This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Qatar, Perennial Holdings Launch Bonds

November 3, 2025

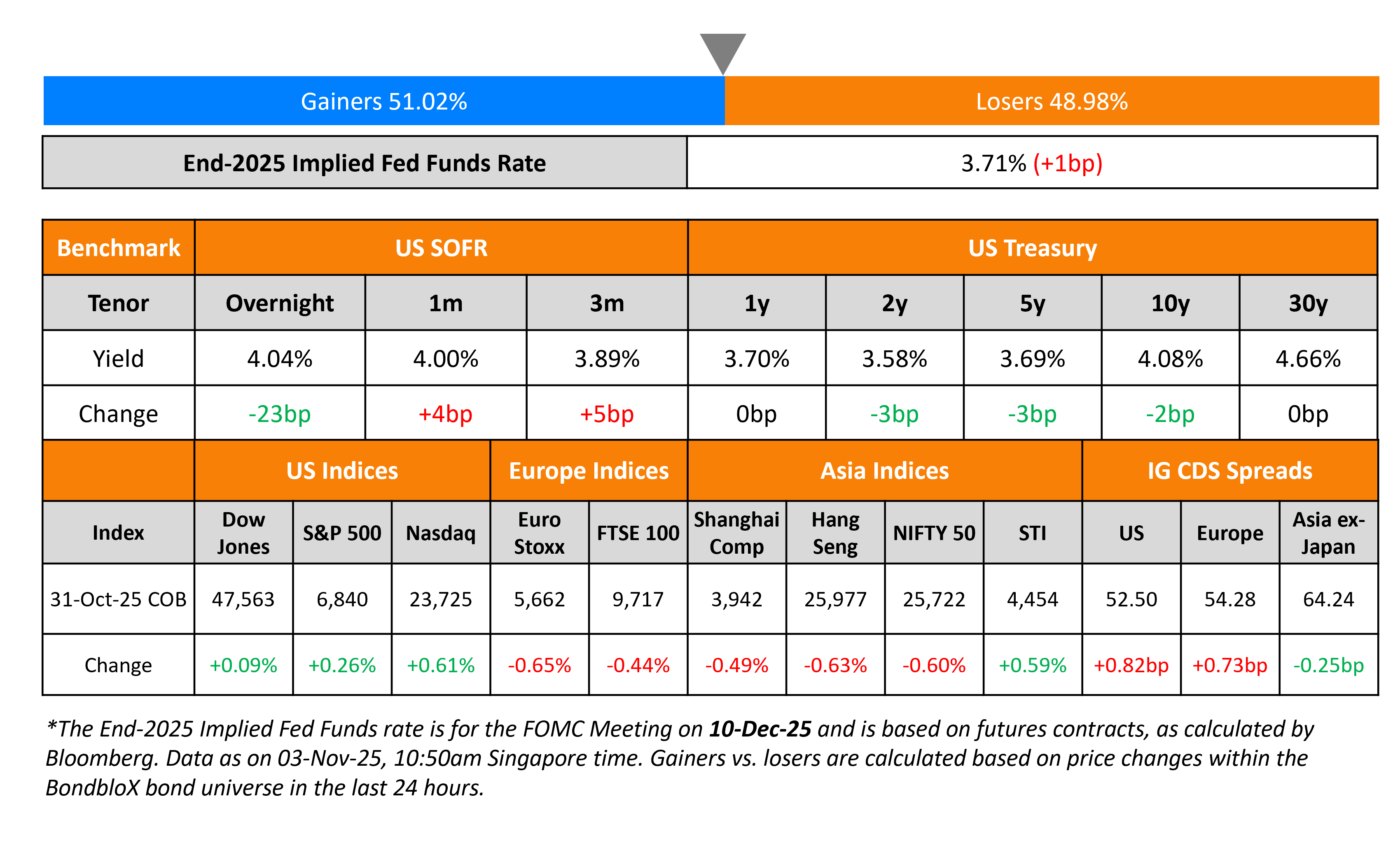

US Treasury yields eased by 2-3bp on Friday. Several Fed speakers came out with their views on monetary policy. Kansas Fed President Jeff Schmid said that his dissent in the recent FOMC meeting in favour of no change was due to his belief that the rate cut would not do much to address labour market stresses. He added that the rate cut could have longer-lasting effects on inflation. Dallas Fed President Lorie Logan and Cleveland Fed President Beth Hammack also said that they would have preferred to keep rates unchanged. Both Logan and Hammack will become voting members on the panel next year. However, Fed Governor Christopher Waller said that he was still in favor of a rate cut in December. He said that labor market was the “biggest concern”, adding that inflation was “going to come back down”.

Looking at equity markets, the S&P and Nasdaq ended higher by 0.3% and 0.6%. The US IG and HY CDS spreads widened by 0.8bp and 2.3bp respectively. European equity indices ended lower. The iTraxx Main CDS spreads were 0.7bp wider while the Crossover CDS spreads were 3.5bp wider. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were 0.3bp tighter. China’s Manufacturing PMI in October fell to 49.0 vs. expectations of 49.6 and the prior month’s 49.8 print. The was its seventh consecutive contractionary reading (below 50.0). The Non-Manufacturing PMI came-in at 50.1, inline with expectations and slightly higher than the prior month’s 50.0 print.

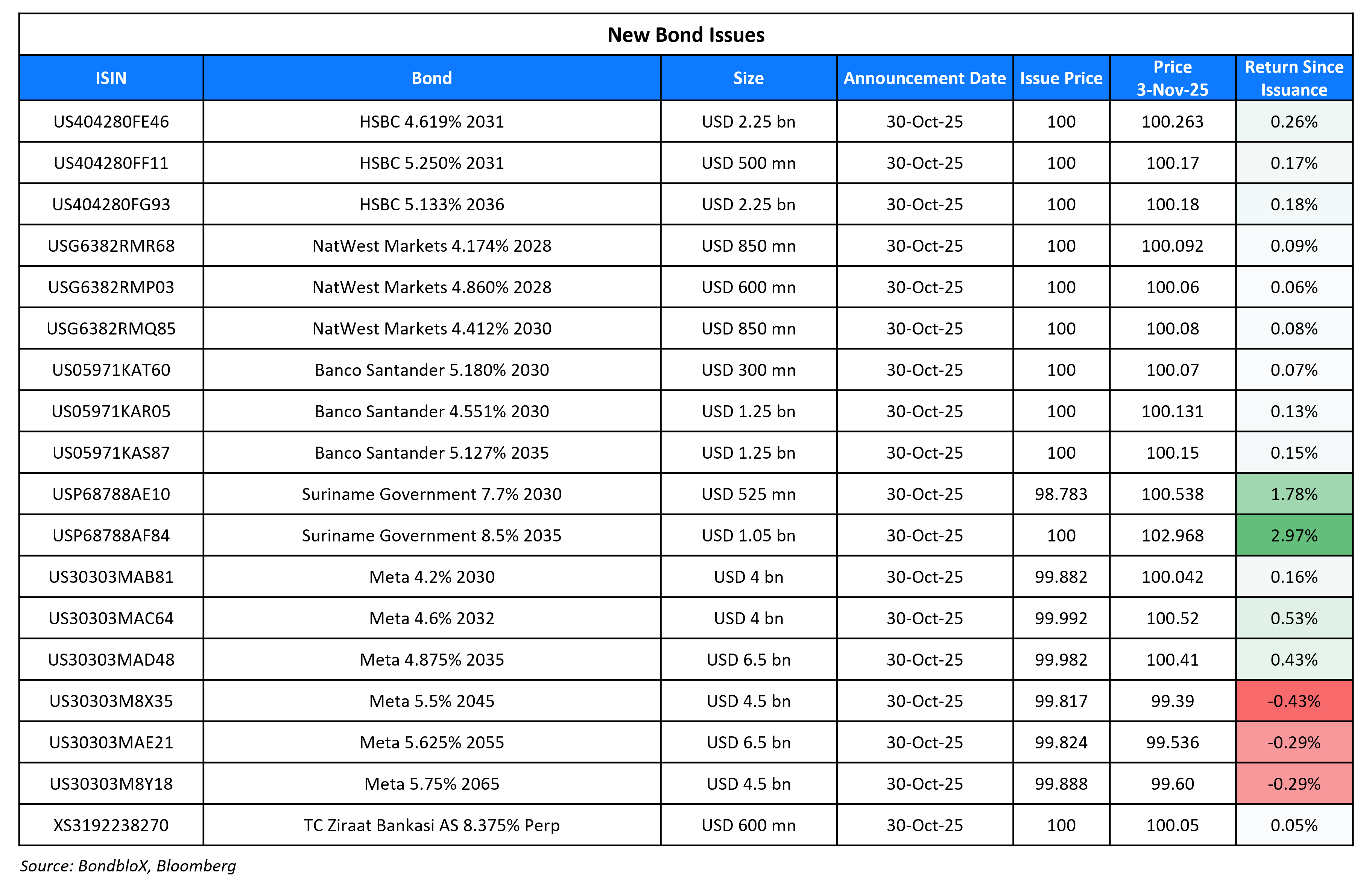

New Bond Issues

- Qatar $ 3Y/10Y at T+45/55bp areas

- Perennial Holdings Pvt Ltd S$ 5Y at 5.05% area

New Bonds Pipeline

- QBE Insurance $ 12NC7 Tier-2

- China $4bn capped 3Y/5Y bonds

- Santos Finance $ 10Y bond

- Hong Kong CNH/HKD/EUR/USD Digitally Native Green Notes

- Sharjah Islamic Bank $500mn 5Y WNG bond

- CDBL $ sustainability 10NC5 Tier-2

- Goodman Australia A$ 6Y

Rating Changes

- Fitch Upgrades Asahi Life’s IFS Rating to ‘A’; Outlook Stable

- Fitch Upgrades Ittihad to ‘BB-‘; Outlook Stable

- Moody’s Ratings downgrades Domtar’s CFR to B2, outlook remains negative

- Office Properties Income Trust Downgraded To ‘D’ From ‘SD’ Following Chapter 11 Bankruptcy Filing

- Boeing Co. Outlook Revised To Stable From Negative On Increasing Production; ‘BBB-‘ Ratings Affirmed

- Charles Schwab Outlook Revised To Positive On Declining Interest Rate Risk; ‘A-/A-2’ Ratings Affirmed

- Golomt Bank JSC Outlook Revised To Positive On Improving Risk Control; ‘B+/B’ Ratings Affirmed

- Moody’s Ratings affirms Tenneco’s B2 CFR and B1 senior secured ratings; changes outlook to negative

Term of the Day: Payment-In-Kind (PIK) Bonds

Payment-in-kind (PIK) is a type of bond for which, on each coupon payment date, the accrued coupon is capitalized and fully or partially paid in the form of additional bonds or added to the principal amount. PIK bonds are typically bonds with deferred coupons. These are riskier for investors due to more credit risk with respect to the PIK interest amount, payment of which can be deferred until maturity. Given this inherent higher risk, interest rates for PIK bonds are higher than for conventional bonds. Generally, issuers with liquidity stresses that are able to pay coupons in non-cash form issue these notes.

Talking Heads

On Troubled Nations Mount Comeback to Debt Markets Amid Yield Hunt

Daniel Wood, William Blair Investment

“The market is looking for high-yield issuers to come to market to actually put cash to work”

Robert Koenigsberger, Gramercy

“Lower bond yields create several possibilities… getting a lot closer to Argentina being able to access the market to roll over maturities”

Gorky Urquieta, Neuberger Berman

“Maybe you wind up paying something close to 10%, but the minute you validate your market access, your country risk goes down”

On Private Credit’s Rising Pile of ‘Bad PIK’ Points to Default Woes

Vijay Padmanabhan, Cambridge

“PIK is a way of avoiding defaults, so we’re not thrilled by it… We understand why it’s done, but it’s something we would classify as a concern”

Garvan McCarthy, Mercer

“Deferred interest could quickly turn into deferred pain”

Jillien Flores, Managed Funds

“Private credit funds play an important role in supporting businesses by proactively working with borrowers to address challenges before they escalate”

On Dollar Has Second Best Month of 2025 on Data Void, Hawkish Fed

Jayati Bharadwaj, TD Securities

“We expect the dollar rally to continue for a little while longer with no major US data releases and focus remaining on the world outside”

Paresh Upadhyaya, Pioneer Investments

“The lack of US data made it difficult for investors to get a sense of the direction of the US economy”

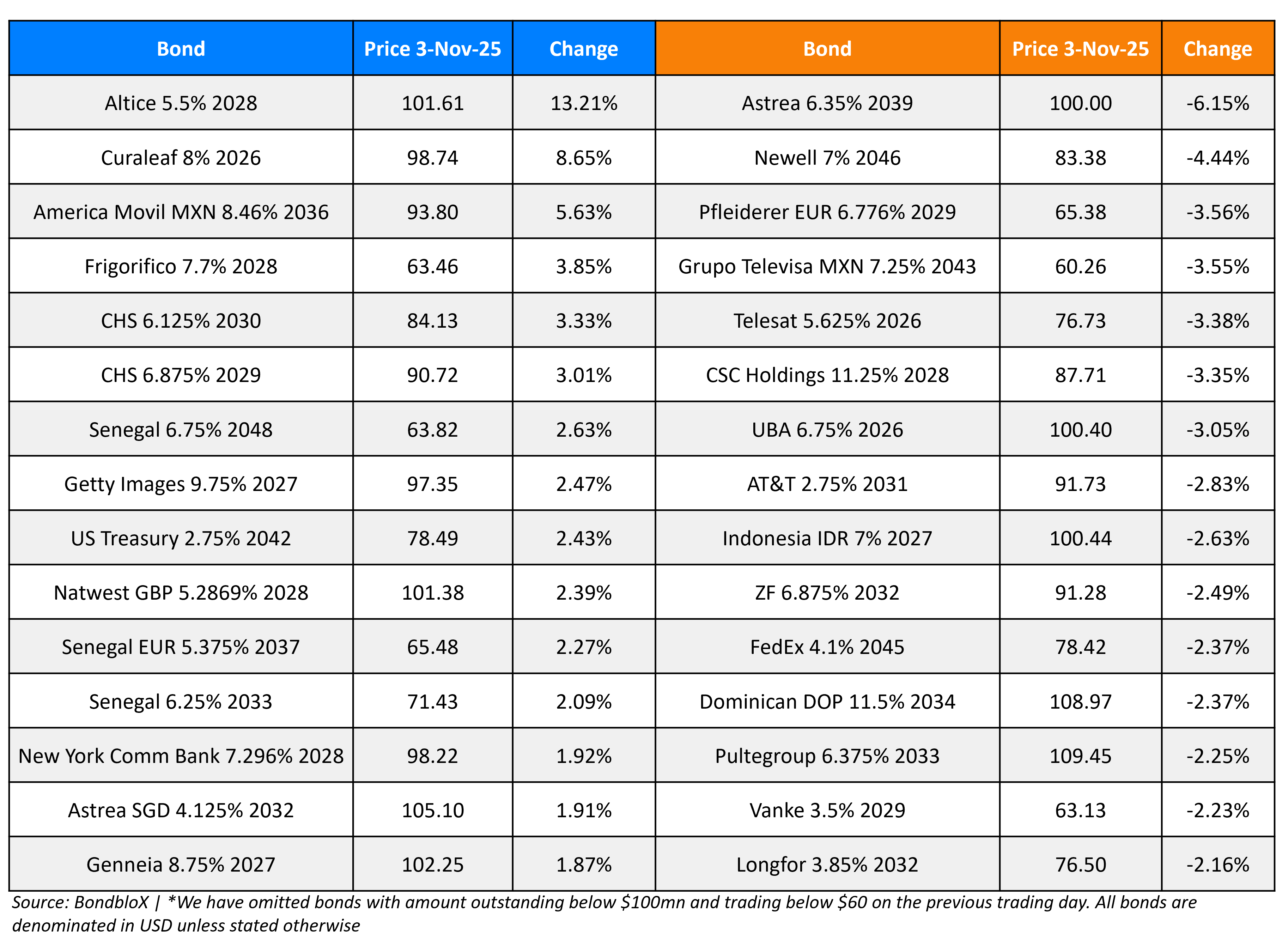

Top Gainers and Losers- 03-Nov-25*

Go back to Latest bond Market News

Related Posts: