This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

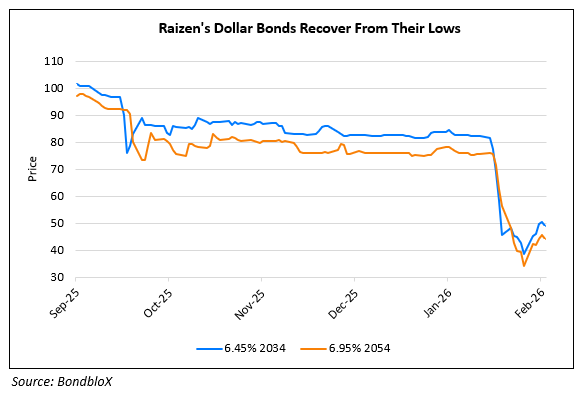

Raizen’s Dollar Bonds Partially Recover

February 20, 2026

Raizen’s dollar bonds have partially recovered from the massive sell-off seen earlier this month. The Brazilian sugar and ethanol producer said that its controlling shareholders “have committed to contributing capital” shortly after its earnings report last week. Details regarding the above remain thin, however, local newspapers report that the proposal could include a capital injection of BRL 1.5-3.5bn ($286-668mn) from Shell and BRL 1bn ($190mn) from Cosan. Separately, Raizen has also spoken about potential asset sales that are in the works. Despite the above, Fitch analyst Renato Donatti noted that the announcement was “not different from what they have been saying for the past six months”. He added that the asset sales would not by itself resolve Raizen’s debt concerns. Earlier this month, Raizen received several downgrades — for instance, Fitch downgraded the company by 8 notches to CCC and S&P cut the company by seven notches to CCC+.

Go back to Latest bond Market News

Related Posts: