This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Oil Prices Surge; xAI Price $ Bonds; DKL, Delek US Holdings Downgraded to B+

June 23, 2025

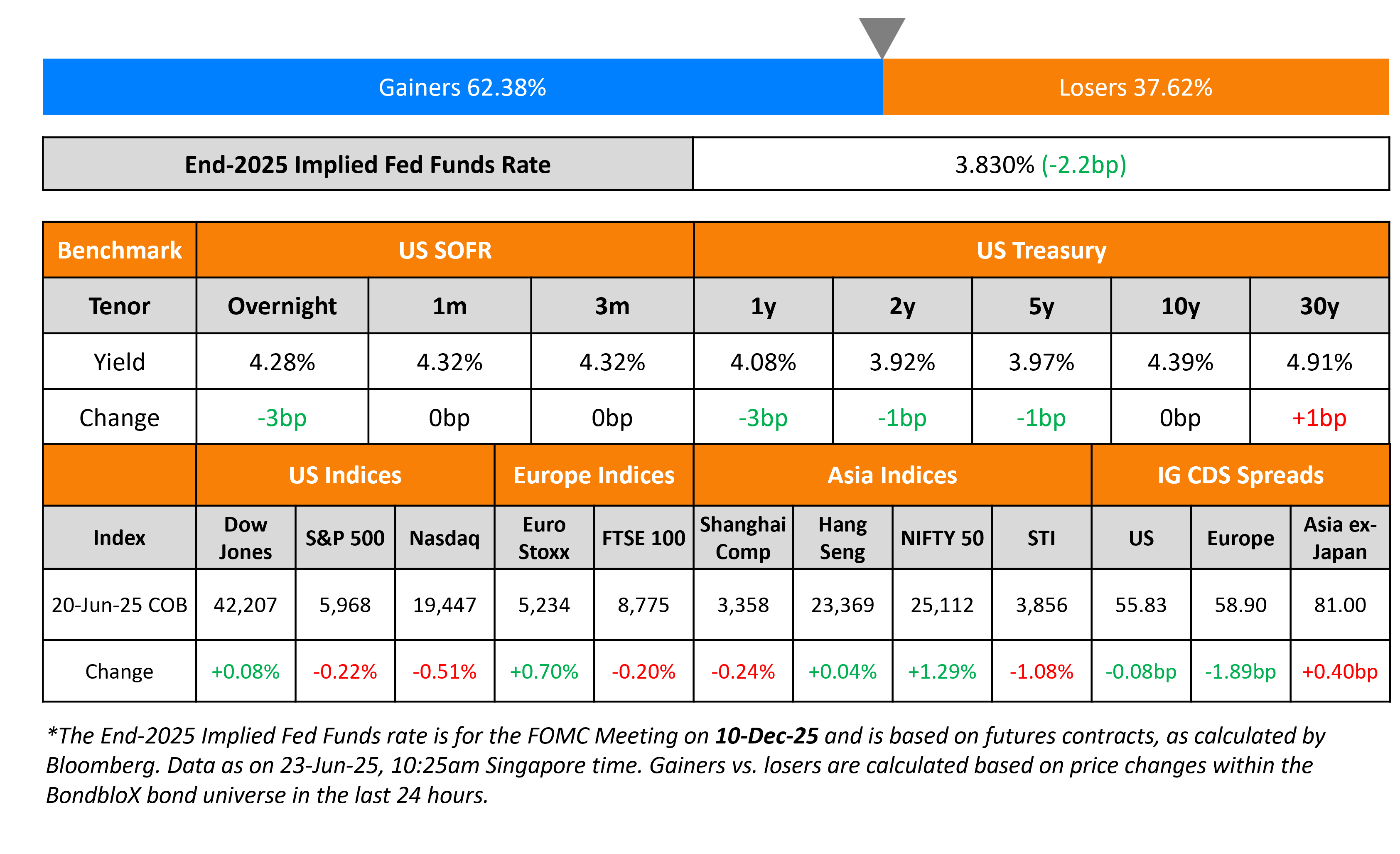

US Treasury yields fell by about 1-3bp on the front end of the curve on Friday. The US entered the Israel-Iran war by attacking three of Iran’s main nuclear sites over the weekend. This has heightened tensions in the Middle East and investor sentiment globally. Oil prices surged to new highs, briefly touching $81.4 per barrel for Brent and $78.4 for WTI, before some of the gains were pared back. This marked their highest levels since January, as escalating tensions sparked fears of significant disruptions to global oil supply. Iran is the world’s ninth-biggest oil-producing country, with output of about 3.3mn barrels per day (mbpd). If Tehran decides to retaliate, it could lead to closure of the strategic Strait of Hormuz, which carries one-fifth of global oil output, according to sources.

SF Fed President Mary Daly said that Fed’s monetary policy stance is in a ‘good place’, with risks to its US employment and price stability mandates as roughly equal. Fed Governor Christopher Waller said that the Fed could lower interest rates as soon as next month, reiterating that the inflation hit from tariffs is likely to be short-lived.

Looking at US equity markets, S&P and Nasdaq closed lower by 0.2% and 0.5% respectively on Friday. In credit markets, US IG CDS spreads and US HY CDS spreads tightened by 0.1 and 0.8bp respectively. European equity markets closed mixed on Friday, with Euro Stoxx closing higher by 0.7% and FTSE sliding by 0.2%. The iTraxx Main CDS spreads and Crossover CDS spreads tightened by 1.9bp and 9.4bp respectively. Asian equity markets have broadly opened lower today. Asia ex-Japan CDS spreads widened by 0.4bp.

New Bond Issues

- KT Corp $ 3.5Y at T+110bp area

Elon Musk’s xAI Corp had to pay up to close its $3bn 5NC2 bond last week. The bonds priced at a yield of 12.50%, 50bp over the initial guidance of 12.00% area. The senior secured notes are unrated. The company also raised $2bn via term loans, with proceeds to be used for general corporate purposes.

Rating Changes

Term of the Day: Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back

Talking Heads

On Japan Flagging Big Cut to Long-End Bond Issuance Before Auction

Naoya Hasegawa, Okasan Securities

“The bond market is being weighed down by concerns over rising oil prices and the upcoming 20-year bond auction…the direction of supply and demand for super-long government bonds has become clearer after the revised issuance plan.”

Shoki Omori, Mizuho Securities

“The ministry publicized its revised plan sooner than anticipated to ward off the risk of a failed 20-year bond auction on June 24 and to avert the market volatility seen in May”

On US Debt Rising Too Fast May Impact Trust In Treasuries – Taiwan Central Bank

“Trump’s budget, the ‘One Big Beautiful Bill Act,’ may cause U.S. debt to expand too quickly, which is unfavourable to the outlook for U.S. sovereign debt…All of these have had a significant impact on the international monetary system centred on the U.S. dollar and based on U.S. creditworthiness.”

On Dollar Hanging On to Its Haven Role by a Thread – Bloomberg Pulse Survey

Christian Mueller-Glissmann & Michael Cahill, Goldman Sachs

“While we expect further dollar weakness, investors now perceive more two-way risks…Some argue the depreciation may be overdone, especially given resilient US asset returns.”

Kristina Campmany, Invesco

“A weaker dollar is here to stay.”

Top Gainers and Losers- 23-Jun-25*

Go back to Latest bond Market News

Related Posts: