This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Primary Markets Spring to Life as HSBC, SBI, Fosun, FAB, ORIX and others Launch $ Bonds

September 2, 2025

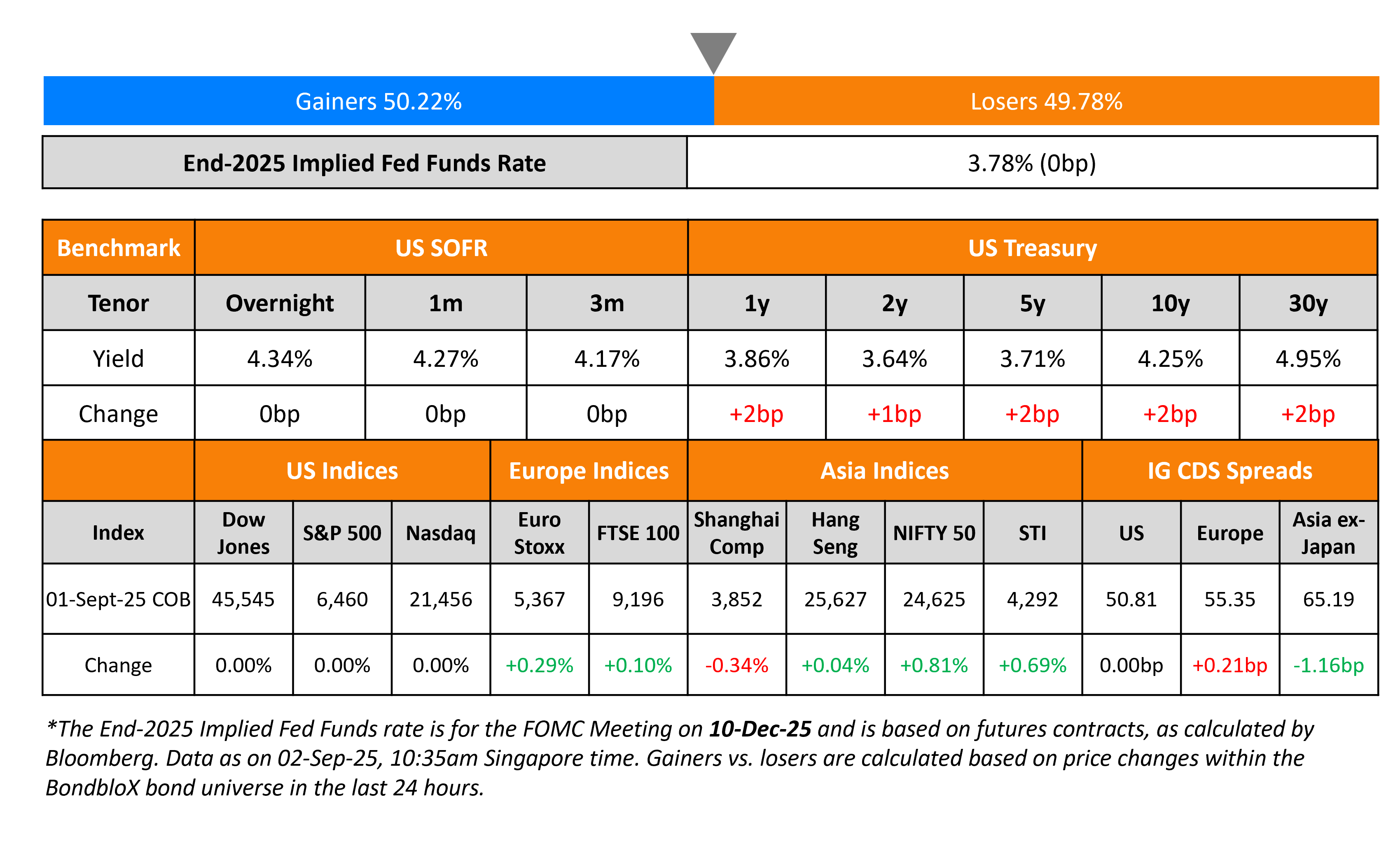

US Treasury yields are higher by 1-2bp this morning after the market was closed on Monday due to Labor Day holidays. Markets await the jobs report on Friday, which will be the first since President Trump fired the BLS head with some analysts keen on the prior reading’s revisions. Besides, the US ISM PMI readings for August are also due this week.

US equity and credit markets were closed. US IG CDS spreads were 0.8bp wider and HY spreads widened by 3.4bp. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads were 0.2bp and 0.1bp wider. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 1.2bp tighter. Primary markets are off to a strong start in September with several dollar deals launched, including HSBC, SBI, Fosun, FAB, ORIX and others.

New Bond Issues

-SBI $ 5Y at T+105bp area

-Fosun $ 4NC2.5 at 7.2% area

-FAB $ 5Y at T+95bp area

-ORIX Corp $ 5Y at T+100bp area

-HSBC $ 11NC10 Tier 2 at T+170bp area

-Sumitomo Mitsui Trust $ 11NC10 at T+145/150bp areas

-Norinchukin Bank $ 5Y/10Y at T+125/140bp areas

-Nomura Holdings $ 10.75NC5.75 at T+160bp area

-MUFG $ 6NC5/6NC5 FRN/11NC10/PerpNC10 at T+105/SOFR eq/120bp/6.875% areas

New Bond Pipeline

-

Turkey Wealth Fund $ bond

Rating Changes

- Fitch Revises Outlook on Baidu to Negative; Affirms at ‘A’

Term of the Day: Initial Price Guidance (IPG)

Initial price guidance (IPG) refers to the proposed yield on a new bond issue. Based on the IPG, investors will place orders with the lead managers of the new bond issue. Once the lead managers have received orders for the proposed bond, they will decide the final pricing on the bond, which in most cases will be tighter (lesser) than the IPG.

Talking Heads

On Fed should be independent but has made mistakes – US Treasury Secretary, Scott Bessent

“The Fed should be independent. The Fed is independent, but I, I also think that they’ve made a lot of mistakes… (On Cook) I’ve been very surprised that the Fed has not done an independent review. She hasn’t said she didn’t do it. She’s just saying the president can’t fire her. There’s a big difference”

On World’s Long-Dated Bonds Facing a Traditionally Terrible Month

Hideo Shimomura, Fivestar Asset Management

“The market right now feels downright unpleasant. September is often when monetary policy takes a sharp turn.”

Mohit Kumar, Jefferies

“We don’t have a lot of issuance during July and August and then not much post-mid November”

On Any Euro Area Government Collapse Being ‘Worrying’ – ECB President, Christine Lagarde

“All risks of governments falling in all euro area countries are worrying… Markets evaluate risks and we’ve seen the country risk increase in recent days… I look very closely at spreads. The additional cost for French debt has increased and is just below Italy, which wasn’t the case a few quarters ago.”

Top Gainers and Losers- 02-Sep-25*

Go back to Latest bond Market News

Related Posts: