This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

OCBC, BOC, NetLink Launch Bonds; Trump Fired Fed Governor Lisa Cook with Immediate Effect

August 26, 2025

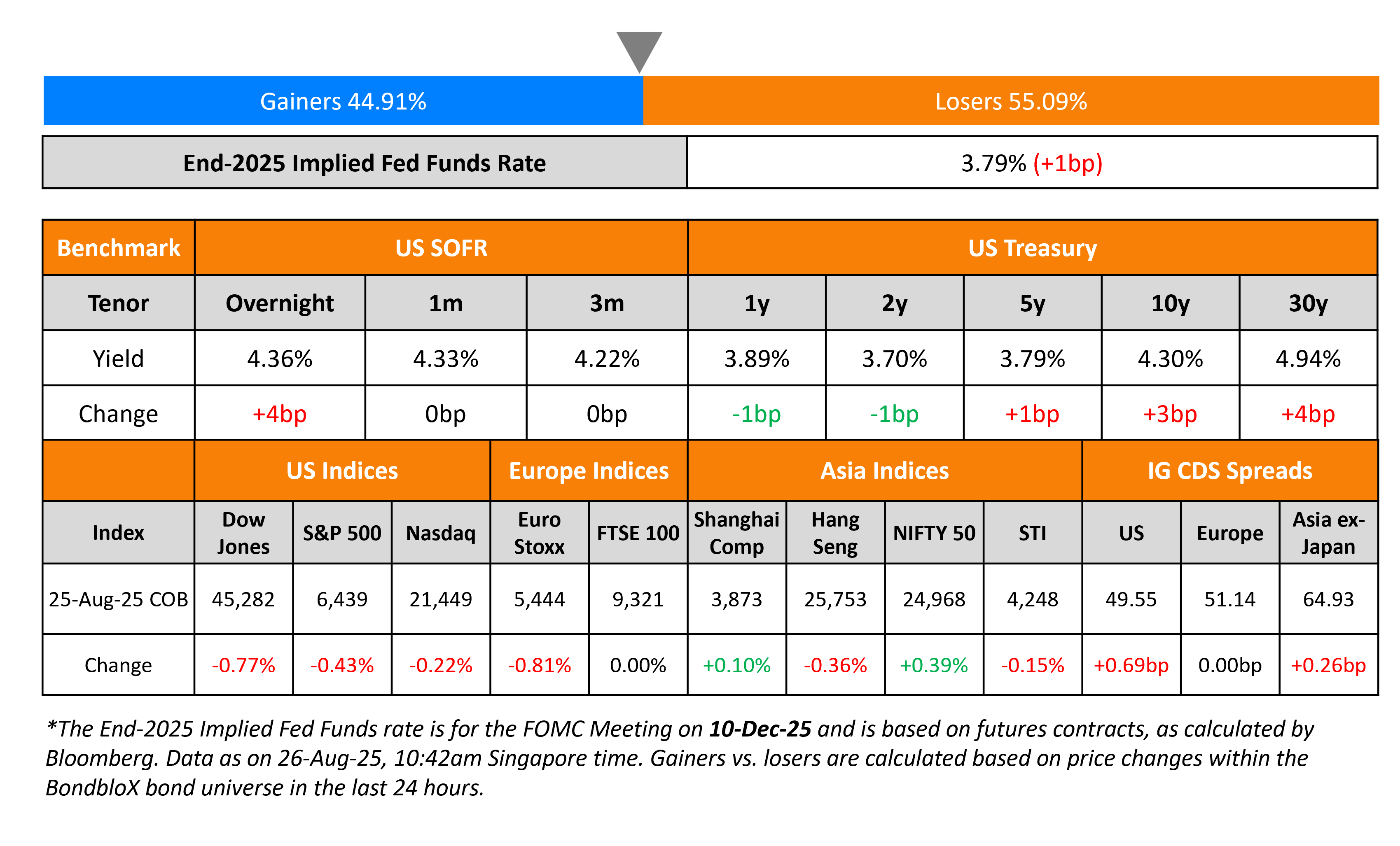

The US Treasury curve bear steepened on Monday, with the 2Y yield down by 1bp while the 10Y rose by 3bp. US President Donald Trump ordered the removal of Fed Governor Lisa Cook with immediate effect after allegations of mortgage fraud. Separately, New York Fed President John Williams said that the neutral interest rate may not be much different than before the pandemic, citing structural factors.

Looking at US equity markets, the S&P and Nasdaq ended 0.4% and 0.2% lower respectively. US IG and HY CDS spreads widened by 0.7bp and 3.4bp each. European equity markets ended lower too, while the FTSE was closed due to the annual Summer Bank Holiday. The iTraxx CDS markets were also closed. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads were 0.3bp wider.

New Bond Issues

-

OCBC $ 10NC5 Tier 2 at T+115bp area

-

BOC Aviation $ 5.5Y at T+90bp area

- NetLink S$ 10Y at 2.95% area

New Bond Pipeline

-

Muthoot Finance $ 4.5Y bond

-

Alinma Bank $500m PerpNC5.5 AT1 Sukuk

-

Saudi Awwal Bank $ 10NC5 Tier 2

Rating Changes

-

Moody’s Ratings changes Austria’s outlook to negative from stable, affirms Aa1 ratings

-

Fitch Revises SK hynix’s Outlook to Positive; Affirms Rating at ‘BBB’

-

Moody’s Ratings affirms Wesco’s CFR at B2; outlook changed to negative

Term of the Day: Neutral Rate of Interest

The neutral rate aka natural rate or “R*” is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Talking Heads

On Dollar Falling with Longer Treasuries as Trump Moves to Fire Cook

Carol Kong, Commonwealth Bank of Australia

“Cook’s removal is dollar negative as it would create another opening for President Trump to appoint a new Governor who may be more inclined to support interest-rate cuts”

Anna Wu, Van Eck Associates

“I see this as an extension of Trump’s intervention with the Fed and a warning…Markets typically take such headlines as a threat to Fed independence. The removal of Cook gives Trump’s administration more space to appoint governors inclined to his playbook.”

“I would expect that this would run out for another few months before the president decides…Treasury Secretary Scott Bessent is running a thorough search process. There are a number of really excellent candidates being interviewed by him and the president.”

On Low Neutral-Rate Era ‘Appears Far from Over’ – John Williams, New York Fed President

“The global demographic and productivity growth trends that pushed r-star down have not reversed…statistical estimates of the neutral rate from early 2025 shows it has not meaningfully rebounded, the era of low r-star appears far from over.”

Top Gainers and Losers- 26-Aug-25*

Go back to Latest bond Market News

Related Posts: