This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

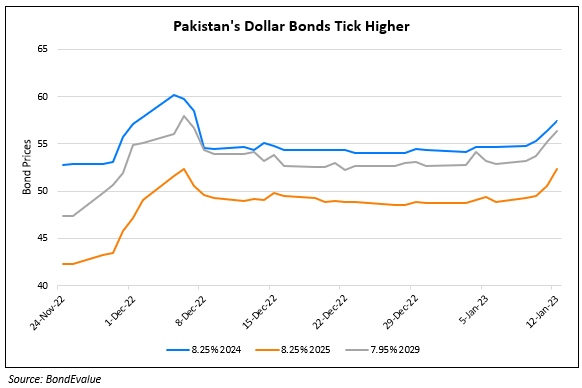

Pakistan’s Dollar Bonds Pick-Up on Budget, Bond Issuance Plans

June 14, 2024

Pakistan’s dollar bonds were up 1 point across the curve after the government raised taxes, in an effort to be able to secure a new loan program with IMF. The Finance Ministry kept the capital gains tax rate unchanged at 15%, seen as a relief for investors, amid broadening the tax base. It set a tax revenue target of PKR 13bn ($46.7bn) for the next fiscal year, a ~40% jump from the current year. They plan to bring down the public debt-to-GDP ratio to a sustainable level. Besides, they sharply cut down the fiscal deficit target to 5.9% of GDP, from an upwardly revised estimate of 7.4% for the current year. Pakistan is hoping to secure a $6-8bn IMF bailout. Separately, Pakistan also plans to raise about $1bn from international bond markets in the the upcoming fiscal, the first of which will be through the Chinese panda bond market for up to $300mn equivalent. Subject to an improvement in its credit ratings, they might plan to also tap European and other international markets, the finance minister added.

Pakistan’s 7.375% 2031s were up 1.1 points to trade at 82.2 cents on the dollar, yielding 11.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts: