This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

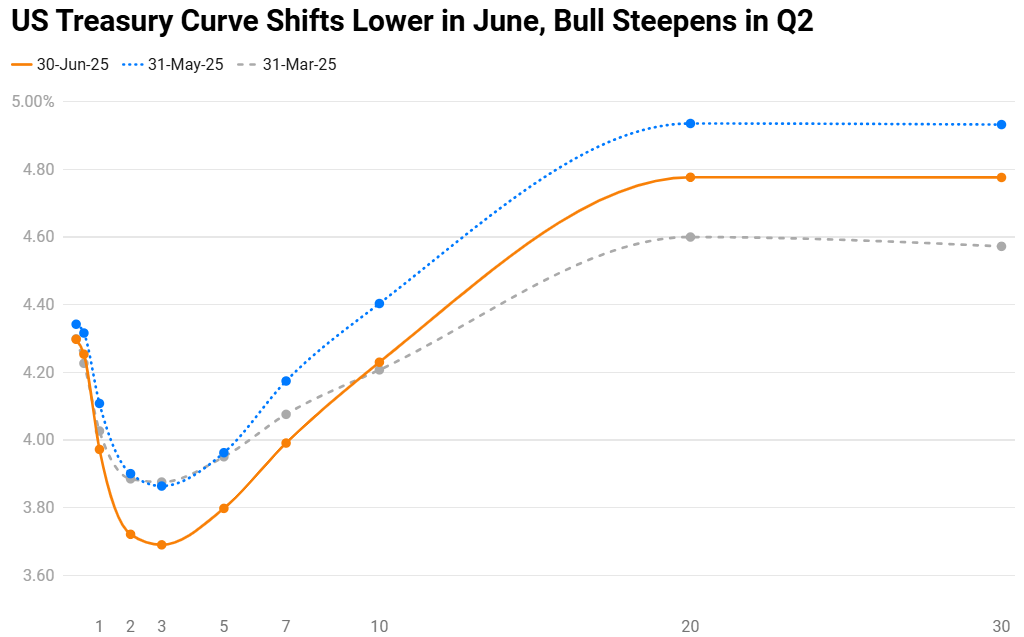

Q2 2025: 75% of Dollar Bonds Rally, led by June Uptick as Yield Curve Shifts Lower

July 1, 2025

Bond investors enjoyed a great second quarter with 75% of dollar bonds in our universe delivering a positive price return (ex-coupon). Both, investment grade (IG) and high yield (HY) bonds delivered strong returns. 75% of IG bonds and 76% of HY bonds ended in the green respectively. This came on the back of a strong uptick in June where 95% and 85% of IG and HY dollar bonds ended higher respectively. The strong performance was led by the rally in Treasuries in June, with markets also pricing-in about 2-3 Fed rate cuts in 2025. This came on the back of uncertainty over the Trump administration’s tariffs, the Fed’s guidance and estimates of a slowing down in growth.

The US Treasury yield curve bull steepened in Q2 – the 2s10s spread steepened by 18bp as the 2Y yield eased 16bp while the 10Y yield was up 2bp. Looking at the move through June alone, the curve shifted parallely lower by ~17bp. Q2 2025 presented a broadly weaker US economic scenario. Average Non-Farm Payroll (NFP) figures indicated a moderation in job growth to about 140-150k, with the average CPI readings showing a drop in inflation to 2.4%. The average ISM data revealed a weakening in activity, with the Manufacturing and Services readings below the 50-mark, indicating a contraction. Consumer sentiment dipped earlier in the quarter, but the latest reading showed its first uptick in the last six months. In their new economic projections, Fed policymakers forecast economic growth slowing down to 1.4% this year, and unemployment rising to 4.5%. 10 Fed officials pencilled-in more than two rate cuts by the end of the year, whereas 7 officials suggested no rate cuts.

Looking at the performance of bonds across bond indices/regions, all regional markets performed well. Among these, the top performers were US High Yield and LatAm corporate bond indices that rallied by nearly 3.3%. Most other indices were up 1.2-1.3% on average.

The IG-space saw most dollar bonds of corporates stay rangebound with no significant patterns being observed in this space.

Among the popular gainers in the High Yield space, Ecuador’s dollar bonds rallied by over 35% after Daniel Noboa won the presidental election followed by reaching an IMF agreement for a $1bn loan boost. Hertz’s bonds also rallied over 15% after it made plans to raise $500mn to strenghten its balance sheet. China Vanke’s dollar bonds were also up by 15-17% after it repaid a dollar bond and secured a new loan amounting to RMB 1.55bn ($215.4mn) from Shenzhen Metro Group to further manage its financial situation. Also, bonds of CHS rallied after its cash buyback offer saw significant interest by bondholders. Lumen’s bonds were higher by 10% during the quarter after AT&T agreed to acquire Lumen Technologies’ consumer fiber operations for $5.75bn in cash.

Dollar bonds of Hong Kong property developer NWD were the biggest losers across the High Yield space, down by over 40% in Q2. The company went through a series of volatile events. It started with reporting a loss of $852mn. It followed-up by seeing high demand for its discounted luxury properties that were seen as a positive for its cashflows. However major concerns rose following a coupon deferral and whether it will be able to secure a key refinancing deal by end-June. NWD ultimately secured a $11.1bn refinancing, one of the largest in Hong Kong. Other property developers’ bonds in different regions were also lower including the likes of Vista Land, GLP China, Far East Consortium etc. Braskem’s dollar bonds fell by over 15% after Brazilian investor Nelson Tanure set the stage for talks to acquire a controlling stake in the company. This was followed by a downgrade to B+ from BB- by S&P.

Issuance Volumes

In Q2 2025, global corporate dollar bond issuances stood at nearly $788bn, 14% higher than the same quarter last year which was at $690bn. In comparison to Q1 2025, issuance volumes were 24% lower. Q2’s issuances were also the highest during the second quarter of a year since 2021 where issuers took to the primary markets after accommodative policy following the pandemic.

Asia ex-Japan & Middle East G3 issuances in Q2 2025 stood at $90.9bn, 5% higher YoY, but 31% lower QoQ. 77% of the volumes in the recently concluded quarter came from IG issuers while HY contributed to 19% of deal volumes, with the remainder taken up by unrated issuers.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024