This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Oxy Emerges as The First Permian Basin Oil Major to Declare Force Majeure

February 17, 2021

Occidental (Oxy) has told buyers it will be forced to curtail deliveries of oil by carriers due to a historic freeze in the Texas and New Mexico regions. Oxy, the second largest oil producer in the Permian Basin had issued a force majeure (Term of the day, explained below) notice to customers that was seen by Bloomberg. The force majeure is the first among the oil players in the Permian Basin and underscores the cold weather blast that began late last week. Over 2mn barrels of production have been stalled. With this, Oxy also stated that they will delay their Q4 earnings release due to the weather disruption. With oil prices rising on the back of these developments and WTI crossing $60/bbl, Oxy’s shares rose 4.2%. Their bonds also rallied with the 3.2% 2026s up 1.25 cents to 98.25 cents on the dollar yielding 3.55% and their 3.5% 2029s up 1.4 to 97.13, yielding 3.9%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

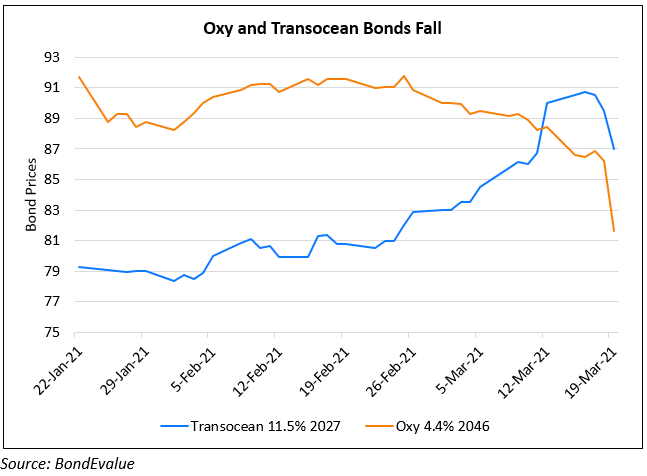

Oxy & Transocean Bonds Slump on Fall in Oil Prices

March 19, 2021