This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NWD Clarifies It is Not Undertaking a Liability Management Exercise

October 22, 2025

New World Development (NWD) said that it was not undertaking a liability management exercise in relation to its perpetual bonds or other bonds, adding that it has not received an equity financing proposal, as per its HKEX filing. NWD made the clarification in response to media reports that said the company was in the process of preparing for such a move. While the company did not mention which media reports it was referring to, Bloomberg notes that credit information provider Octus reported about a potential a liability management exercise being discussed where the developer could offer some cash to its perpetual bonds’ holders, along with credit enhancements from the Cheng family-controlled Chow Tai Fook. NWD has a total of $7.9bn in outstanding bonds, of which about 57%, or $4.5bn are in the form of perpetual notes, as per Bloomberg data.

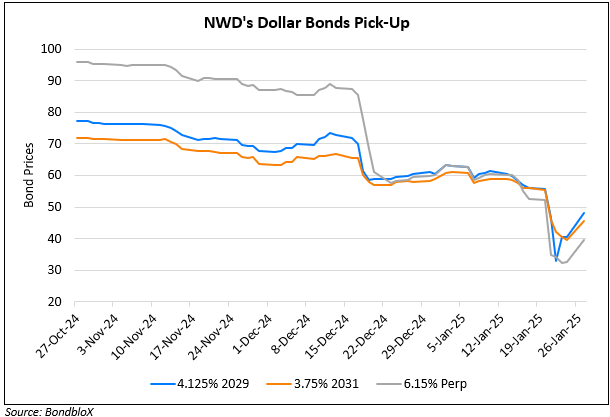

Its 4.125% 2029s are higher by ~4 points from a week ago, currently trading at 74.5 cents on the dollar, yielding nearly 13%.

For more details, click here

Go back to Latest bond Market News

Related Posts: