This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

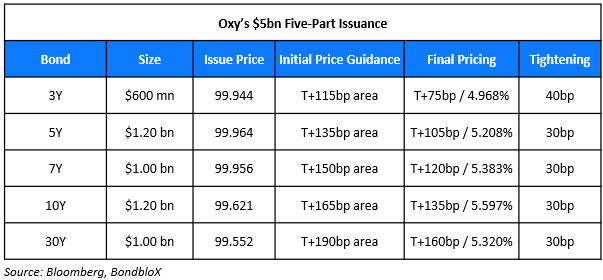

Occidental Raises $5bn via a Five-Part Deal

July 24, 2024

Occidental raised $5bn via a five-part issuance. Details are in the table above. The senior unsecured notes are rated Baa3/BB+/BBB-. Proceeds will be used to finance the cash consideration of the CrownRock acquisition and related financing transactions, fees and expenses. The new 3Y bonds are priced 5bp tighter to its existing 8.5% 2027s that yield 5.02%. The new 5Y bonds are priced 13bp tighter to its existing 3.5% 2029s that yield 5.34%. The new 7Y bonds are priced 4bp tighter to its existing 7.5% 2031s that yield 5.42%.

Go back to Latest bond Market News

Related Posts: