This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Nordea Prices $ AT1; Markets Cheer Fed Rate Cut

September 20, 2024

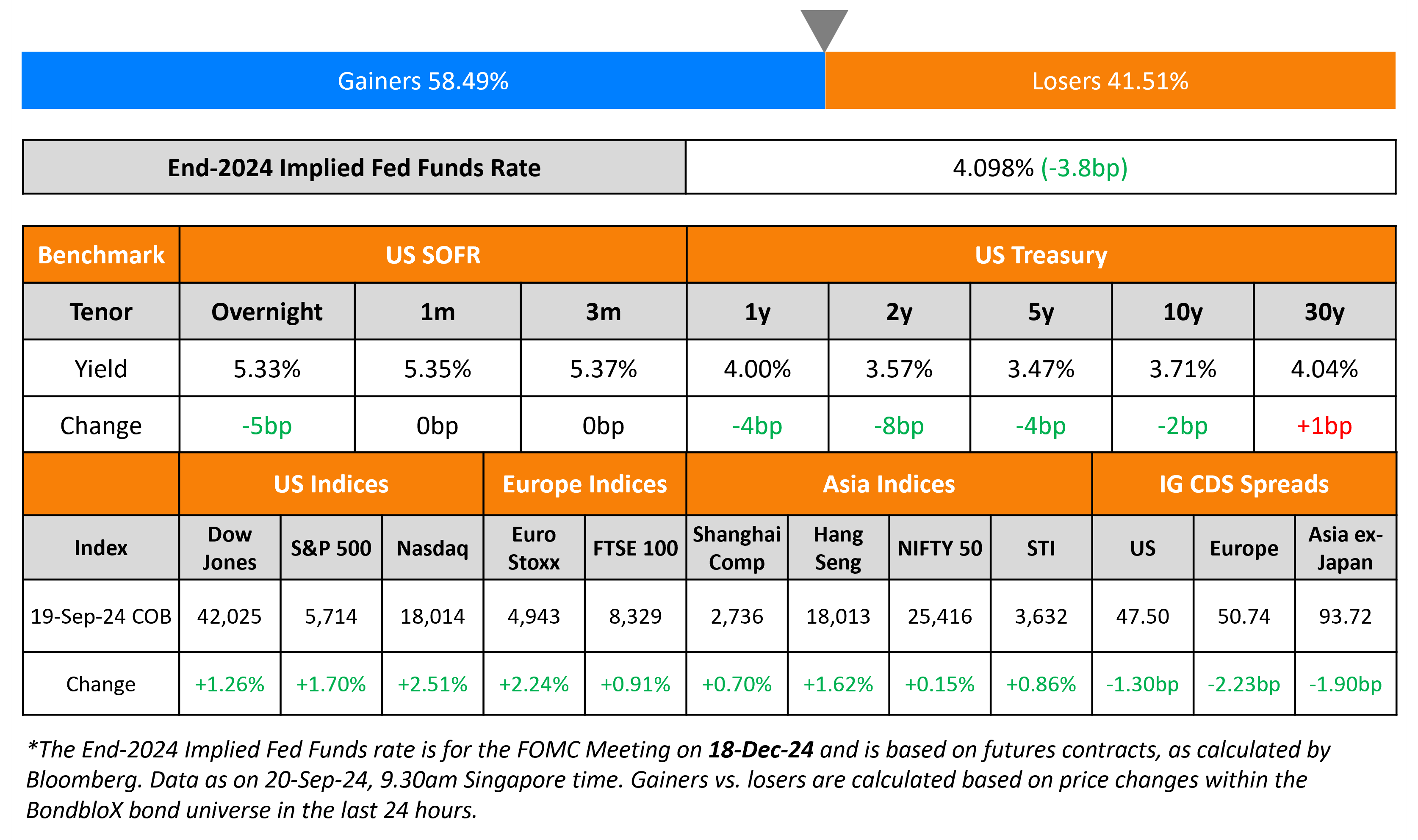

It was a sea of green for markets on Thursday as investors digest the Fed’s 50bp rate cut a day prior. Initial Jobless Claims for the week came in at 219k, beating estimates of 230k. The jobless claims fell by 12k vs. the prior week to reach the lowest level since mid May. US Treasuries fell across the curve with 2Y down 8bp to 3.57% and 10Y down 2bp to 3.71%. US IG and HY CDS tightened by 1.3bp and 8.3bp respectively. US equity markets continued its climb with the S&P and Nasdaq higher by 1.7% and 2.5% respectively.

European equity markets also ended higher. The Bank of England (BoE) warned investors that it won’t rush to ease monetary policy and decided to keep rates steady at 5%, in contrast to the Fed’s policy stance. Further, the BoE said that it will continue to reduce its government bond holdings by a further £100bn ($132bn) between October 2024 and September 2025. Looking at Europe’s CDS spreads, the iTraxx Main tightened by 2.2bp and Crossover tightened by 11.2bp. Asian equity indices have opened broadly mixed today morning. Asia ex-Japan IG CDS spreads tightened by 1.9bp.

New Bond Issues

Nordea Bank Abp raised $800mn via a PerpNC7.5 AT1 at a yield of 6.3%, 57.5bp inside revised initial guidance of 6.875%. The junior subordinated notes are rated BBB/BBB+ (S&P/Fitch). The bond is callable from 25 Sep 2031 to 25 March 2032 and any interest payment date thereafter. If not called by 25 March 2032, the coupon resets to 5Y US Treasury plus 266bp. A trigger event would occur if the issuer/group’s CET1 ratio falls below 5.125%. The bond priced ~30bp tighter than the BNP 8% Perp (Ba1/BBB-/BBB, having a reset of 372.7bp over 5Y UST) which currently yields 6.6% and is callable in August 2031.

OUE REIT raised S$180mn via a 7Y bond at a yield of 3.9%, 25bp inside initial guidance of 4.15% area. The senior unsecured bond is expected to be rated BBB- (S&P). OUE REIT Treasury Pte Ltd is the issuer of the bond and it is guaranteed by DBS Trustee Ltd. Proceeds will be used to finance or refinance, in whole or in part, new or existing eligible green projects that meet eligibility as recognized in the Green Bond Principles (2021) and Green Loan Principles (2023) in accordance with green financing framework established.

New Bonds Pipeline

- Agrobank hires for $ bond

- QIIB hires for $ PerpNC5.5 bond

Rating Changes

- Fitch Upgrades Mongolia to ‘B+’; Outlook Stable

- Diamondback Energy Inc. Upgraded To ‘BBB’ On Close Of Acquisition; Outlook Stable

- TalkTalk Telecom Group Ltd. Downgraded To ‘D’ On Receiving Consent From Lenders To Implement Proposed Debt Restructuring

- Fitch Places Odea on Rating Watch Negative

- Fitch Revises INEOS Enterprises’ Outlook to Negative; Affirms IDR at ‘BB-‘

Term of the Day

Sukuk

A Sukuk is a sharia-compliant fixed income instrument that essentially works similar to bonds. In a Sukuk, key differentiators vs. conventional bonds are:

- Investors share partial ownership of an asset rather than it being a debt obligation by the issuer

- The pricing is based on the underlying value of assets rather than credit worthiness

- The holder receives a share of underlying profits rather than interest payments (considered ‘riba’)

Sharia compliance broadly implies that any profits derived from these funding arrangements must be derived from commercial risk-taking and trading only; that interest income is prohibited on lending activities and; that the assets must be halal.

Talking Heads

On AT1s Poised for Money Boost After Fed

Raphael Stern, Global Head of fixed income at Invesco Asset Management Ltd.

“Some investors were on the sideline. AT1s is a yield product without much duration, positioned nicely for a lower yield and curve-steepening period.”

On How Fast Will Fed Cut Rates

Aditya Bhave, Mark Cabana and Alex Cohen, economists and strategists at BoFA

“The Fed “will get pushed into deeper cuts” with another 75 basis points coming in the fourth quarter and 125 basis points next year.”

Marc Giannoni, economist at Barclays

“The bank continues to see the Fed cutting by 25 basis points in November and December, followed by three more quarter-point reductions in 2025.”

On Fed Pivot Driving Outsized Gains in Asian Assets

Gary Dugan, chief executive officer at Global CIO Office

“The rate cut gives a clear signal to the financial markets, industrialists and householders that the Fed is supporting growth. The Fed’s action should be taken very positively by Asian markets.”

Top Gainers & Losers-20-September-24*

Go back to Latest bond Market News

Related Posts: