This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

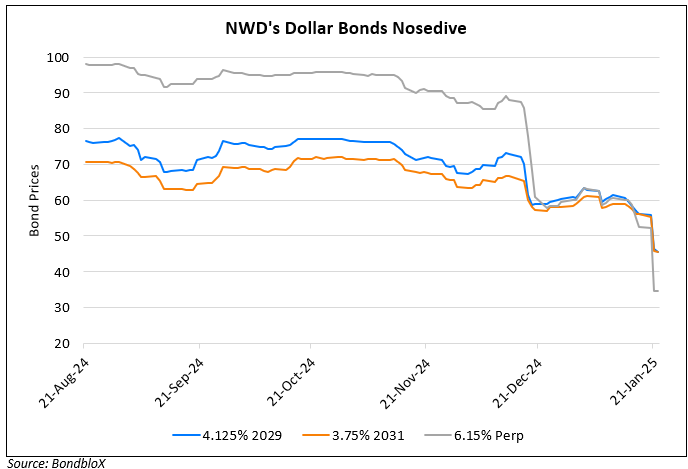

NWD’s Dollar Bonds Plummet on $15bn Prized Collateral Offering; UBS Halts Margin Loans – Sources

January 22, 2025

NWD’s dollar bonds plummeted across the curve, by 7-9 points on the back of the following developments. First, the company is said to have offered prized properties worth $15bn as collateral for loan refinancing, as per sources. It is believed that NWD has offered important properties including its luxury K11 Artus apartment, K11 Atelier office building, as well as the New World Tower in central Hong Kong as collateral. The sources added that NWD has asked banks to provide a 3Y loan facility backed by more than 20 of its properties to refinance HKD 58.1bn ($7.5bn) of unsecured loans due in 2025 and 2026. Analysts note that the likely implication is that it would leave fewer assets available for unsecured bondholders.

Separately, UBS has joined HSBC and Citigroup in not accepting some bonds and shares of NWD as collateral for margin loans, as per sources. As per Bloomberg analysts, NWD may be able to roll over maturing debt and reduce its funding gap, but might need to post collateral. While it continues to face financial pressures, NWD denied rumors that it had started debt restructuring talks.

Go back to Latest bond Market News

Related Posts: