This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Rakuten Launches $ PerpNC5; Nigeria, CVS Price $ Bonds

December 4, 2024

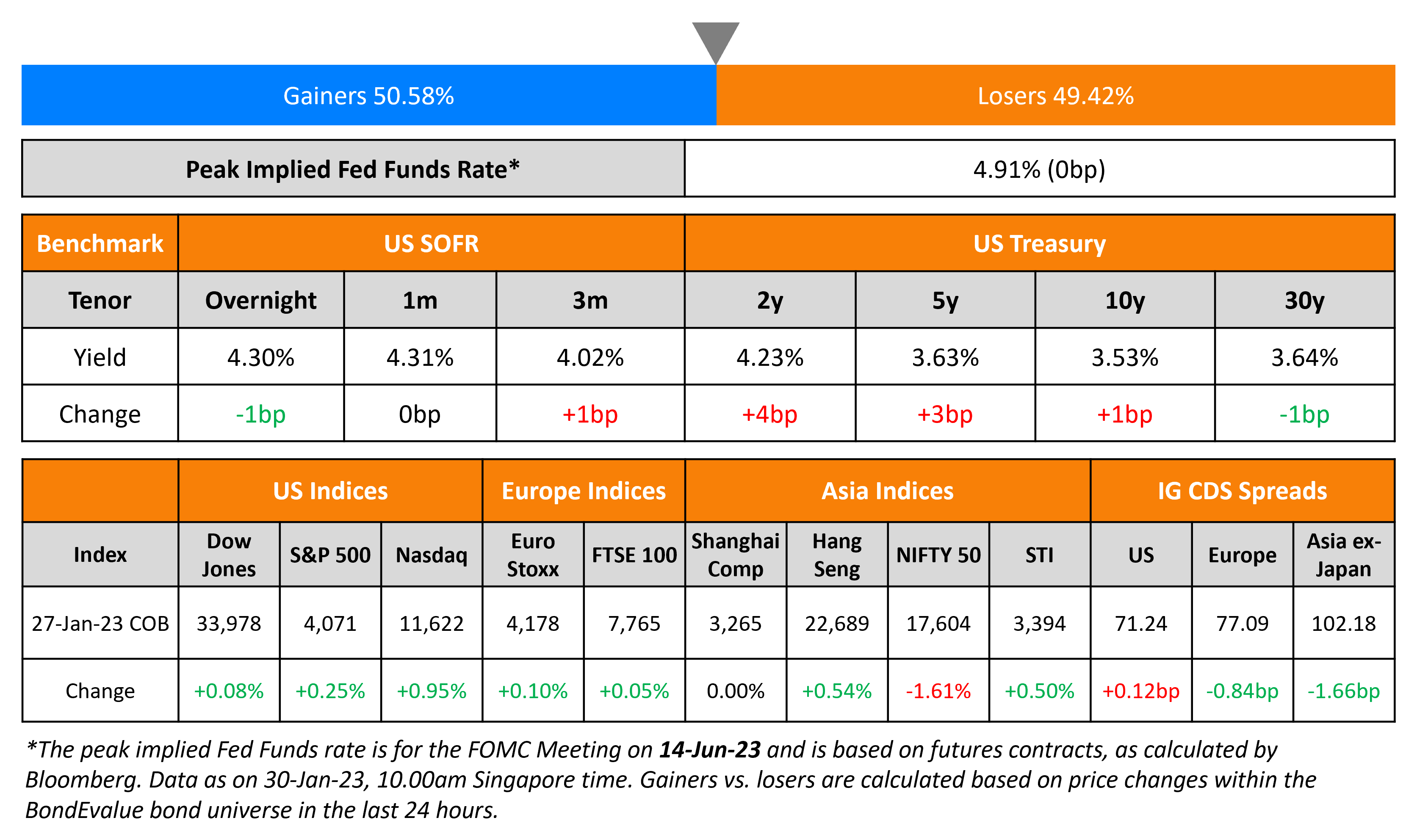

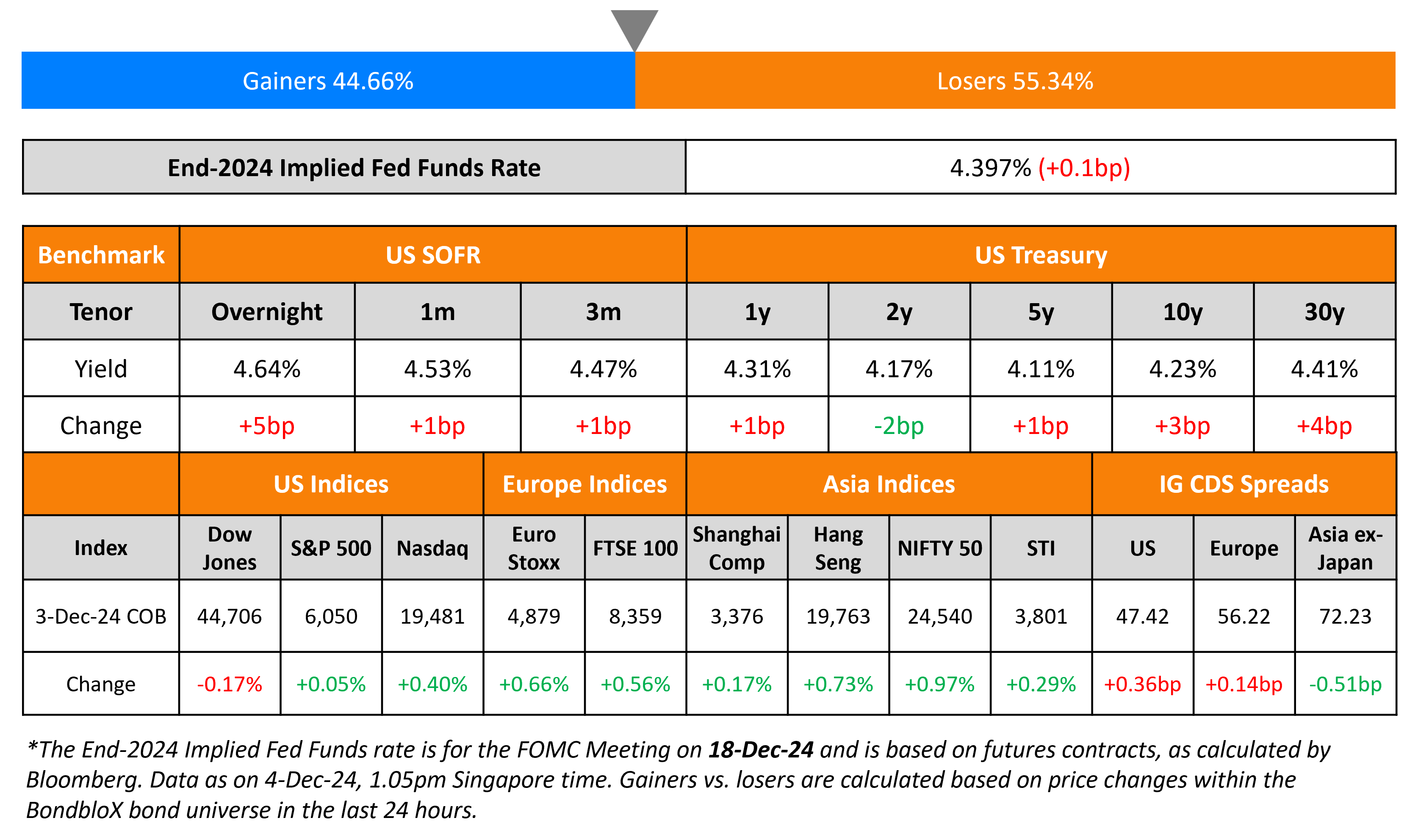

US Treasuries held largely stable across the curve yesterday. The JOLTS job openings for October came-in at 7.74mn, stronger than estimates of 7.52mn. Following this, analysts expect the NFP data later this week to show a rebound from October’s figures which were adversely affected by the labor strikes and hurricanes. Fed speakers Mary Daly, Adriana Kugler and Austan Goolsbee gave their thoughts on the rate cut trajectory moving forward. All three agreed that the policy rate should ease over the course of next year, citing the economy’s sustainable path towards the central bank’s 2% inflation target. However, no clear signal was given regarding the December 18 meeting. Markets are currently pricing-in a 75% chance of a 25bp rate cut this month, looking at interest rate futures.

US IG and HY CDS spreads tightened by 0.1bp and 0.6bp respectively. Looking at US equity markets, the S&P ended flat, while the Nasdaq was up 0.4%. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.1bp and 0.4bp respectively. Asian equities have opened higher this morning. Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

- Rakuten $ PerpNC5 at 8.375% area

Nigeria raised $2.2bn via a two-part deal. It raised $700mn via a 6.5Y bond at a yield of 9.625%, 50bp inside initial guidance of 10.125% area. It also raised $1.5bn via a 10Y bond at a yield of 10.375%, 25bp inside initial guidance of 10.625% area. The notes received orders of over $8.8bn, 4x the issue size. This is its first dollar bond issuance since 2022, where it raised $1.25bn via a 7Y bond at a yield of 8.375% at the time. The new 6.5Y bond is priced at a new issue premium of 22.5bp over its existing 8.747% 2031s that yield 9.4%.

CVS raised $3bn via a two-part deal. It raised $2.25bn via a 30.25NC5.25 bond at a yield of 7%, ~43.25bp inside initial guidance of 7.375-7.5% area. It also raised $750mn via a 30NC10 bond at a yield of 6.75%, ~56.25bp inside initial guidance of 7.25-7.375% area. The subordinated notes are rated Baa3/BB+. Proceeds will be used will be used to purchase notes tendered under its concurrent tender offers.

Rating Changes

-

Delta Air Lines Inc. Upgraded To ‘BBB-‘ On Expectation For Stronger-Than-Forecast Credit Measures, Outlook Stable

-

Kernel Holding Upgraded To ‘CCC’ On Improved Debt-Servicing Capacity; Outlook Negative

-

Fitch Downgrades Empresa de Transmision Electrica to ‘B’ on Delayed Coupon Payment

-

PG&E Corp. Outlook Revised To Positive On Stronger Balance Sheet And Wildfire Fund Payments; Ratings Affirmed

-

Tapestry Inc. Outlook Revised To Stable From Negative On Termination Of Capri Holdings Acquisition, Ratings Affirmed

-

Forum Energy Technologies Inc. Outlook Revised To Stable From Negative; Ratings Then Withdrawn At Issuer’s Request

New Bonds Pipeline

- Buenos Aires hires for $ bond

Term of the Day

Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Talking Heads

On EU Needs Common Debt to Remain Competitive – ECB’s Fabio Panetta

“From 2028 onwards, the outstanding volume of EU bonds will start to decrease… Creating a common fiscal capacity to finance public goods would help Europe overcome this anomaly”

On World Bank Calls for Debt Relief as Funds Flee Poor Countries

World Bank Chief Economist, Indermit Gill

“It’s time to face the reality: the poorest countries facing debt distress need debt relief if they are to have a shot at lasting prosperity… reflects a broken financing system”

S&P Global report

“Sovereigns will default more frequently on foreign currency debt over the next 10 years than they did in the past.”

Top Gainers and Losers- 04-December-24*

Go back to Latest bond Market News

Related Posts: