This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

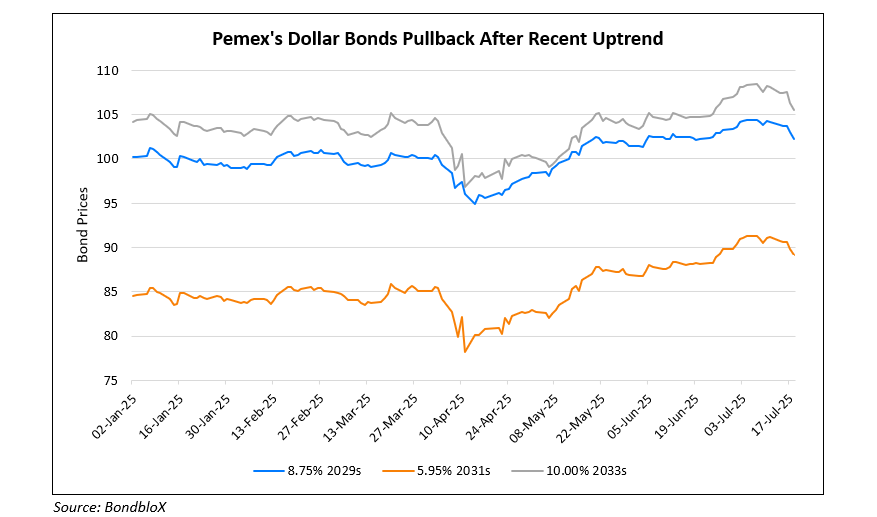

Pemex’s Dollar Bonds Trade Weaker

July 18, 2025

Pemex’s dollar bonds which were on an uptrend since mid-April, rallying by ~10% are trading weaker over the last two days. The Energy Workforce & Technology Council (EWTC), a Houston-based national trade association for energy service companies, requested Mexican President Claudia Sheinbaum to address non-payments by Pemex. In a letter, the EWTC warned that continued delays in payment are threatening future investment in Mexico’s energy sector. Pemex owes the EWTC’s members $871mn for services rendered in 2024 and $983mn for work completed in 2025

Pemex has recently started slashing its exploration and production spends, begun laying-off workers and is relying on the government to pay off its creditors. To address the company’s financial struggles, Pemex was said to be in talks with billionaire Carlos Slim to finance the Zama and Ixachi oil and natural gas fields. Mexican President Sheinbaum recently announced that she was planning to present a restructuring plan for Pemex with details to be confirmed by end-July. Currently, the company has $101bn in financial debt and owes about $20bn to its suppliers and oil field service companies.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Pemex Reports 38% Wider Loss at $23 Billion

March 1, 2021

Pemex’s Rating Withdrawn by Fitch

March 3, 2021