This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

PCE Records Lowest Quarter Reading Since Pandemic

June 27, 2025

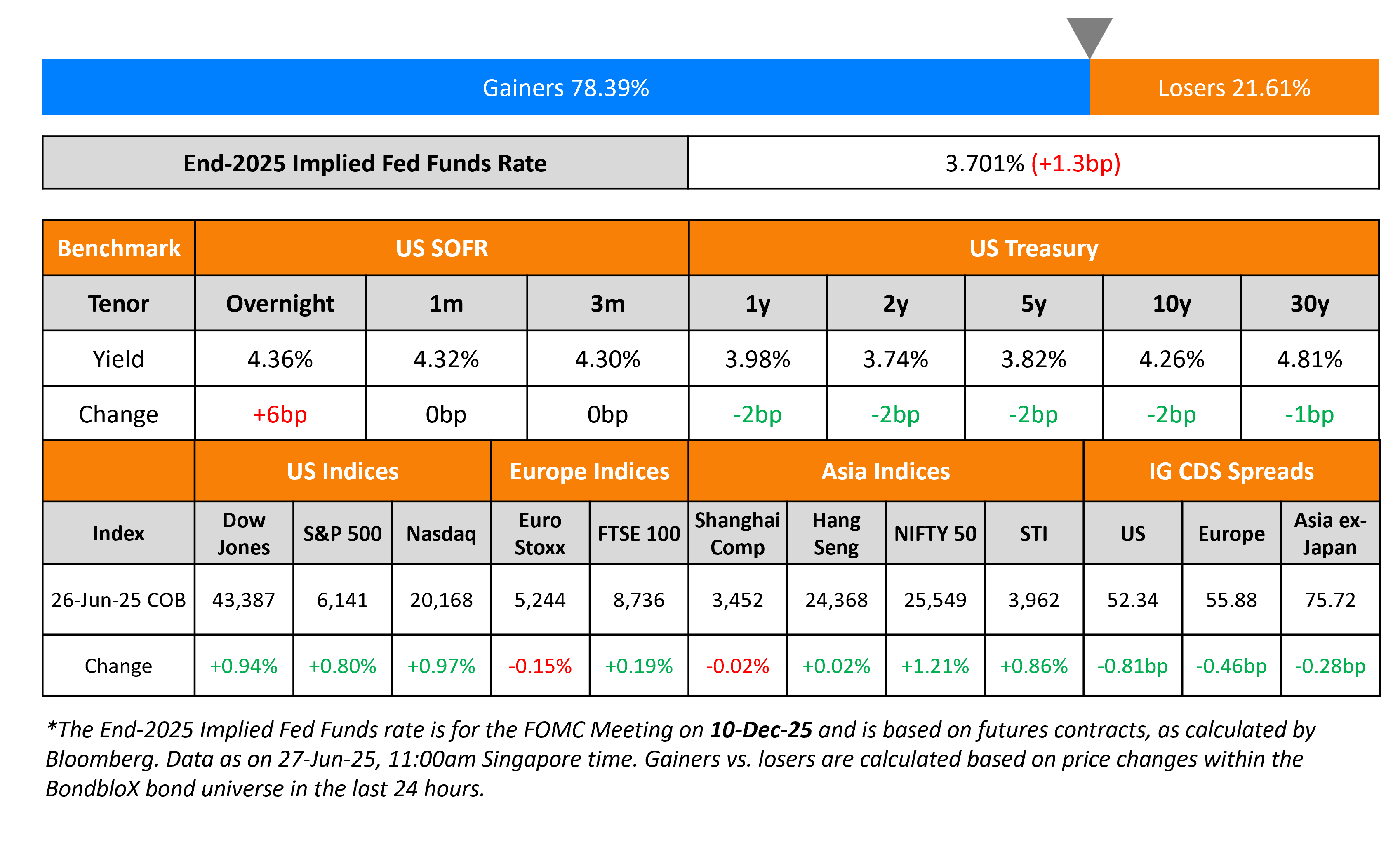

US consumer spending for the first quarter grew at 0.5%, lower than expectations of 1.2% and the lowest reading since Q2 2020 during the onset of the pandemic. As a result, the US GDP declined at a downwardly revised 0.5% annualized rate, worse than estimates of a 0.2% decline. Initial jobless claims for the week came in at 236k, lower than expectations of 243k and prior week’s figure of 245k. Markets’ expectations of three Fed rate cuts before the end of the year increased as a result. Current rate cut probabilities stand at 74% in September (from 56% a week ago), 59% in October (from 33% a week ago) and 44% in December (from 22% a week ago). Treasury yields eased further by 2bp across the board and equity markets climbed higher.

The S&P and Nasdaq rose 0.80% and 0.97% respectively, with Nvidia hitting a new record high to reclaim the world’s most valuable company ($3.78tn!). In credit markets, US IG CDS spreads eased by 0.9bp while HY CDS spreads remained unchanged. European equity markets closed mixed, with EuroStoxx down 0.15% and FTSE up 0.19%. The iTraxx Europe Main and Crossover CDS spreads tightened by 0.5bp and 2.2bp respectively. Asian equity markets have opened higher today, led by Nikkei up by 1.6% at the time of writing. Asia ex-Japan CDS spreads remain unchanged.

New Bond Issues

Latam Airlines raised $800mn via a long 5NC3 bond at a yield of 7.625%, 37.5bp inside initial guidance of 8% area. The senior secured bond is expected to be rated Ba2/BBB-/BB+. Proceeds will be used for repayment of certain indebtedness, including the redemption in full, together with cash on hand, of the 2029 Notes, and any remainder for general corporate purposes. The 13.375% 2029s are currently trading at 112.2 and callable on 15 october at 110. The new 5NC3 priced at a new issue premium of 21.5bp vs. its existing 7.875% 2030s currently yielding 7.41%.

Mizuho Financial Group raised $3bn via a three trancher. It raised:

- $1.25bn via a 6NC5 bond a yield of 4.711%, 28bp inside initial guidance of T+120bp area.

- $750mn via a 6NC5 FRN at SOFR+125bp, compared to inside initial guidance of SOFR equivalent area.

- $1bn via a 11NC10 bond a yield of 5.323%, 30.5bp inside initial guidance of T+135-140bp area.

The senior unsecured bonds are rated A1/A- (Moody’s/S&P). Proceeds will be used to make a loan that is intended to qualify as Internal TLAC under the Japanese TLAC Standard to Mizuho Bank, Ltd. Mizuho Bank, Ltd. intends to utilize such funds for its general corporate purposes.

ICBC Financial raised $400mn via a 3Y FRN at SOFR+63bp against initial guidance of SOFR+115bp area. The senior unsecured green bond is rated A/A (S&P/Fitch). ICBC Financial Leasing Co Ltd. is the Keepwell provider. Proceeds will be used to finance and/or refinance Eligible Green Assets as described under “Renewable energy” and “Clean transportation” categories in the Company’s Sustainable Finance Framework.

Argentina’s Province of Cordoba raised $725mn via a 7Y bond at a yield of 9.75%. The senior unsecured bond is rated Caa2/CCC+ (Moody’s/Fitch). Proceeds will be used to repurchase the Step-up International 6.99% notes due 2027 validly tendered and accepted in the Tender Offer, and the remainder to finance infrastructure projects and/or repay existing liabilities.

New Bond Pipeline

-

-

Softbank hires for $ 5Y/10Y bond

-

Shinhan Bank hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

-

Rating Changes

-

Fitch Upgrades Ronesans Gayrimenkul Yatirim to ‘BB-‘; Outlook Stable

-

Moody’s Ratings downgrades RDM’s CFR to Caa1, negative outlook

-

Energean PLC Outlook Revised To Negative From Developing; ‘B+’ Ratings Affirmed

Term of the Day

Keepwell Provision

A Keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Talking Heads

Kaspar Hense, RBC Bluebay

“We are short the dollar in this environment, where there is an erosion of institutions”.

Seema Shah, Principal Asset Management

“Talk about having the next Fed chair announced within the next couple of months, that would be fairly disruptive. It brings up the whole concern about the credibility and reliability of U.S. institutions again, which is typically something that people don’t like.”

On Indonesia’s Yield Curve Steepening – Winson Phoon, Maybank Securities

“Indonesian bond curve has steepened largely because it is in the midst of an easing cycle but reflecting in part some fiscal risk premiums”.

Analysts at Goldman Sachs

“The changes to the SLR calculation should increase the availability (and potentially lower the cost) of short-term, secured financing for market participants, improving liquidity in financial markets and the U.S. treasury market in particular.”

Analysts at Barclays

“The Fed’s proposal to calibrate eSLR should give the banking system meaningful capacity to expand its balance sheet in low-risk assets.”

Top Gainers and Losers- 27-Jun-25*

Go back to Latest bond Market News

Related Posts: