This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

OCBC, Saudi Fransi, Muthoot, BOC Aviation Price $ Bonds; Nippon Life, Xiaomi Upgraded

August 27, 2025

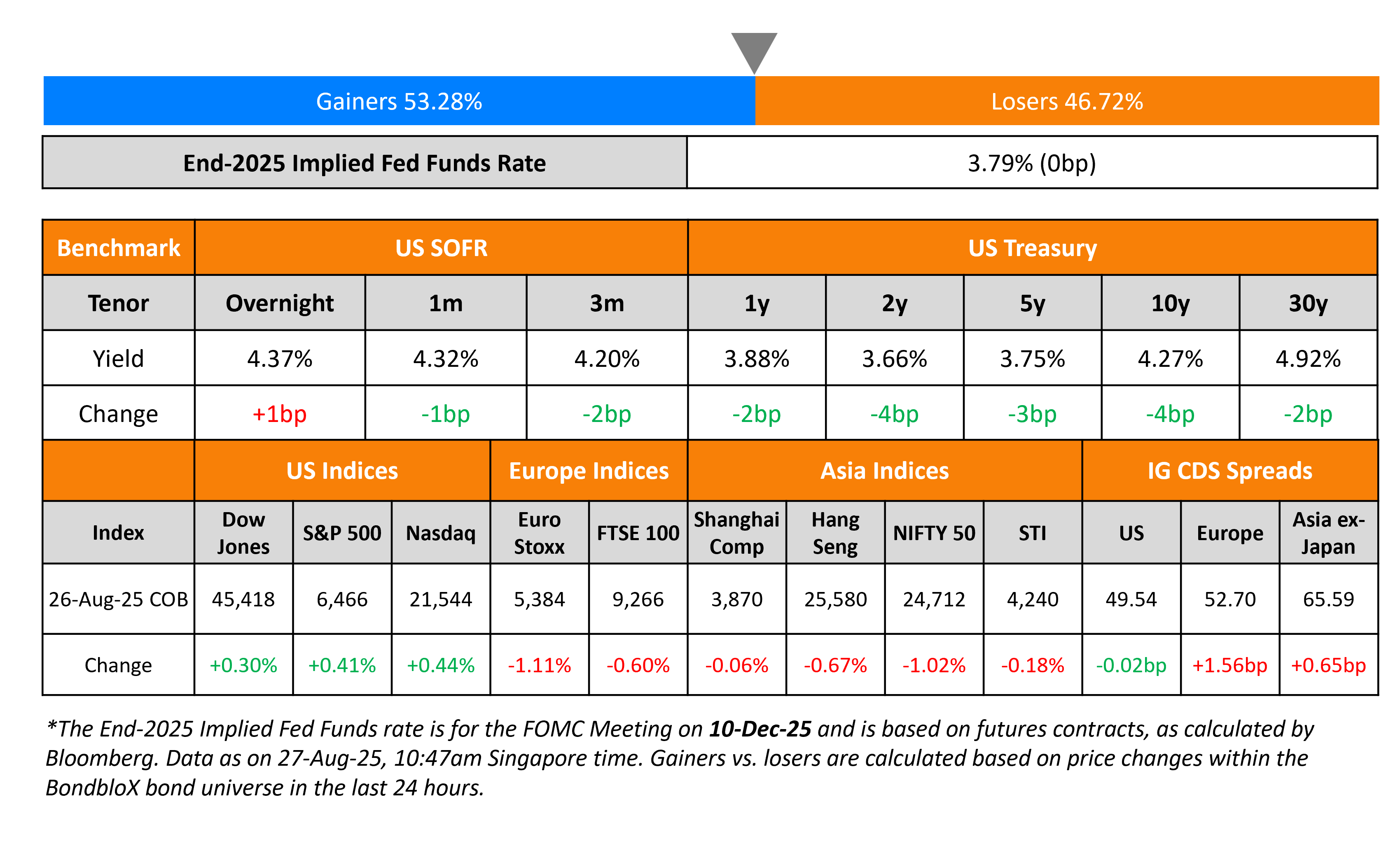

US Treasury yields eased across the curve with the 2Y down by 4bp after the new Treasury note auction saw solid demand. The new 2Y issuance saw a bid-to-cover ratio of 2.69x, higher that the prior month’s 2.62x. On the data front, the preliminary US Durable Goods Orders fell 2.8% MoM in July, better than expectations of a 3.8% drop. Separately, Richmond Fed President Tom Barkin said that if there is a “modest movement in the economy, that would imply a modest adjustment in rates”.

Looking at US equity markets, the S&P and Nasdaq ended 0.4% higher. US IG CDS spreads were flat while HY spreads tightened by 1.4bp. European equity markets ended lower. The iTraxx Main CDS spreads were 1.6bp wider and the Crossover spreads closed over 7.2bp wider. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 0.7bp wider.

New Bond Issues

Banque Saudi Fransi raised $1bn via a 10NC5 Tier 2 bond at a yield of 5.761%, 35bp inside initial guidance of T+235bp area. The subordinated note is rated BBB by Fitch, and received orders of over $2.7bn, 2.7x issue size.

Muthoot Finance raised $600mn via a 4.5Y bond at a yield of 6.375%, 25bp inside initial guidance of 6.625% area. The senior secured note is rated Ba1/BB+ (Moody’s/S&P). The amortizing note has a weighted average life (WAL) of 4Y. The note amortizes by 20% in the 42nd, 45th, 48th, 51st and 54th month. The bond has a maintenance covenants taht includes but is not limited to:

- Capital Adequacy Ratio compliant with RBI requirements

- Security Coverage Ratio greater than or equal to 1.0x (reviewed quarterly and annually)

- Minimum Security Coverage Ratio calculated on collateral excluding the portion classified as NPAs or Stage 3 assets

Proceeds will be used for permitted purposes including onward lending, in accordance with the approvals granted by the RBI.

OCBC raised $1bn via 10NC5 Tier 2 bond at a yield of 4.55%, 35bp inside initial guidance of T+115bp area. The subordinated note is rated Aa1/AA-/AA-. Proceeds will be used for general corporate purposes.

BOC Aviation raised $500mn via a 5.5Y bond at a yield of 4.344%, 32bp inside initial guidance of T+90bp area. The senior unsecured note is rated A-/A-. Proceeds will be used for new capital expenditure, refinancing of existing borrowings along with general corporate purposes.

NetLink Treasury raised S$300mn via a 10Y bond at a yield of 2.65%, 30bp inside initial guidance of 2.95% area. The note is unrated. Net proceeds will be used for general corporate purposes, refinancing existing debt, financing investments, acquisitions, general working capital and/or capital expenditure.

Rating Changes

-

Fitch Upgrades Nippon Life’s IFS Rating to ‘AA-‘; Outlook Stable

-

Moody’s Ratings upgrades Xiaomi’s ratings to Baa1; revises outlook to stable

-

QVC Group Inc. Downgraded To ‘CCC’ On Increased Refinancing Risk; Outlook Negative

Term of the Day: Weighted average life (WAL)

Weighted average life (WAL) is a feature of amortizing bonds, which are different from straight bonds in that they payback principal through the life of the bond rather than a one-time payment of the full principal at maturity. WAL refers to the average time, stated in years, in which the bond’s unpaid principal remains outstanding. WAL is calculated as follows with an example of a 3Y bond with a $100 face value where P1 refers to principal repayment in year one, P2 in year two and P3 in year three:

WAL = [(P1 x 1) + (P2 x 2) + (P3 x 3)] / $100

Talking Heads

On Options Traders Seeing More Room for US Long Bonds to Underperform

Jonathan Cohn, Nomura Securities

“Curve steepeners generally remain well-subscribed and for good reason…Not only is there an asymmetric risk towards lower policy rates, but the back-end could suffer if credibility is called into question”

On Trump Team Weighing Options to Extend Influence to Fed Banks

Derek Tang, LHMeyer/Monetary Policy Analytics

“This White House is turning over every stone to see where the levers are to change the Fed… One of those levers could be the vote to reauthorize regional bank presidents. Once the administration secures a majority on the Board of Governors, it could indirectly pressure Fed officials perceived as more hawkish by using their reappointment vote as a new tool at its disposal”

On Forecast for Modest Adjustment in Rates – Tom Barkin, Richmond Fed President

“If there’s modest movement in the economy, that would imply a modest adjustment in rates…I don’t know that there will be modest movement in the economy. That’s what we’re going to have to see when we get there. So, that’s my forecast, but the forecast could change…I make the best call I can on the day, with all the information.”

Top Gainers and Losers- 27-Aug-25*

Go back to Latest bond Market News

Related Posts: