This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Oman Upgraded to Ba1; CDS Spreads Tighten to 4Y Lows

December 8, 2023

Oman was upgraded to Ba1 from Ba2 by Moody’s on expectations that “further improvements in Oman’s debt burden and debt affordability metrics during 2023 will last”. This is expected to make the sovereign resilient to future shocks, maintain fiscal prudence and increase policy effectiveness. The windfall gains from the rally in oil prices in 2022-23 saw Oman prioritize debt repayments whilst restraining spending. Moody’s projects Oman’s government debt-to-GDP to drop to 35% over the next three years from about 40% at end-2022. They also expect Oman’s current account to remain in a surplus through 2025. The rating agency also noted that Oman’s “liquidity and external vulnerability pressures have diminished substantially” since 2020.

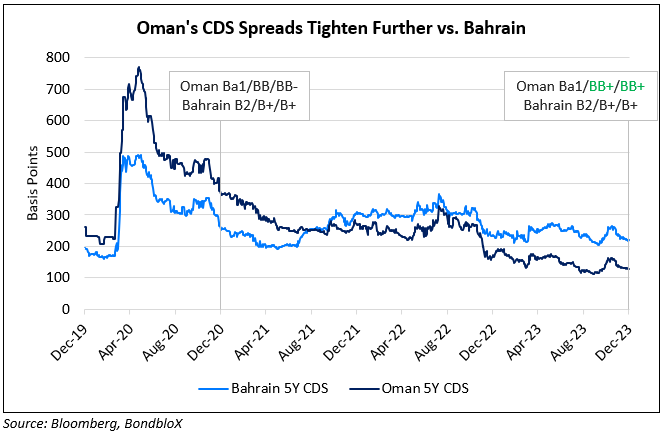

Oman’s improving credit metrics are reflected in its dollar bond credit spreads, which have tightened by nearly 300bp since December 2020. In particular, it is interesting to see the evolution of Oman’s credit spreads versus its GCC peer Bahrain.

As seen in the chart above, Oman’s 5Y CDS spreads were trading at 262bp, about 66bp wider to Bahrain’s 196bp pre-pandemic, in December 2019. This only worsened further during the height of the pandemic where Oman’s CDS spreads were trading 280bp wider than Bahrain. Ever since, its credit spreads have compressed significantly and currently, Oman’s 5Y CDS spreads trade tighter at 128bp vs. Bahrain’s 220bp. Since 2019, Oman’s credit rating has seen a one/two notch upgrade from S&P/Fitch to BB+/BB+. Over the same period however, Bahrain’s ratings have remained unchanged at B+/B+.

In the scatterplot below, we have plotted dollar bonds of Oman, Bahrain and Turkey to assess relative value across the curve. Click on the image below to view the interactive scatterplot, where you can hover over each bond for details on the latest price, yield, z-spread and duration (best viewed on PC/Desktop).

Go back to Latest bond Market News

Related Posts:

Oman Secures $1.56bn from Sovereign Wealth Fund

April 5, 2021

Oman Upgraded to BB by S&P

November 28, 2022

Oman Expects 3% Budget Deficit in 2023 after a Surplus This Year

December 21, 2022