This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Omniyat, Alphabet, Tongyang Price $ Bonds

April 29, 2025

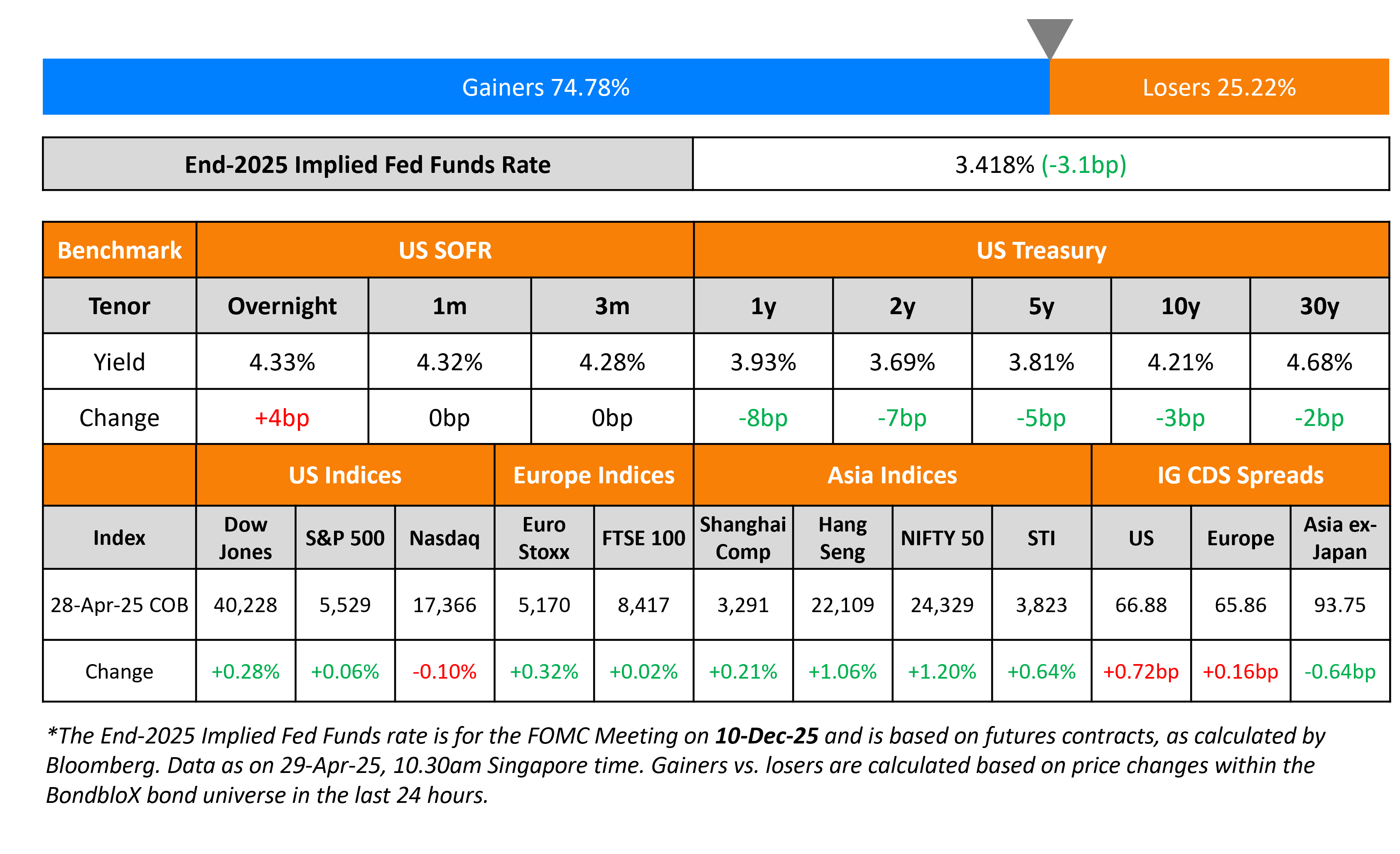

US Treasury yields continued to ease, with the curve steepening yesterday. The 2Y yield fell by 7bp while the 10Y yield was lower by 3bp. The Dallas Fed Manufacturing Activity Index reading for April dropped sharply to -35.8 vs. expectations of -14.1 and the prior month’s -16.3, its lowest level since May 2020.

Looking at equity markets, the S&P and Nasdaq ended broadly unchanged. Looking at credit markets, US IG CDS spreads were wider by 0.7bp, and HY CDS spreads widened by 2.8bp. European equity markets ended marginally higher. The iTraxx Main and Crossover CDS spreads widened 0.2bp each. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were tighter by 0.6bp.

New Bond Issues

- Singapore Technologies Engineering $ 5Y at T+85bp area

Omniyat raised $500mn via a 3Y green sukuk at a yield of 8.375%, inside initial guidance of the high 8% area. The note is rated BB-/BB- (S&P/Fitch) and received orders of over $1.8bn, 3.6x issue size. Proceeds will be used to finance/refinance eligible green projects as set out in its framework.

Tongyang Life Insurance raised $500mn via a 10NC5 Tier 2 bond at a yield of 6.297%, 45bp inside initial guidance of T+285bp area. The subordinated note is rated Baa3/BBB (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

BNP Paribas raised €2.75bn via a two-trancher. It raised €1.25bn via a 5NC4 senior preferred bond at a yield of 2.88%, 20bp inside initial guidance of MS+100bp area. The bond is rated A1/A+/AA-. It also raised €1.25bn via a senior non-preferred bond at a yield of 3.979%, 25bp inside initial guidance of MS+175bp area. The bond is rated Baa1/A-/A+.

ADNOC Murban raised $1.5bn via a 10Y sukuk at a yield of 4.876%, in-line with its guidance of T+60bp area. The senior unsecured note is rated Aa2/AA (Moody’s/Fitch), and has a change of control put.

Alphabet raised $5bn via a four-trancher.

The senior unsecured notes are rated Aa2/AA+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Saudi Fransi hires for $ PerpNC6 AT1 bond

Rating Changes

-

Fitch Upgrades Delhi International Airport to ‘BB+’; Outlook Stable

-

Fitch Upgrades EQM Midstream to ‘BBB-‘ and Withdraws Ratings

-

Moody’s Ratings upgrades Constellation Brands’ ratings to Baa2, P-2; outlook stable

-

Iceland-Based Landsbankinn hf. Upgraded To ‘A-‘ On Additional Loss-Absorbing Capacity; Outlook Stable

-

Fitch Downgrades Nissan Motor Acceptance Company’s IDR to ‘BB’; Outlook Negative

-

Moody’s Ratings downgrades Under Armour’s CFR to Ba3; outlook remains negative

-

Boeing Co.’s ‘BBB-‘ Ratings Affirmed; Removed From CreditWatch Negative On Improving Aircraft Production, Lower Cash Usage; Outlook Negative

Term of the Day: Senior Non-Preferred (SNP) Bond

Senior non-preferred (SNP) notes are type of debt security that banks issue as part of their Tier 3 capital. These bonds have an inherent bail-in feature where in the case of bankruptcy, creditors holding these notes may be subject to conversion into shares. In a liquidation scenario, SNP bonds are ranked higher than Subordinated Bonds. However, they rank inferior to Senior Preferred Bonds or Senior Unsecured Bonds.

Talking Heads

On Bessent Playing Safe on Debt After Market Chaos

Subadra Rajappa, SocGen

“Given the volatility in the Treasury market, Treasury Secretary Bessent is going to be very careful about how he communicates any changes — especially to coupon sizes”

On ECB to Mull Rate Hike by End of Year

David Zahn, Franklin Templeton

“If you look out to 2026, it’s going to be very clear that Europe is doing well. Inflation will be low, growth will be going super well. If you’re a central bank why would you not think about how to start hiking… We tend to like the core because it’s the most defensive… Spain, Germany, Netherlands, Belgium”

“That kind of decoupling of the world is a very negative scenario. You are in a situation now where you have… a hot war, you have a cold war, you’ve got a trade war, you’ve got a tech war. It’s just a lot of friction here between the superpowers… leads to lower economic growth, higher inflationary pressure, and more uncertainty”

Top Gainers and Losers- 29-April-25*

Go back to Latest bond Market News

Related Posts: