This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Nigeria’s Downgraded to Caa1 by Moody’s

January 30, 2023

Nigeria was downgraded to Caa1 from B3 by Moody’s primarily on the back of expectations that the “government’s fiscal and debt position will continue to deteriorate”. The government’s 2023 budget plans on an even larger fiscal deficit than in 2022 and lack of access to external funding sources will add to the external pressure from depressed oil production and capital outflows, they noted. Moody’s said that the nation’s debt-to-GDP will continue rising to ~45%, higher than the 34% in 2022 and 19% in 2019. They did note that immediate default risk was low.

Nigeria’s dollar bonds were trading stable with its 8.375% 2029s at 88.6, yielding 10.97%

Go back to Latest bond Market News

Related Posts:

Nigeria Explores Debt Restructuring

October 13, 2022

Pakistan and Nigeria Downgraded to CCC+ and B3

October 25, 2022

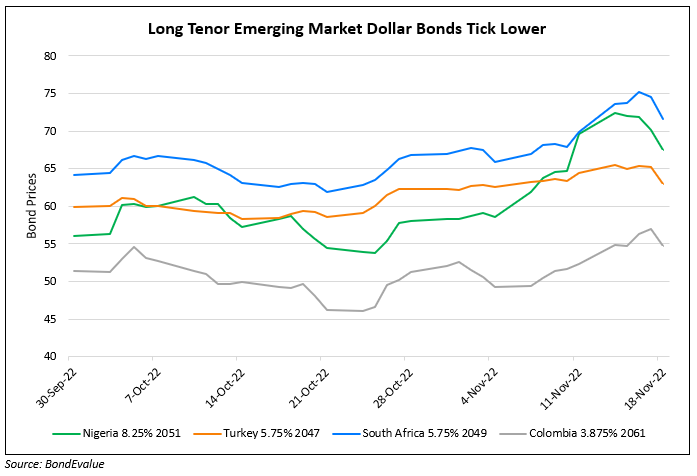

Long-Dated Bonds of EM Sovereigns Drop Over 3%

November 18, 2022