This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Oman, Rabobank, Burgan, KIB, Sammaan Price $ Bonds

October 10, 2025

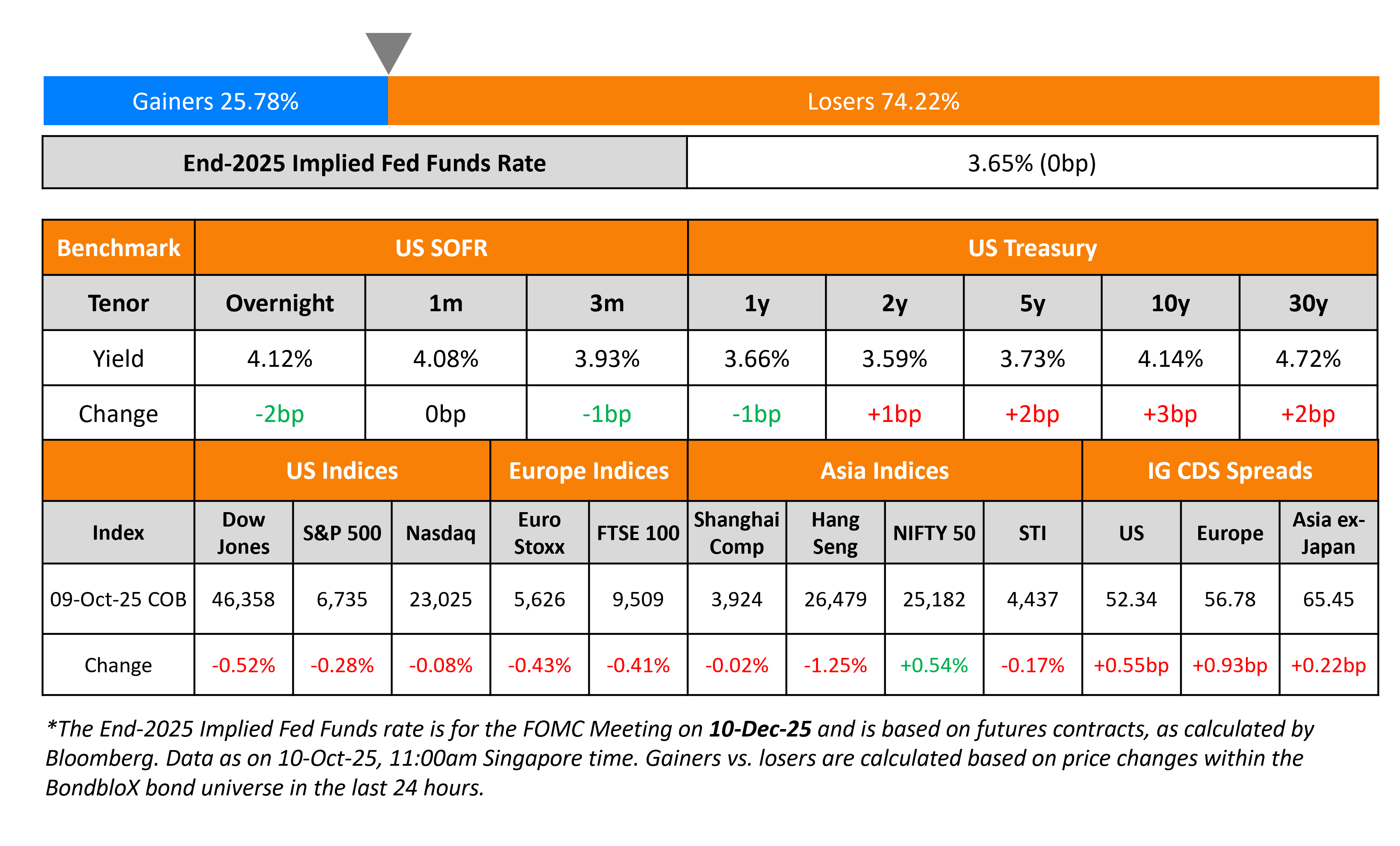

US Treasury yields inched higher by ~2bp across the curve on Thursday. The US Treasury’s 30Y note auction saw a bid-to-cover ratio of 2.38x, similar to the prior auction last month, tailing by 0.4bp. However, other metrics like the indirect take up was solid at 64.5% (vs. 62.0% last month) and primary dealers were awarded 8.7% of the notes, a record low.

Looking at equity markets, both the S&P and Nasdaq ended lower by 0.3% and 0.1%. The US IG and HY CDS spreads widened by 0.6bp and 5.5bp respectively. European equity indices also closed lower. The iTraxx Main CDS spreads and Crossover spreads were 0.9bp and 6.6bp wider respectively. Asian equity markets have opened broadly weaker today. Asia ex-Japan CDS spreads were 0.2bp wider.

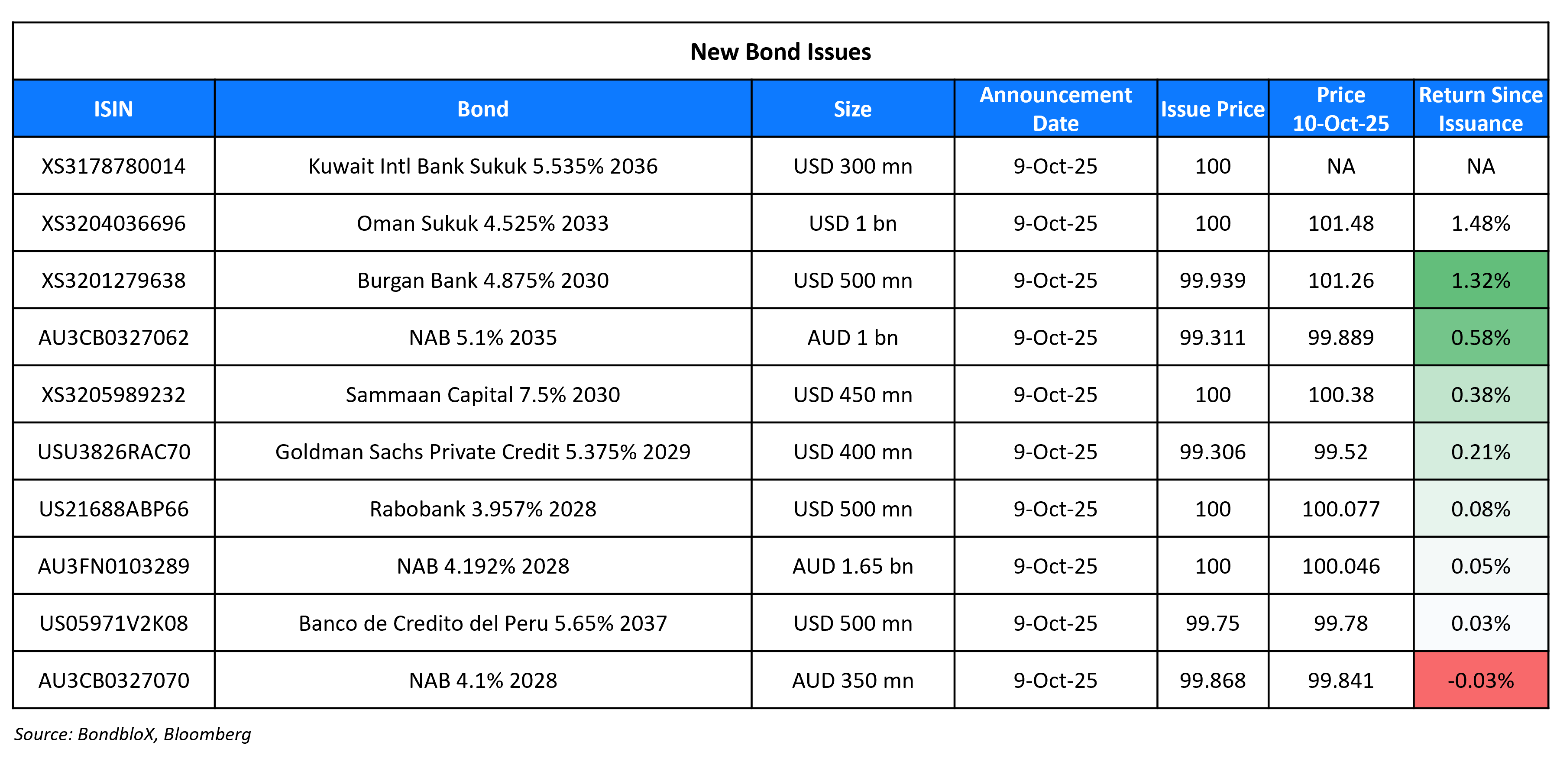

New Bond Issues

Oman raised $1bn via a 7Y sukuk at a yield of 4.525%, 35bp inside initial guidance of T+95bp area. The senior unsecured note is rated Baa3/BBB- (Moody’s/S&P) and received orders of over $2.5bn, 2.5x issue size. The new sukuk is priced 13.5bp tighter to its existing 7.375% bond due 2032 that currently yields 4.66%.

Rabobank raised $1bn via a two-trancher. It raised $500mn via a 3Y bond at a yield of 3.957%, ~22.5bp inside initial guidance of T+55/60bp area. It also raised $500mn via a 3Y FRN at SOFR+59bp vs. initial guidance of SOFR equivalent area. The senior preferred notes are rated Aa2/A+/AA- (Moody’s/S&P/Fitch).

Burgan Bank raised $500mn via a 5Y bond at a yield of 4.889%, 35bp inside initial guidance of T+150bp area. The senior unsecured note is rated BBB+/A. Proceeds will be used for general corporate purposes.

Goldman Sachs Private Credit Corp raised $400mn via a 3Y bond at a yield of 5.612%, 20bp inside initial guidance of T+220bp area. The senior unsecured note is rated BBB- (Fitch) and has a change of control put at par. Proceeds will be used to repay a portion of its outstanding debt and for general corporate purposes.

Kuwait International Bank (KIB) raised $300mn via a 10.5NC5.5 Tier-2 sukuk at a yield of 5.535%, 45bp inside initial guidance of T+220bp area. The subordinated note is rated BBB+ by Fitch, and received orders of over $2bn, 6.7x issue size. If not called by 16 April 2031, the profit rate will reset to prevailing 5Y US Treasury yield plus 175bp.

Sammaan Capital raised $450mn via a 5Y social bond at a yield of 7.5%, inline with guidance. The senior secured note is rated B+ (S&P). Proceeds will be used in accordance with its sustainable financing framework.

Banco de Credito Del Peru SA raised $500mn via a 11.25NC6 Tier-2 bond at a yield of 5.70%, 17.5bp inside initial guidance of 5.875% area. The subordinated note is rated Baa2/BB+ (Moody’s/Fitch). Proceeds will be used for general corporate purposes, including refinancing its outstanding obligations.

Rating Changes

- UniCredit SpA Long-Term Rating Upgraded To ‘A-‘, One Notch Above The Sovereign Italy; Outlook Stable

- Dye & Durham Corp. Rating Lowered To ‘B-‘ On Weak Performance; Outlook Negative

- Moody’s Ratings downgrades Dye & Durham’s CFR to B3; outlook is negative

- Fitch Revises Barbados’s Outlook to Positive; Affirms at ‘B+’

- Fitch Revises Mercer International Inc.’s Outlook to Negative; Affirms IDR at ‘B+’

- Moody’s Ratings downgrades the IFS rating of MBIA Corp., outlook stable

New Bonds Pipeline

- Avation $300-400mn, up to 5.5NC2 Bond

Term of the Day: Panda Bonds

Panda bonds are renminbi denominated notes sold by a non-Chinese issuer in onshore China. The first of its kind was issued by the IFC and ADB in 2005. While these bonds attract Chinese investors, they have also gained traction among international investors. It also helps issuers diversify investor bases and reduce currency risk.

Sharjah has issued a mandate for a CNY-denominated Panda Bond.

Talking Heads

On Buying High-Grade Bonds After M&A Being a Good Trade – BofA Strategists

Buying high-grade bonds from a company that’s funding an acquisition can be a good trade because spreads on the securities often narrow… Companies that are digesting an acquisition often focus on cutting debt over time, which is good for bondholders

On US Treasuries Risk Losing Haven Status – Manroop Jhooty, Canada Pension Investment Board

“We worry that if the fiscal scenario continues for a period of time”… US Treasuries could begin “to lose this diversification effect because it looks more and more like a risky asset and less and less like a risk-free asset”

On Asia Bonds Looking Vulnerable as Fed Rate Cuts Deliver Less Support

SocGen

“One prominent headwind to emerging-market performance relates to the diminished valuations appeal of local assets”

Rajeev De Mello, Gama Asset Management

The “focus is now shifting to domestic fundamentals”… Investors are likely to reward economies with “coherent and credible policy framework”

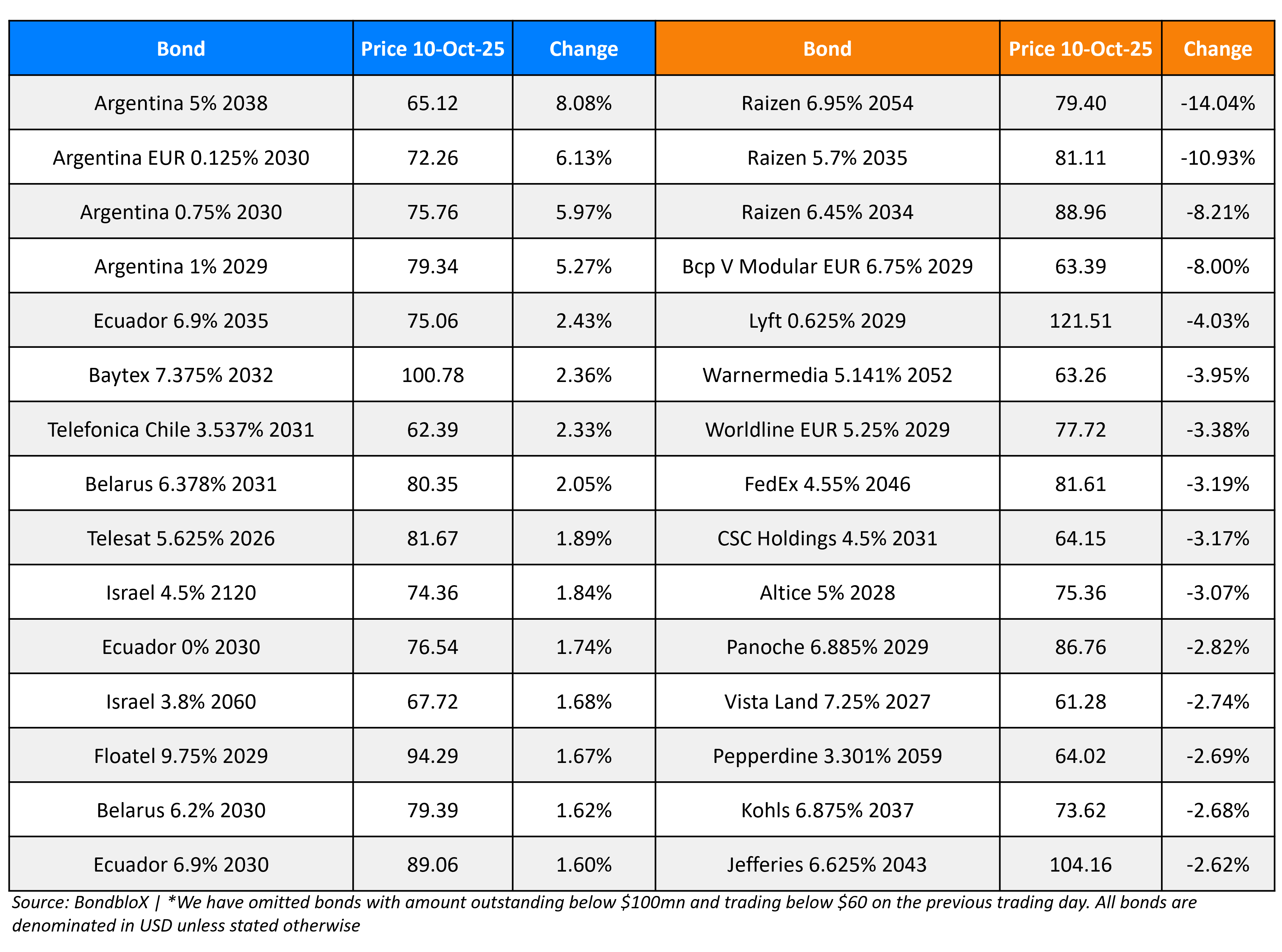

Top Gainers and Losers- 10-Oct-25*

Go back to Latest bond Market News

Related Posts: