yesterday, up by 2.5-2.7%, reversing the move earlier on Monday. Looking at credit markets, US IG and HY CDS spreads tightened by 1.8bp and 8.6bp respectively. European equity markets ended higher. The iTraxx Main spreads were 0.1bp wider while Crossover CDS spreads tightened 2.3bp. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 0.1bp.

New Bond Issues

Rating Changes

-

Fitch Upgrades mBank S.A. to ‘BBB’; Outlook Stable

-

Moody’s Ratings upgrades PNC Investments’ rating to Ba2, affirms sukuk rating at Ba2 and assigns (P)Ba2 rating to sukuk program; stable outlook

-

Fitch Upgrades Fairfax’s Ratings; Outlook Stable

-

Fitch Downgrades Telefonica del Peru’s IDRs to ‘RD’

-

Moody’s Ratings affirms Bombardier’s B1 CFR; outlook changed to positive

-

The Michaels Companies Inc. Ratings, Including The ‘B-‘ Issuer Credit Rating, Placed On CreditWatch Negative On Tariff Risk

Term of the Day: Spin-off

Spin-offs are a corporate re-organization strategy used by companies to create a new subsidiary from its parent company. The parent separates (spins-out) part of its business into a new entity and distributes shares of the new entity to its current shareholders. Spin-offs are typically carried out to increase shareholder value of the business being spun-out or to separate out a business that is no longer core to the parent’s business. Spin-offs come in different types like pure play spin-offs, equity carve outs etc.

Talking Heads

On Japanese Super-Long Bonds Drawing Record Foreign Inflow

Shoki Omori, Mizuho Securities

“The scarcity of buyers and the rise in long-term and long-end US interest rates likely discouraged active investment… March coincides with the Japanese fiscal year-end, during which investors typically adjust their balance sheets”

On Threat to US Exceptionalism Spurs Rush for EM Local Bonds

Jon Harrison, GlobalData TS

“We have a strong preference for EM local debt… The slowing US economy, with a growing chance of recession, is bad for global growth, which is likely to further incentivize EM central banks to cut rates

Philip McNicholas, Robeco

“Among the larger markets, we prefer the local-currency side… heightened volatility in Treasuries and US policy should be imbuing a higher term premium”

On Trump’s Push Against Powell Adds to Doubts of US’s Haven Status

Ian Lyngen, BMO Capital Markets

“Any attempt to remove Powell will add to the downward pressure on US assets”

Helen Given, Monex

“Should the US fall into a recession with a central bank that either does not or cannot act independently, there’s a chance such a downturn could be exacerbated”

Top Gainers and Losers- 23-April-25*

Go back to Latest bond Market News

Related Posts: