This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

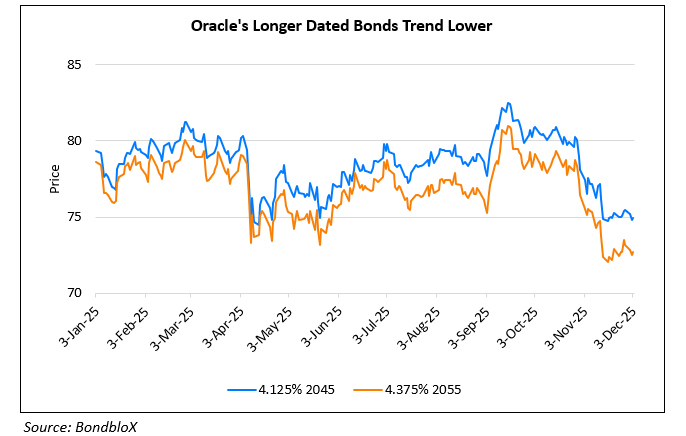

Oracle’s 5Y CDS Jumps to Its Highest Level Since 2009

December 3, 2025

Credit default swap (CDS) spreads on Oracle’s 5Y debt surged to its highest level since the 2008–09 financial crisis, reflecting mounting concerns that the tech sector’s heavy borrowing to fund AI-led expansion may be turning into a bubble. The company has issued significant debt this year, both directly and through AI-infrastructure projects it backs. Oracle now carries about $105bn of total debt, including $95bn in corporate bonds, making it the largest non-bank issuer in the Bloomberg US Corporate Index. Oracle, which is rated Baa2/BBB/BBB lower than rivals like Amazon and Microsoft, saw an outlook revision to negative by S&P in July on expectations of weakening cash flows. Strategists have exercised caution over the recent AI boom with TD Securities noting similarities to the dot-com bubble. Analysts warn that heavy issuance could push credit spreads wider as investors demand higher yields. While past debt binges have not always ended badly, strategists note that bondholders capture limited upside from an AI boom, while bearing the risk of deteriorating credit quality amid aggressive spending.

Oracle’s longer dated bonds have trended down over the past few months as seen in the chart above. Its 4.125% 2045s is currently trading at 74.9, yielding 6.4%.

For more details, click here

Go back to Latest bond Market News

Related Posts: