This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

OUE REIT Launches S$ 7Y; Vedanta Plans $ 7NC2 Bond

September 29, 2025

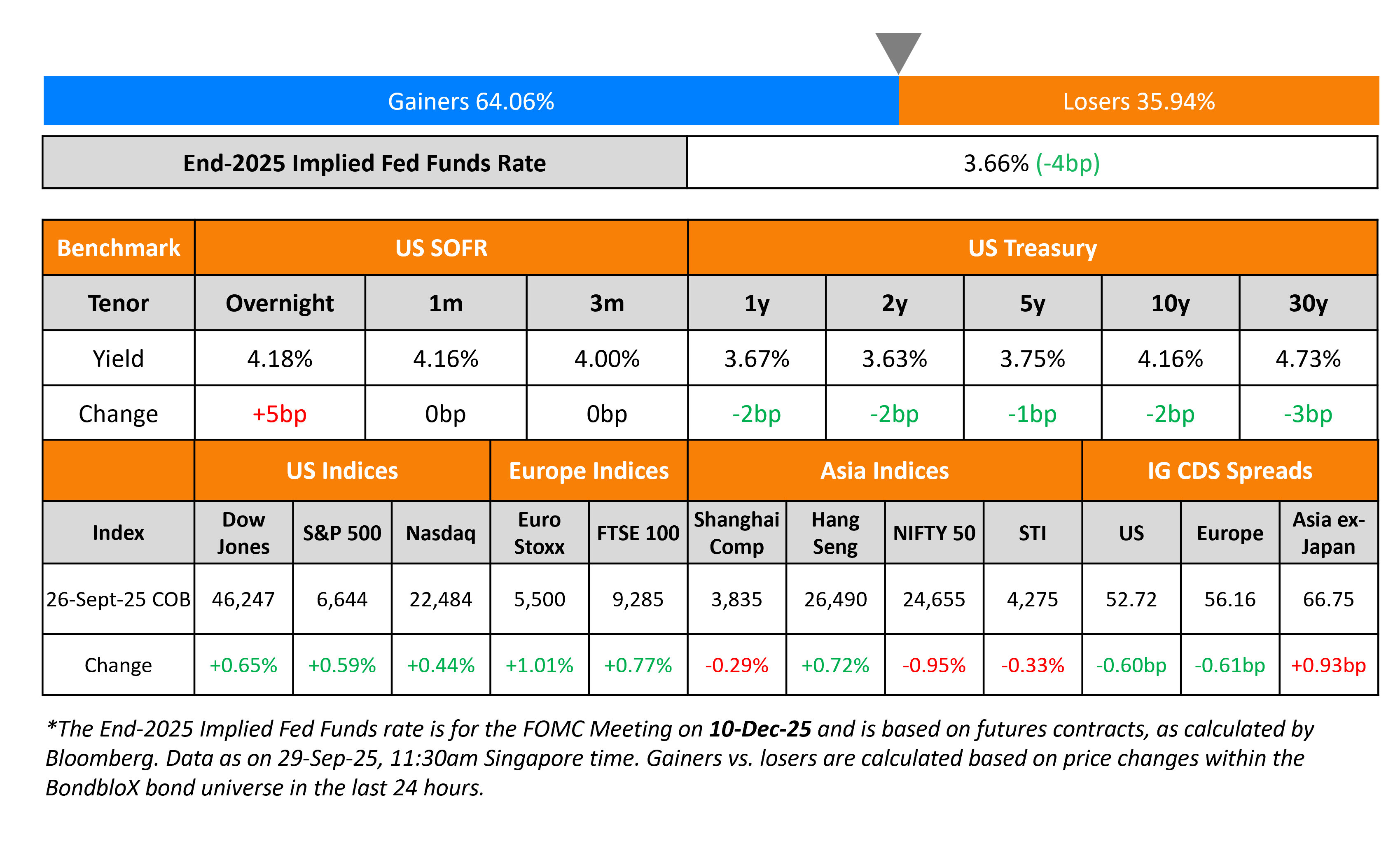

US Treasury yields were marginally lower, by 1-2bp across the curve. On the data front, the US Headline and Core PCE for August rose by 2.7% and 2.9% YoY, both inline with expectations. The final reading of the Michigan Consumer Sentiment Index for September came-in at 55.1, slightly lower than the surveyed 55.4.

Looking at equity markets, both the S&P and Nasdaq ended 0.6% and 0.4% higher respectively. US IG and HY CDS spreads were tighter by 0.6bp and 4.6bp respectively. European equity markets ended higher. The iTraxx Main CDS spreads tightened by 0.6bp and the Crossover CDS spreads were tighter by 2.7bp. Asian equity markets have broadly opened higher today. Asia ex-Japan CDS spreads were 0.9bp wider.

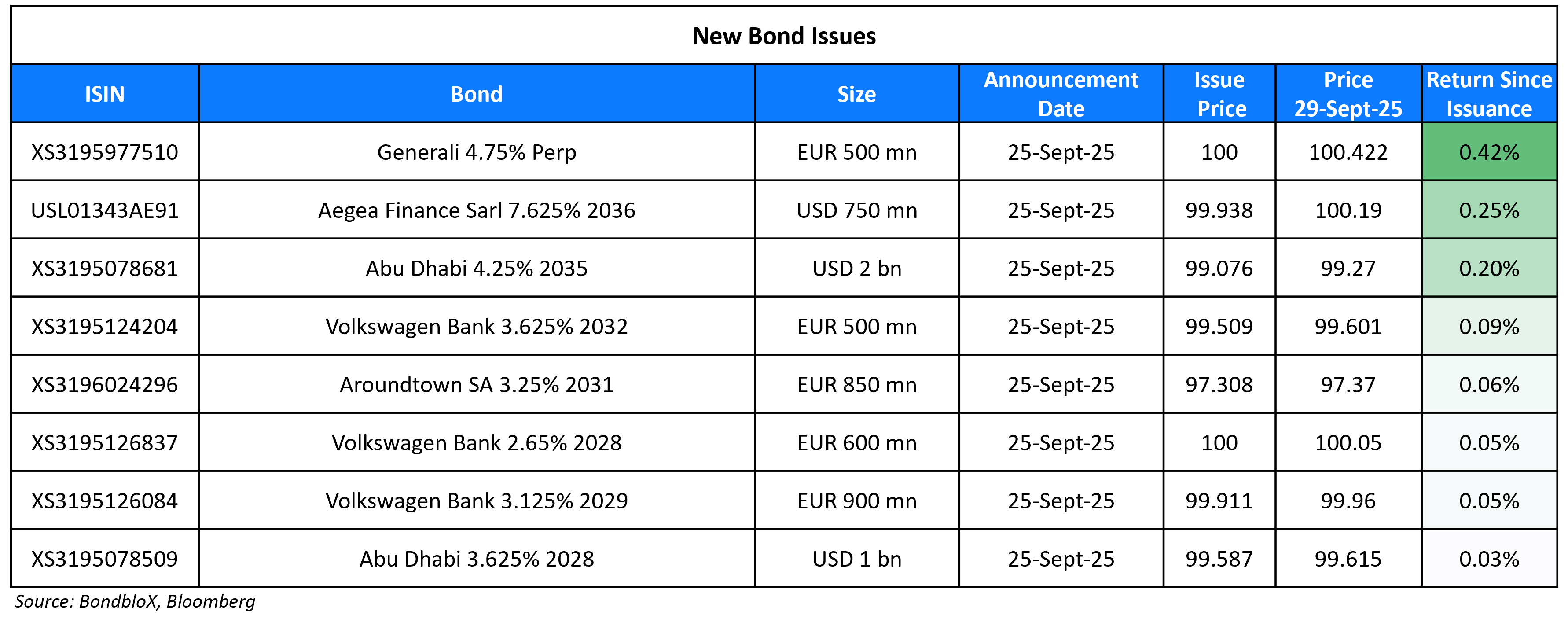

New Bond Issues

- OUE REIT S$ 7Y at 3.05% area

New Bond Pipeline

- Vedanta Resources plans $ 7NC2 bond

- Giti Tire Pte. Ltd. 5Y S$ sustainability bond

Rating Changes

- The Commonwealth of The Bahamas Long-Term Ratings Raised To ‘BB-‘ From ‘B+’ On Stronger Economy; Outlook Stable

- Fitch Upgrades PG&E Corp. and PG&E to ‘BBB-‘; Outlook Stable

- Moody’s Ratings upgrades T-Mobile’s unsecured ratings to Baa1; outlook changes to stable

- Morocco Upgraded To ‘BBB-/A-3’ On Sound Macroeconomic Policies; Outlook Stable

- Fitch Upgrades Spain to ‘A’; Outlook Stable

- Moody’s Ratings upgrades Spain’s ratings to A3, changes outlook to stable

- Moody’s Ratings upgrades Deutsche Telekom to A3; outlook stable

- Tutor Perini Corp. Upgraded To ‘B’ From ‘B-‘ On Improved Operating Performance; Outlook Positive

- Fitch Downgrades Braskem’s IDR to ‘CCC+’

- Braskem S.A. Downgraded To ‘CCC-‘ On Risk Of Debt Restructuring After Hiring Advisors; Outlook Negative

- Fitch Upgrades Thomson Reuters’ IDR to ‘A-‘; Outlook Stable

- Fitch Revises Aareal’s Outlook to Positive; Affirms at ‘BBB’

- Xcel Energy Inc. And Most Subsidiary Outlooks Revised To Stable, Ratings Affirmed On Settlement Agreement

Term of the Day: Collateralized

Talking Heads

On Private Credit Being on Course for Biggest Year in EMs

Jeff Schlapinski, Global Private Capital Association

“We see more of the big global players participating with larger packages… still at a relatively early phase compared to the US”

Pranav Khamar, a partner at Gemcorp Capital

“It’s really the great fundamentals of emerging markets that we’re finally seeing investors pay attention, looking to use emerging markets private credit as a tool to diversify”

Yaser Moustafa, Janus Henderson

“One of the reasons we’ve been able to go out and raise bigger funds and do bigger deals is because the borrowers are getting bigger”

On Fed Should Use Smallest Possible Balance Sheet – Fed’s Michelle Bowman

“Over the longer run, my preference is to maintain the smallest balance sheet possible with reserve balances at a level closer to scarce than ample… Simply relying on MBS runoff will not allow returning to a Treasury-only portfolio within a credible time frame”

On US dollar at risk if Trump can sway Fed to more dovish stance

Daleep Singh, PGIM Fixed Income

“We do worry quite a bit about an abruptly dovish shift in the Fed’s reaction function going into next year… very decent chance that the FOMC looks and acts quite differently… “On a cyclical basis, I think the risks to the dollar are skewed to the downside”

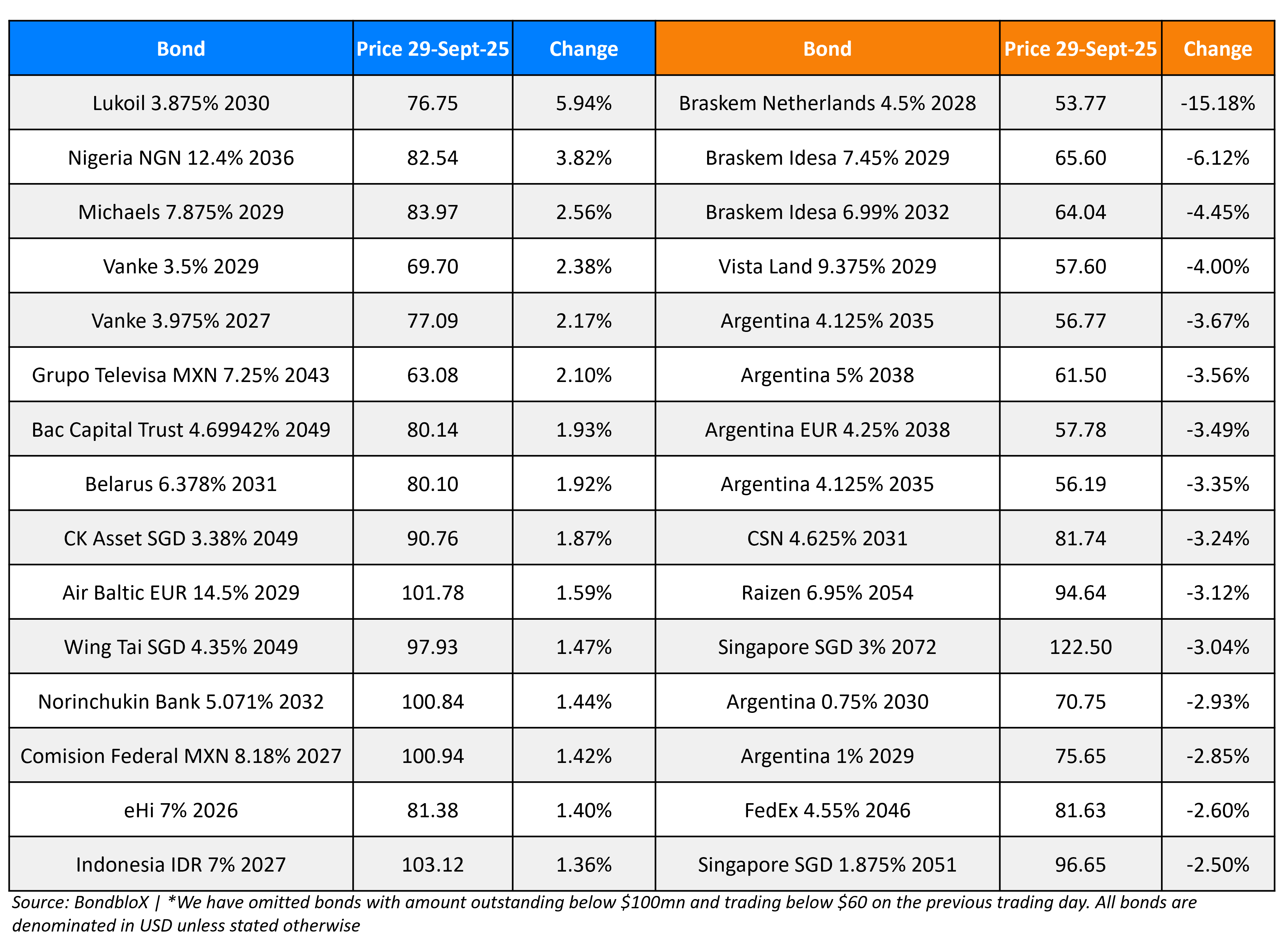

Top Gainers and Losers- 29-Sep-25*

Go back to Latest bond Market News

Related Posts: