This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

PCE, Core PCE Inline With Expectations

June 3, 2024

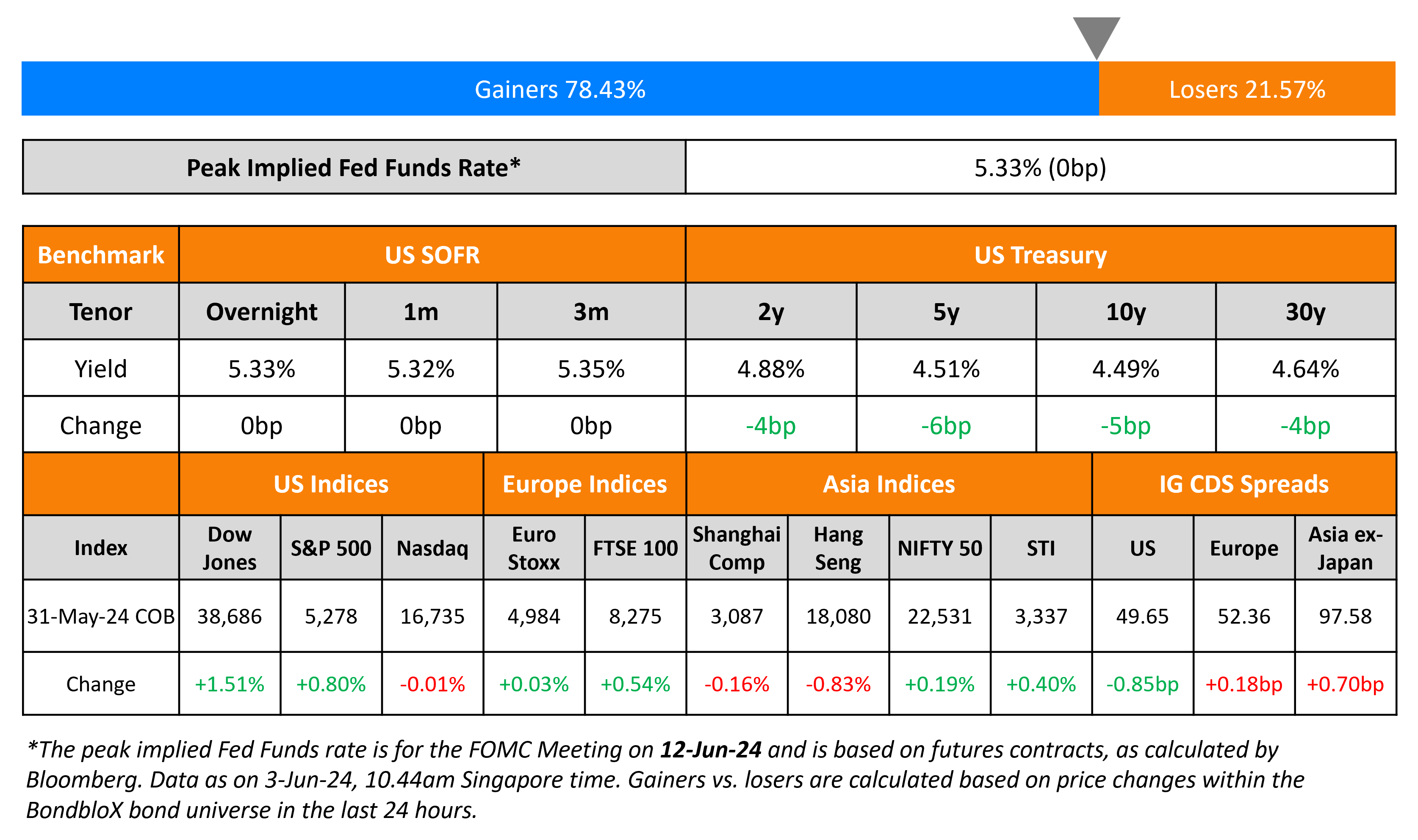

US Treasury yields dipped by 4-6bp on Friday. The US PCE and Core PCE deflators were in-line with expectations, at 2.7% and 2.8% respectively in April. Markets continue to price-in just over one rate cut by the end of this year, as per CME probabilities. Equity markets were mixed, with the S&P up 0.8% while the Nasdaq was flat. US IG CDS spreads tightened 0.9bp and HY spreads were 4.3bp tighter.

European equity markets ended in the green. Europe’s iTraxx main CDS spreads were 0.2bp wider and crossover spreads were wider by 1.6bp. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads widened 0.7bp.

New Bond Issues

- iFast Corp S$ 5Y at 4.75% area

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

- Continuum Green Energy India hires for $ green bond

- Mashreq bank hires for $ PerpNC5.5 bond

- Paratus Energy Services hires for $ 5Y bond

Rating Changes

- Fitch Upgrades Chongqing International Logistics to ‘BBB’; Removes UCO; Outlook Stable

- CPI Property Group Downgraded To ‘BB+’ On Ongoing Tight Credit Metrics And Financial Policy Deviations; Outlook Negative

- France Long-Term Rating Lowered To ‘AA-‘ From ‘AA’ On Deterioration Of Budgetary Position; Outlook Stable

- Moody’s Ratings affirms Societe Generale’s A1 senior unsecured debt and deposit ratings; outlook changed to negative

Term of the Day

Personal Consumption Expenditures (PCE)

Personal Consumption Expenditures (PCE) is an inflation metric measuring consumer spending on goods and services, released by the US Department of Commerce. The Fed’s preferred measure of inflation is the Core PCE – this refers to the Headline PCE after stripping out two volatile components, namely, food and energy.

The US also publishes another inflation metric, the CPI (Consumer Price Inflation), a key inflation indicator. CPI and PCE differ on four fronts: formula, weight, scope and other factors. As per the BLS, “CPI sources data from consumers, while PCE sources from businesses. The scope effect is a result of the different types of expenditures CPI and PCE track…CPI only tracks out-of-pocket consumer medical expenditures, but PCE also tracks expenditures made for consumers, thus including employer contributions. The implications of these differences are considerable.”

Talking Heads

On Bonds Rally as Inflation Gauge Sustains Fed Rate-Cut Outlook

Jack McIntyre, PM at Brandywine Global

“Inflation continues to move in the right direction. As long as the Fed’s next move is to cut rates, you still want to own Treasuries”

Subadra Rajappa, head of US rates strategy at SocGen

“There is really no urgency for the Fed to cut rates this year… would require the Fed to either hike or not cut for the next year”

On India Considering Allowing Bad Banks to Buy Equity – RBI Deputy Governor, Rajeshwar Rao

For debt aggregation and better value realization “there is a demand that even the equity pertaining to the distressed company should be allowed to be sold by the lenders to asset reconstruction companies, along with debt”

On Turkey Wooing Investors With Faith in Economic Turnaround Growing

Carmen Altenkirch, an analyst at Aviva Investors

“To say that Turkey’s turnaround has been impressive is an understatement… looks like the economics team has been given the power to do the right thing”

Simon Quijano-Evans, economist at Gemcorp Capital

“If the leadership allows Simsek and the central bank to continue fighting inflation, there will likely be plenty more foreign investment flows and ratings upgrades”

Top Gainers & Losers- 03-June-24*

Go back to Latest bond Market News

Related Posts: