This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Powell Wins 10-2, Fed pauses; Muthoot IPTs at 6.125%

January 29, 2026

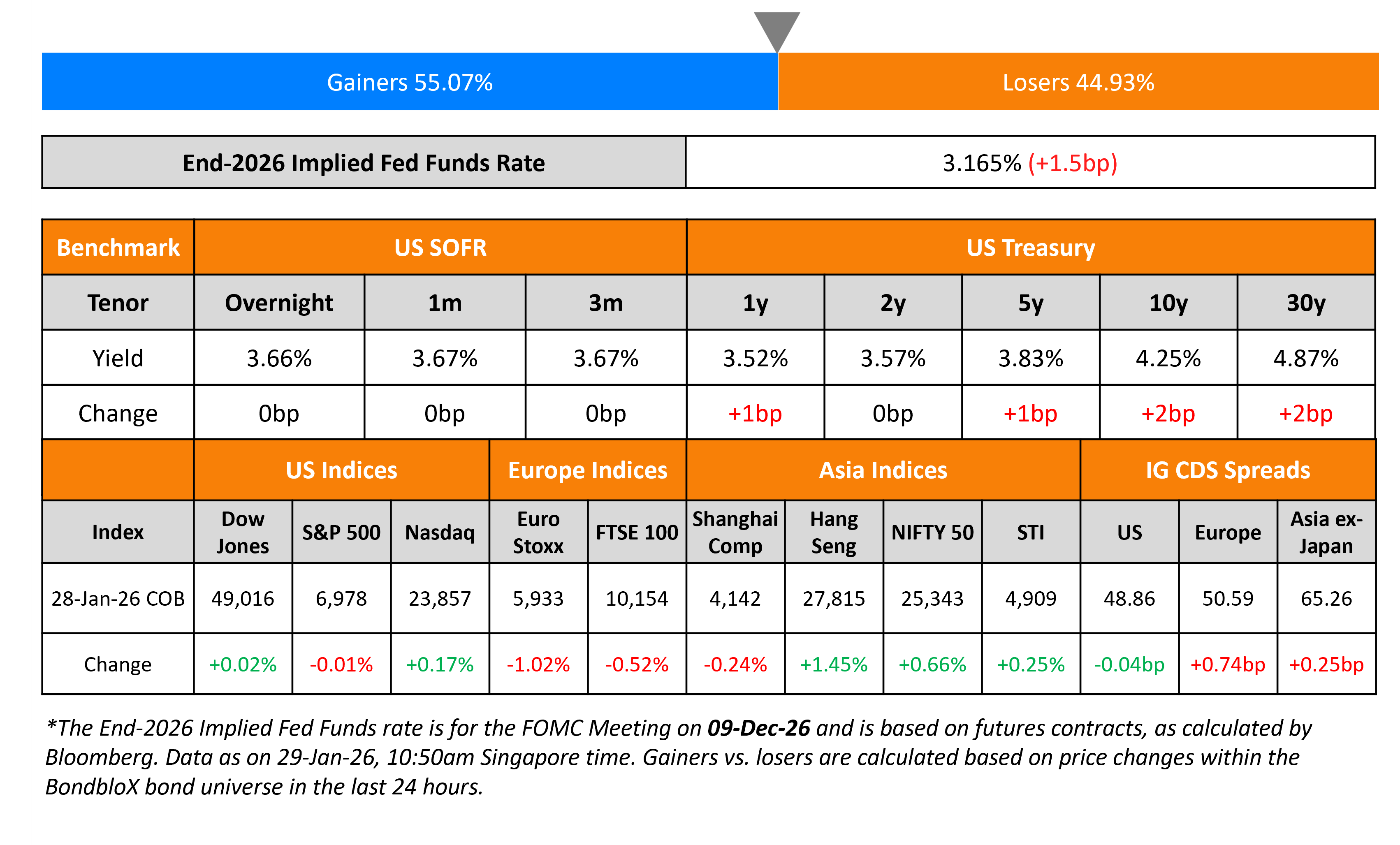

US Federal Reserve kept interest rates unchanged at 3.50%–3.75% in the FOMC concluded yesterday, signaling a potentially extended pause. The FOMC members voted 10–2 in favour, with Christopher Waller and Stephen Miran dissenting in favor of a 25bp cut. Policymakers removed language highlighting rising downside risks to employment, signaling greater confidence in labor market conditions. Fed Chairman Jerome Powell said the outlook for economic activity has “clearly improved,” though he cautioned against overstating labor market gains. Inflation was described as “modestly positive”, but still above target, with Powell attributing much of the overshoot to tariff-related goods price increases, which he views as one-off rather than persistent.

US Treasuries remained broadly stable. Investors are now pricing-in the next potential rate cut around June, likely under Powell’s successor, amid political scrutiny and calls from President Donald Trump for deeper rate cuts. Separately, US Treasury Secretary Scott Bessent reaffirmed the US’ strong dollar policy, after sharp dollar selloff. He stressed that a strong dollar comes from sound economic fundamentals, not market intervention, and said that the US was not selling dollars against the yen.

Looking at US equity markets, the S&P ended flat while Nasdaq ended 0.2% higher. US IG CDS spreads were almost flat while HY CDS spreads were 1.2bp wider. European equity indices ended lower. The iTraxx Main CDS spreads were 0.7bp wider and the Crossover CDS spreads were 3.6bp wider. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 0.3bp. Singapore left its monetary policy unchanged but raised its forecast for inflation to 1%-2%, from 0.5%-1.5% previously.

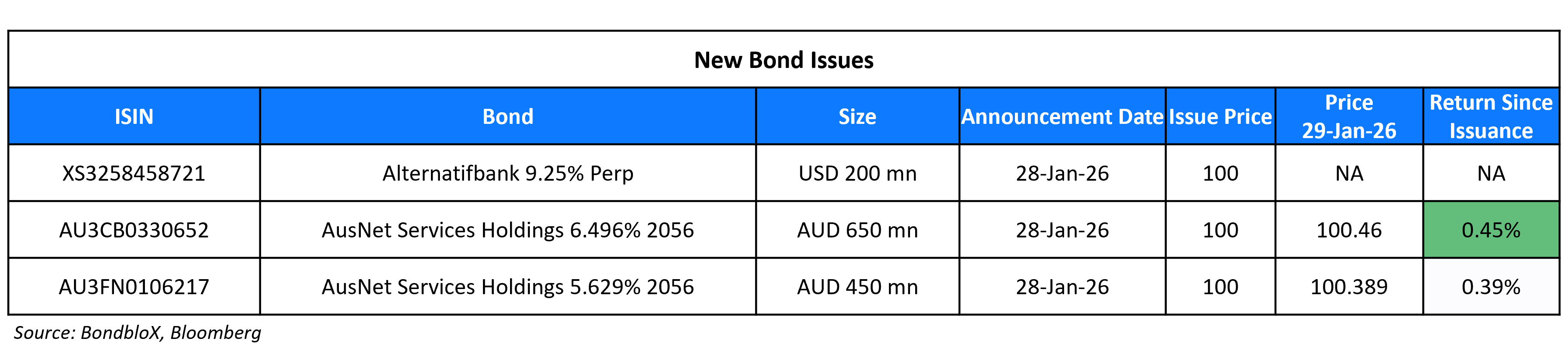

New Bond Issues

- Muthoot Finance $ 4.5Y at 6.125% area

- FAB $ 5Y FRN at SOFR+75bp area

- Wanda Properties $ 2NC1.5 at 13% area

AusNet Services raised A$1.1bn via a two-trancher. It raised A$650mn via a 30NC10 bond at a yield of 6.496%, 30bp inside initial guidance of ASW+205-210bp. It also raised A$450mn via a 30NC10 FRN at 3mBBSW+177bp, 30bp inside initial guidance of 3mBBSW+205-210bp. The subordinated notes are rated Baa3/BBB- (Moody’s/S&P).

AlternatifBank raised $ 200mn via a PerpNC5.5 AT1 at a yield of 9.25%, 62.5bp inside initial guidance of 9.875% area. The junior subordinated note is rated B3 (Moody’s). If not called before 4 August 2031, the coupon will reset to the 5Y Mid-Swap plus 564.1bp.

Rating Changes

- Fitch Upgrades Assured Life Re’s IFS Rating to ‘BBB’; Off Rating Watch Evolving; Outlook Positive

- Fitch Downgrades Afreximbank to ‘BB+’/Stable; Withdraws Ratings

- Moody’s Ratings downgrades Petroperu’s ratings to Caa1; negative outlook

- Fitch Revises 9 Turkish Banks’ Outlooks to Positive on Sovereign Action; Affirms at ‘BB-‘

- Fitch Revises ENA Norte’s Outlook to Stable; Affirms USD Notes at ‘BB’

Term of the Day: Supranationals

Supranationals aka supras, are institutions owned or established by governments of two or more countries. These are generally established by international treaties to accomplish specific policy objectives like economic development, regional integration, expand cross-border trade etc. Multilateral lenders like the IMF, World Bank, ADB are some examples of supranationals. Recently, Turkey said it was planning to limit supply of lira liquidity in the offshore market by restricting local investors from purchasing new lira-denominated bonds issued by supranationals (IFC, World Bank, EBRD etc).

Talking Heads

On Australian Bond Sales Surging to Record

Amy Xie Patrick, Pendal Group

“The asset class has exhibited more resilience and stability during recent bouts of risk-off sentiment that have impacted global credit markets. The surge highlights Australia’s growing appeal as efforts to diversify away from the US dollar gather pace. Historically low default rates, driven by ‘conservative issuers’, are reinforcing that trend.”

Theo Hadiwidjaja, JPMorgan Asset Management

“Given Australia’s AAA sovereign ratings and more balanced supply and demand, the Australian dollar bond market tends to be less volatile.”

On Corporate Hybrid Bonds at Record Low Spreads

Alex Temple, Allspring Global Investments

“I have passed on quite a few of the deals for that reason and we are underweight corporate hybrids in our total return funds.”

Alexandra Ralph, Nedgroup Investments

“On a sub-senior level it’s very hard to justify” corporate hybrids. They are buying short call hybrids for good carry and as “they almost always call”.

On Japan Selloff Reflecting Global Bond Deluge

Brian Coulton, Fitch Ratings

“It’s probably not telling you that the market thinks Japan is going to blow up fiscally, but it is a signal that bond markets and supply of government debt through fiscal deficits and central banks putting bonds back to the market is an issue for rates, and it’s not only an issue for Japan.”

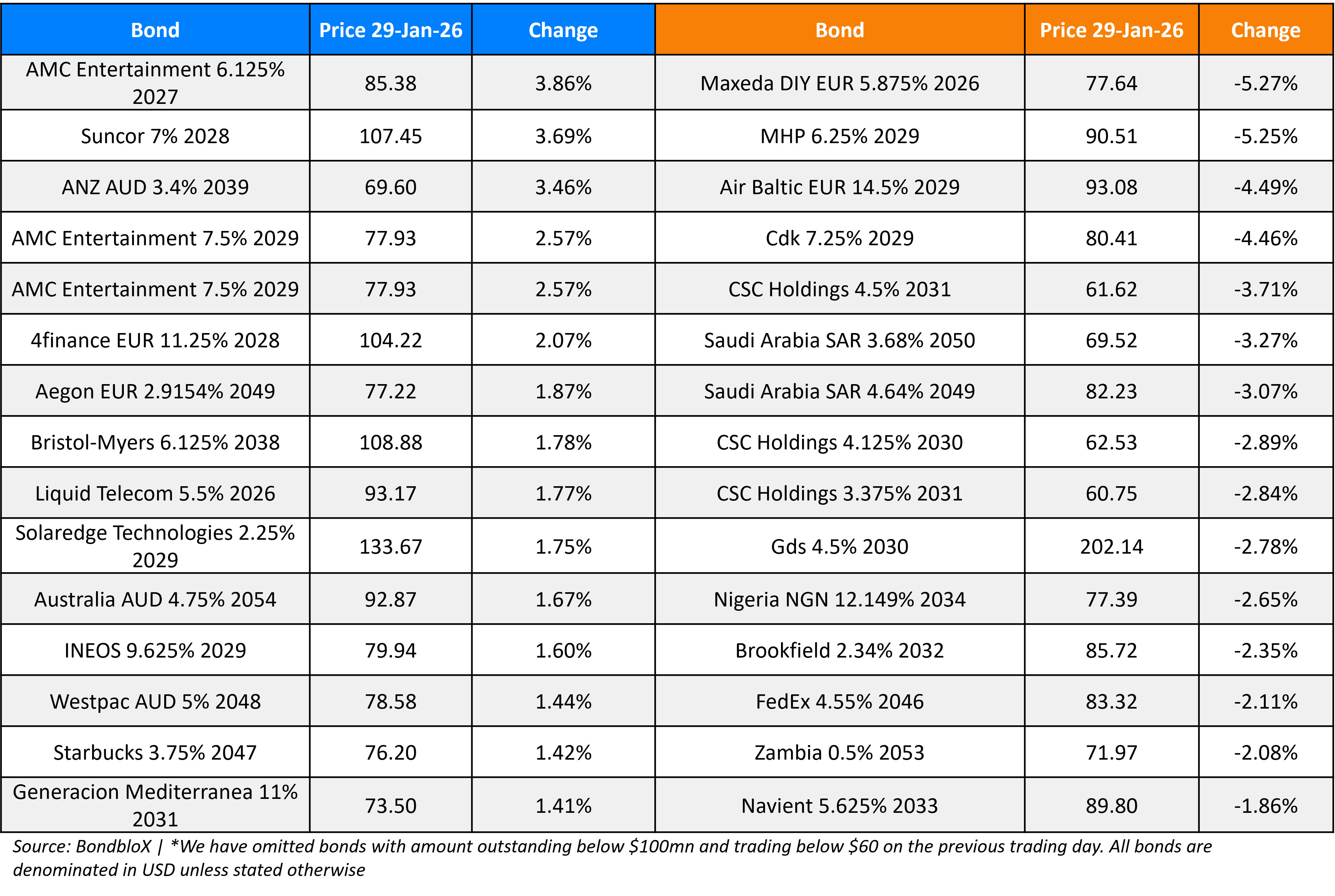

Top Gainers and Losers- 29-Jan-26*

Go back to Latest bond Market News

Related Posts: