This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pemex’s Dollar Bonds Ease as Analysts Criticise the Impact of Mexico’s Plan

August 7, 2025

Despite the Mexican government’s new plan and $13bn infusion to make Pemex financially self-sufficient by 2027, analysts remain skeptical about an anticipated Pemex turnaround. Bloomberg and industry experts note that the strategy fails to address entrenched operational challenges – namely, Pemex’s aging oil fields, oversized workforce, and loss-making refineries. Bloomberg says that the total leverage is expected to remain above 10x, vs. industry peer levels of 2x, even if the $77bn debt target is achieved by 2030. While Pemex is pursuing new joint ventures and targeting increased production at a handful of key fields, analysts have highlighted concerns. This relates to the unclear path to securing committed private partners and the lack of concrete measures to overhaul unprofitable segments.

Pemex’s dollar bonds are trading weaker across the curve, with its 5.95% 2031s down by 1 point, currently trading at 91.97 and yielding 7.78%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

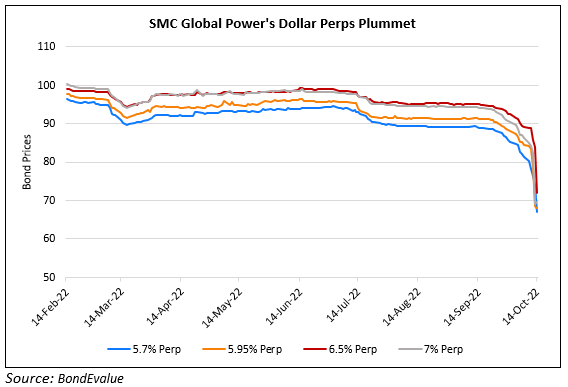

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

Fitch Expects Mexican Government to Continue Supporting Pemex

August 17, 2023