This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

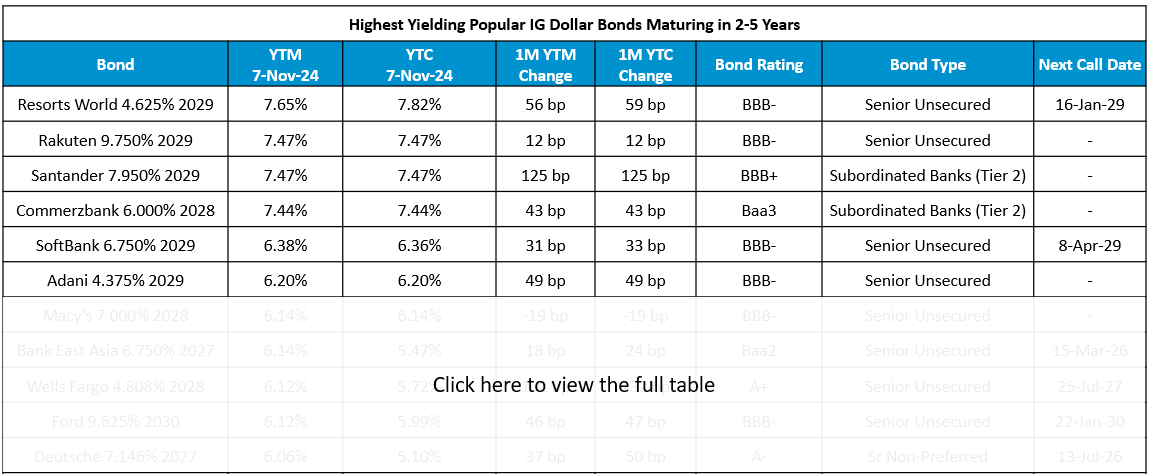

View Popular Top Yielding, Low Duration IG Dollar Bonds

November 7, 2024

Amid the jump higher in yields across the US Treasury curve since September, corporate dollar bond yields have also moved higher. With credit spreads on investment grade indices across US and Asia ex-Japan now near record tight levels of 48bp and 71bp respectively, the pick-up in bond yields has primarily occurred due to the move in Treasuries as compared to spreads. However, the rise in yields also causes duration risk on high grade bonds, with some analysts preferring short-to-medium duration bonds and avoiding high duration risk. On this front, we have provided a list of the top yielding popular global IG-rated dollar bonds in our universe, that mature in 2-5 years, (between 2027 and 2030). The bonds are rated as investment grade by at least one rating agency, and are callable at least after six months.

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

What is The Yield Curve Inversion and Should it Cause Panic?

December 7, 2018

Will You Pay Your Bank To Keep Your Money?

July 15, 2020