This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Q2 GDP Comes in-line with Estimates; Weekly Initial Jobless Claims Fall Further

September 27, 2024

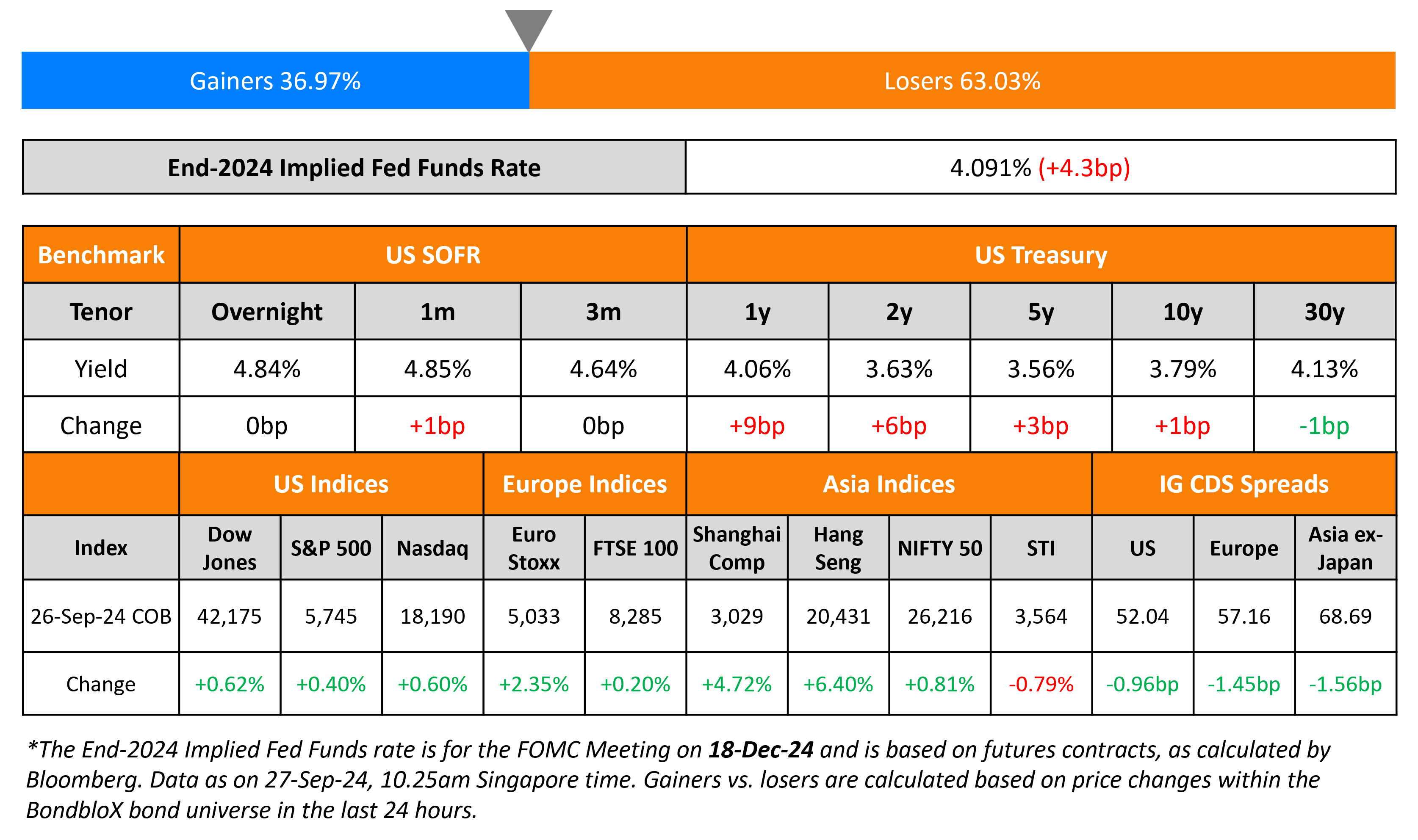

Short-term US Treasury yields rose by about 6-9bp while the long-end held largely steady. Yesterday saw a solid 7Y auction, with a bid-to-cover of 2.63x (vs. 2.5x last month) and an indirect acceptance rate of 70.8%. The annualized GDP growth rate for 2Q came in-line with the expectations at 3.0%, and higher vs. the 1.6% in 1Q. The Core PCE for 2Q came in-line with the expectations at 2.8% but lower than the prior quarter’s reading at 3.7%. Initial jobless claims for last week came at 218K, lower than estimates of 225k and the prior week’s number of 222k. US IG and HY CDS tightened by 1bp and 5.9bp respectively. US equity markets ended higher with the S&P and Nasdaq up by 0.4% and 0.6% respectively.

European equity markets also ended higher. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.5bp and 8.5bp respectively. Asian equity indices have opened higher this morning. Asia ex-Japan IG CDS spreads tightened by 1.6bp.

New Bond Issues

- AerCap $ 5Y Sukuk @ T+140bp area

Lloyds Banking Group raised $1bn via a PerpNC7 AT1 bond at a yield of 6.75%, 37.5bp inside initial guidance of 7.125% area. The junior subordinated notes are expected to be rated Baa3/BB-/BBB-. The bond is callable from 27 September 2031, and any interest payment date thereafter. If not called by 27 September 2031, the coupon resets to 5Y US Treasury plus 315bp. The bond offers a marginal pickup of 8bp compared to BNP’s 8% Perp (Ba1/BBB-/BBB, with a reset of 5Y UST + 372.7bp), which currently yields 6.67%.

Rating Changes

- Fitch Upgrades Turkiye Wealth Fund to ‘BB-‘ on Sovereign Rating Action; Outlook Stable

- Jefferies Finance ‘BB-‘ Rating Affirmed; New Senior Secured Facilities Rated ‘BB-‘; Unsecured Notes Downgraded To ‘B+’

- Vertex Energy Inc. Downgraded To ‘D’ From ‘CCC-‘ On Bankruptcy Filing

- Moody’s Ratings changes Tajikistan’s outlook to positive from stable, affirms B3 rating

- Moody’s Ratings changes Almarai’s outlook to positive; affirms Baa3 issuer rating

-

Fitch Revises Ambipar’s Outlook to Positive; Affirms IDR at ‘BB-‘

Term of the Day

Personal Consumption Expenditures (PCE)

Personal Consumption Expenditures (PCE) is an inflation metric measuring consumer spending on goods and services, released by the US Department of Commerce. The Fed’s preferred measure of inflation is the Core PCE – this refers to the Headline PCE after stripping out two volatile components, namely, food and energy. The US also publishes another inflation metric, the CPI (Consumer Price Inflation), a key inflation indicator. CPI and PCE differ on four fronts: formula, weight, scope and other factors. As per the BLS, “CPI sources data from consumers, while PCE sources from businesses. The scope effect is a result of the different types of expenditures CPI and PCE track…CPI only tracks out-of-pocket consumer medical expenditures, but PCE also tracks expenditures made for consumers, thus including employer contributions. The implications of these differences are considerable.”

Talking Heads

On China Bonds Flashing ‘Japanification’ Warning

Duncan Wrigley, chief China economist of Pantheon Macroeconomics

The yield convergence “is a result of growing optimism that Japan will be able to escape its three decades plus of economic stagnation, combined with mounting pessimism over China’s medium to long-term outlook. China shares some of the features of Japan when it entered stagnation, such as the property sector downturn, balance sheet adjustment issues, asset price corrections and a demographic drag.”

On Stock Market’s ‘Goldilocks Zone’ in Danger of Abrupt End

Mark Spitznagel, founder and chief investment officer of Universa Investments

“When the yield curve disinverts and then unverts, the clock starts ticking and that’s when you enter black swan territory. Gold is going to go down, cryptocurrencies will go down along with risk assets and that bonds could be a place to hide.”

On French Debt Being Riskier Than Spanish Debt

Guy Miller, chief market strategist at Zurich Insurance Co.

“As an investor, I’m not sure what’s going to happen with the current government or thereafter. Right now, the tailwind is still with Spain, potentially an upgrade in terms of the debt dynamic in Spain, investor perception of the growth dynamic, even the political dynamic. All these things together mean Spain is still in the ascendancy.”

Top Gainers & Losers 27-September-24*

Go back to Latest bond Market News

Related Posts:

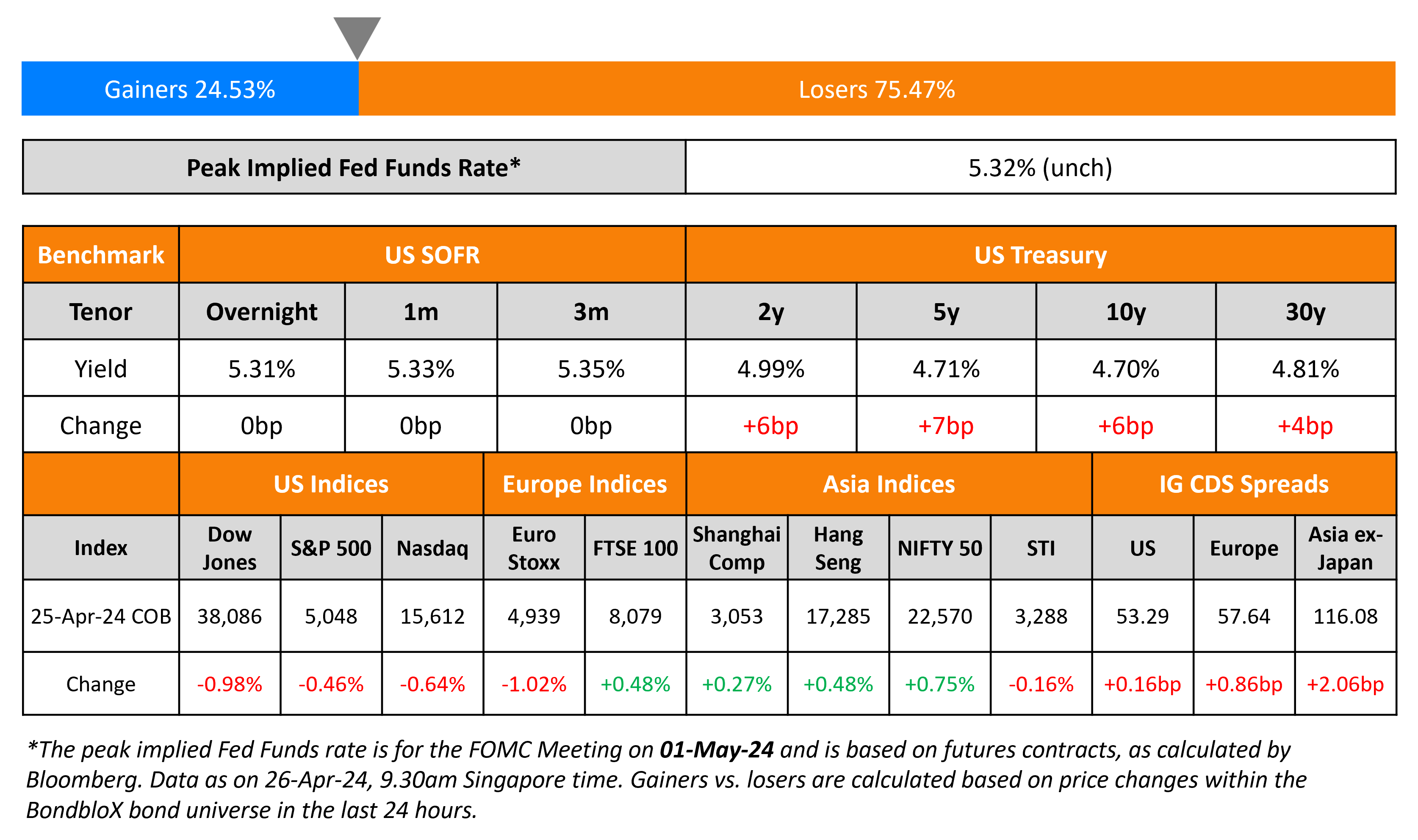

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024