This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Petrobras, TWF, Suzano, Nordea and others Price $ Bonds

September 4, 2025

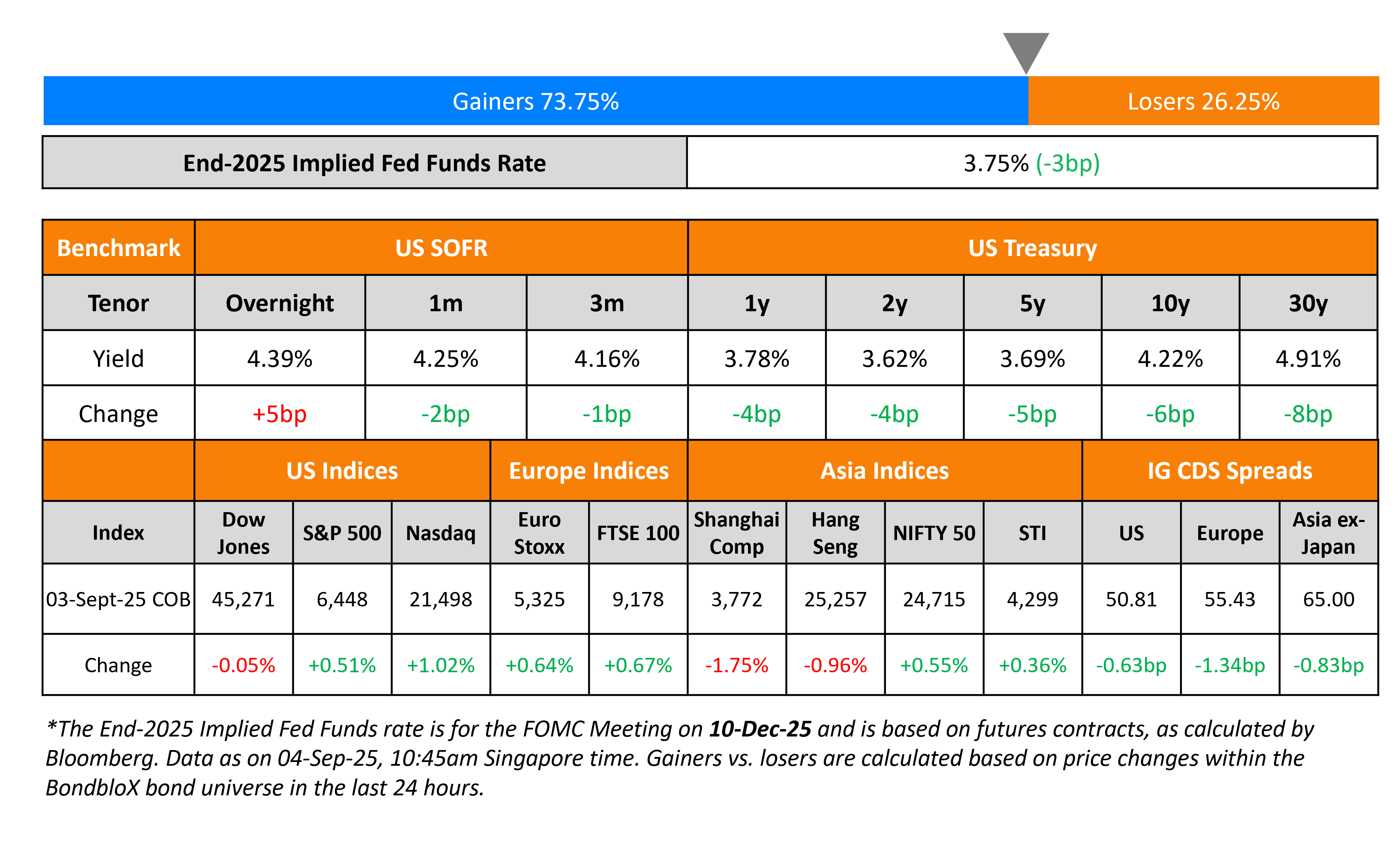

US Treasury yields fell by 4-6bp across the curve, on the back of softer than expected labor market data. US JOLTS job openings for July came-in at a 10-month low of 7.18mn, worse than expectations of 7.38mn. Besides, Factory Orders for July fell 1.3% and the final print of the Durable Goods Orders showed a 2.8% drop. Separately, Atlanta Fed President Raphael Bostic reiterated his stance for one interest rate cut being appropriate for the year. Fed governor Chris Waller also reiterated that the FOMC must start cutting rates from the upcoming meeting, and that 100-150bps in cuts would be needed to get towards the neutral rate. However, St. Louis Fed President Alberto Musalem said that the FOMC’s modestly restrictive rate stance was appropriate going by the labor market data.

Looking at US equity markets, the S&P and Nasdaq were higher by 0.5% and 1% respectively. US IG CDS spreads were 0.6bp tighter while HY spreads widened by 0.8bp. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads were 1.3bp and 7.1bp tighter. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 0.8bp tighter.

New Bond Issues

-CCB London 3Y/5Y SOFR green at T+105/115bp area

Petrobras raised $2bn via a two-part deal. It raised $1bn via a 5Y bond at a yield of 5.35%, 35bp inside initial guidance of 5.70% area. It also raised $1bn via a long 10Y bond at a yield of 6.55%, 35bp inside initial guidance of 6.90% area. The senior unsecured notes are rated Ba1/BB/BB. Proceeds will be used for general corporate purposes. The new 5Y bond was priced at a new issue premium of 14bp over its existing 5.6% 2031s that currently yield 5.21%. The new 10Y bond was priced at a new issue premium of 20bp over its existing 6% 2035s that currently yield 6.35%.

Turkey Wealth Fund raised $1bn via a two-part deal. It raised $500mn via a long 5Y bond at a yield of 7.00%, 62.5bp inside initial guidance of 7.625% area. It also raised $500mn via a long 10Y bond at a yield of 7.75%, 62.5bp inside initial guidance of 8.375% area. The senior unsecured notes are rated BB- (Fitch). The notes have a change of control put at 100. Proceeds will be used for general corporate purposes. The new 5Y bond was priced at a new issue premium of 58bp over its existing 6.95% 2030s that currently yield 6.42%. As compared to the Turkish sovereign’s 5.95% 2031s that currently yield 6.34%, the new 5Y bond offers a yield pick-up of 66bp.

Nordea Bank raised $850mn via a PerpNC8 AT1 bond at a yield of 6.75%, 50bp inside initial guidance of 7.25% area. The junior subordinated note is rated BBB/BBB+, and received orders of $7.3bn, ~8.6x issue size. If not called by 10 November 2033, the coupon will reset to the 5Y UST+272.3bp. A trigger event would occur if the CET1 ratio of the issuer (solo basis) or the Group (consolidated basis) is less than the 5.125%.

Suzano Netherlands raised $1bn via a long 10Y bond at a yield of 5.667%, 25bp inside initial guidance of T+180bp area. The senior unsecured note is rated Baa3/BBB-/BBB-. Proceeds will be used to repurchase its 2026s and 2027s under its concurrent tender offer.

Blackstone Private Credit raised $500mn via a 5Y bond at a yield of 5.291%, 25bp inside initial guidance of T+185bp area. The senior unsecured note is rated Baa2/BBB-. Proceeds will be used for general corporate purposes.

CBQ raised $600mn via a 5Y bond at a yield of 4.689%, 25bp inside initial guidance of T+125bp area. The senior unsecured note is unrated. Proceeds will be used for general corporate purposes.

Sumitomo Life Insurance raised $1.2bn via a 30NC10 bond at a yield of 5.875%, 25bp inside initial guidance of 6.125% area. The subordinated note is rated A3/A-.

PTT Global Chemical raised $1.1bn via a two-trancher:

- It raised $600mn via a PerpNC5.25 bond at a yield of 6.5%, 50bp inside initial guidance of 7.0% area. If not called by 10 December 2030, the coupon will reset to the 5Y UST+281.5bp. If not called by 10 December 2035, a step-up of 25bp will take effect on the above (5Y UST+ 306.5bp). However, if not called by 10 December 2050, a larger step-up of 75bp will take effect over and above the previous step-up (5Y UST+381.5bp)

- It also raised $500m via a PerpNC10 bond at a yield of 7.125%, 50bp inside initial guidance of 7.625% area. If not called by 10 December 2035, the coupon will reset to the 5Y UST+316.2bp. If not called by 10 December 2050, a step-up of 50bp will take effect on the above (5Y UST+ 366.2bp).

The notes are rated Ba2/BB. Proceeds will be used towards payment of the purchase price and accrued interest for the notes under its tender offer and for general corporate purposes, that includes debt repayment and onward lending.

Fubon Life Singapore raised $650mn via a 10.25Y Tier-2 bond at a yield of 5.469%, 30bp inside initial guidance of T+150bp area. The subordinated notes are rated BBB+/BBB+. Proceeds will be used to supplement and strengthen its financial structure and capital base and to improve the capital adequacy ratio.

BNY Mellon raised $500mn via a PerpNC5 bond at a yield of 5.95%, 30bp inside initial guidance of 6.25% area. The subordinated note is rated Baa1/BBB/BBB+. The SEC registered depositary shares, represent a 1/100th interest in a share of its fixed-rate reset non-cumulative Series L preferred stock. Proceeds will be used for general corporate purposes.

Plains All American raised $1.25bn via a two-trancher. It raised $700mn via a long 5Y bond at a yield of 4.73%, 32.5bp inside initial guidance of T+137.5bp area. It also raised $550mn via a long 10Y bond at a yield of 5.627%, 28bp inside initial guidance of T+170bp area. The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used to redeem the 4.65% 2025s due in October and to fund a portion of its EPIC Acquisition. The new 5Y bond was priced at a new issue premium of 9bp over its existing 3.8% 2030s that currently yield 4.64%. The new 10Y bond was priced roughly inline with its existing 5.95% 2035s that currently yield 5.28%.

New Bond Pipeline

– Sobha Realty hires for $ 5Y bond

-SK Hynix plans $ 3Y/5Y bond

-KHFC hires for $ 3Y/5Y FRN bond

Rating Changes

-Moody’s Ratings upgraded United Arab Bank’s deposit ratings to Baa2, outlook changed to stable

-Moody’s Ratings Reviews Kraft Heinz’s Baa2/P2 ratings for downgrade following announced split of company

-Fitch Revises Fibra Soma’s Outlook to Stable; Affirms IDRs at ‘BBB- ‘

Term of the Day: Tier 2 Bonds

Tier 2 bonds are debt instruments issued by banks to meet their regulatory tier 2 capital requirements. Tier 2 capital (and thus tier 2 bonds) rank senior to tier 1 capital, which consists of common equity tier 1 (CET1) and additional tier 1 (AT1) capital. CET1 consists of a bank’s common shareholders’ equity while AT1 consists of preferred shares and hybrid securities or perpetual bonds. Tier 2 capital consists of upper tier 2 and lower tier 2 wherein the former is considered riskier to the latter. From a bond investor’s perspective, tier 2 bonds are senior, and therefore less risky, compared to AT1 bonds as AT1s would be the first to absorb losses in the event of a deterioration in bank capital.

Talking Heads

On Bearish Treasuries Bets Growing as Traders Brace for Key Jobs Data

Kathryn Kaminski, AlphaSimplex

“If we get enough bad data to tip the scales we could have a break out in yields lower for the short end… could be sort of a catalyst to signal that things in the labor market are a little bit worse than we thought”

Sean Simko, SEI Investments

“A strong number will move yields higher, faster than a weak number will push yields lower, unless the number is very weak”

Steven Englander, StanChart

“To take a cut off the table completely, we think NFP would have to rise to 130k or more, with positive revisions”

On Japanese Investors Facing ‘Sea Change’ in Rising Yields – RBC Capital Markets

“For the first time since 2020, Japanese investors will have yields attractive enough to invest at home… in the not-too-distant future, Japanese investors will be indifferent from buying anywhere on the Japanese government bond curve versus US Treasuries”

On Trump Putting Fed on Verge of ‘Credibility Crisis’ – Fmr US Treasury Secretary, Larry Summers

“We’re on the foothills of a credibility crisis. We are in completely unprecedented territory… This is an attack on the governance of the institution… There hasn’t yet been a dramatic market reaction… playing with fire in terms of inflation expectations”

Top Gainers and Losers- 04-Sep-25*

Go back to Latest bond Market News

Related Posts: