This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Philippines’ BPI, QBE, Perennial Holdings Price Bonds

March 28, 2025

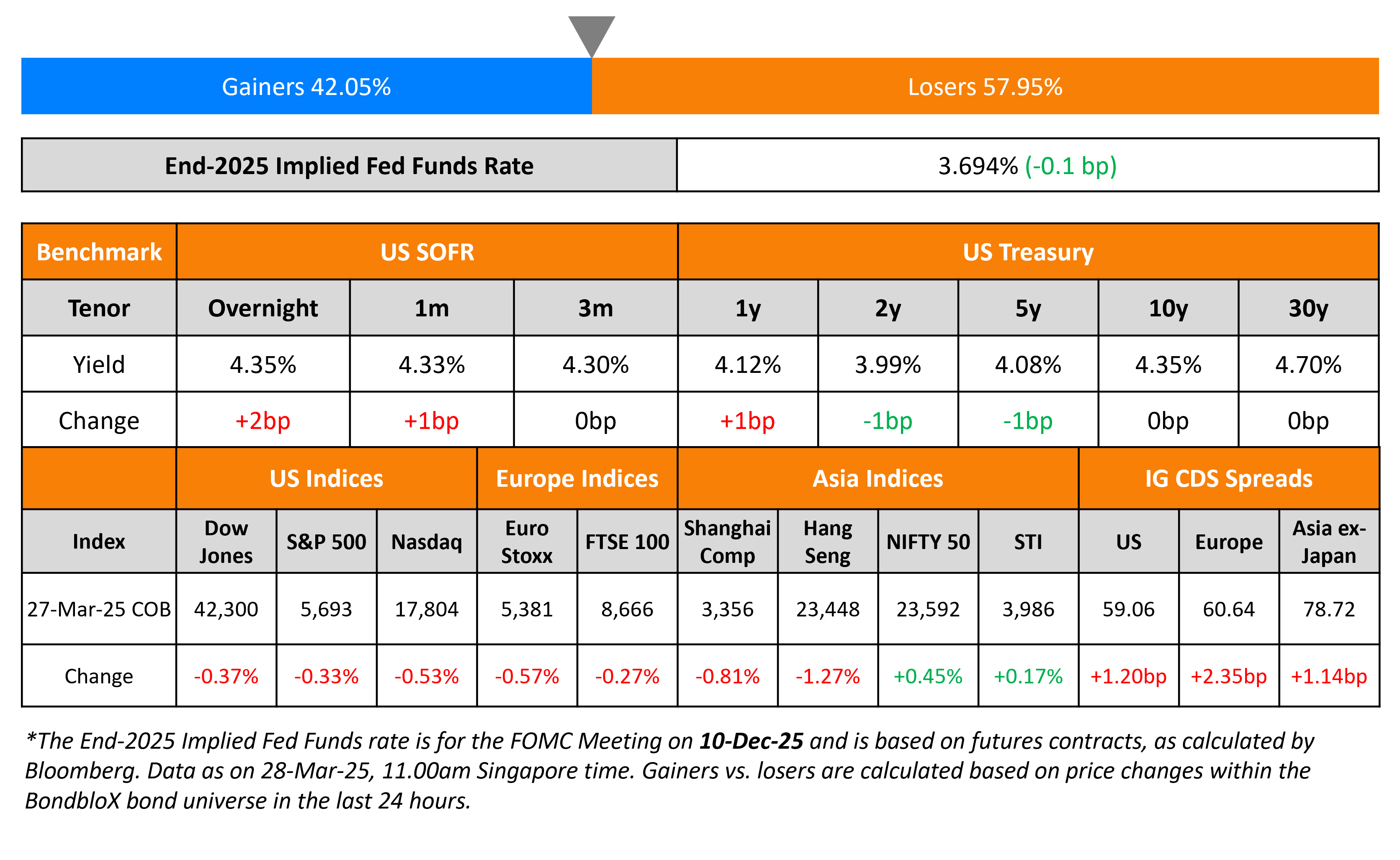

US Treasury yields were broadly unchanged, for a third straight day. The final reading of US Q4 GDP came-in at 2.4%, higher than expectations and the second reading of 2.3%. Boston Fed President Susan Collins said that it was “inevitable” that tariffs will boost inflation, at least in the near term. Richmond Fed President Tom Barkin said that businesses, consumers, and the Fed were waiting for the fog to clear on the uncertainty induced by recent tariff measures.

US equity markets moved lower, with the S&P and Nasdaq down by 0.3% and 0.6% respectively. Looking at credit markets, US IG and HY CDS spreads widened 1.2bp and 21bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 2.4bp and 8bp respectively. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads were wider by 1.1bp.

New Bond Issues

Philippines’ BPI raised $800mn via a two-trancher. It raised $500mn via a 5Y bond at a yield of 5.14%, 25bp inside initial guidance of T+130bp area. It also raised $300mn via a 10Y bond at a yield of 5.665%, 25bp inside initial guidance of T+155bp area. The unsecured bonds are rated Baa2/BBB+/BBB-. Proceeds will be used for general corporate purposes and to refinance existing debt.

QBE Insurance raised $500mn via a 10.5NC5.5 bond at a yield of 5.834%, 25bp inside initial guidance of T+200bp area. The subordinated bond is rated BBB/BBB (S&P/Fitch).

Perennial Holdings raised S$125mn via a 3Y bond at a yield of 5.75%. The bond is unrated. Proceeds will be used for general corporate purposes, including refinancing of existing borrowings/financing working capital, investments (including M&A) and/or capex requirements.

Rating Changes

-

Three Spanish Banks Upgraded, The Rest Affirmed On Stronger Industry Dynamics

-

Moody’s Ratings upgrades PG&E Corporation and Pacific Gas & Electric’s ratings; outlooks stable

-

Moody’s Ratings upgrades Carvana’s CFR to B3, outlook remains positive

-

Moody’s Ratings upgrades DCP Midstream’s ratings to Baa2; stable outlook

-

Moody’s Ratings upgrades Toll Brothers’ unsecured ratings to Baa2, stable outlook

-

Marriott Vacations Worldwide Corp. Senior Unsecured Notes Rating Lowered To ‘B’, Recovery Rating Revised To ‘6’

-

Fitch Revises Outlook on Commonwealth Bank of Australia to Positive, Affirms Long-Term IDR at ‘AA-‘

-

Raiffeisen Bank International Outlook Revised To Stable From Negative On Lower Nonfinancial Risks; Ratings Affirmed

Term of the Day: Collateralization

Collateralization refers to the process of securing a loan with a valuable asset, known as collateral. The assets/collateral is provided by the borrower so that in the event of a default, the lender can take possession of the asset to cover the debt. The amount that is lent is typically a percentage (for example 60-90%) of the collateral provided.

Talking Heads

On IMF assessing Trump’s tariff plans, and not seeing a US recession

“Since then, of course, there have been many developments. Large policy shifts have been announced, and the incoming data is signaling a slowdown in economic activity from the very strong pace in 2024 … recession is not part of our baseline.”

On Fed Backstop Fears Potentially Threatening the Dollar – Deutsche Bank

“Were such concerns to prevail among America’s Western allies, it would likely create the most significant impetus to global de-dollarisation”

On Debt Investors Needing to Get Paid More for Tariff Risk – JPMorgan

“We just need to be paid a little bit more for the uncertainty risk… tariffs are very uncertain, so we can’t really have a zero probability of recession… technicals from where we were at the beginning of the year have deteriorated,… competition from JGBs is pretty keen and we haven’t seen that in years”

Top Gainers and Losers- 28-March-25*

Go back to Latest bond Market News

Related Posts: