This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Nigeria Launches $ Bonds

December 3, 2024

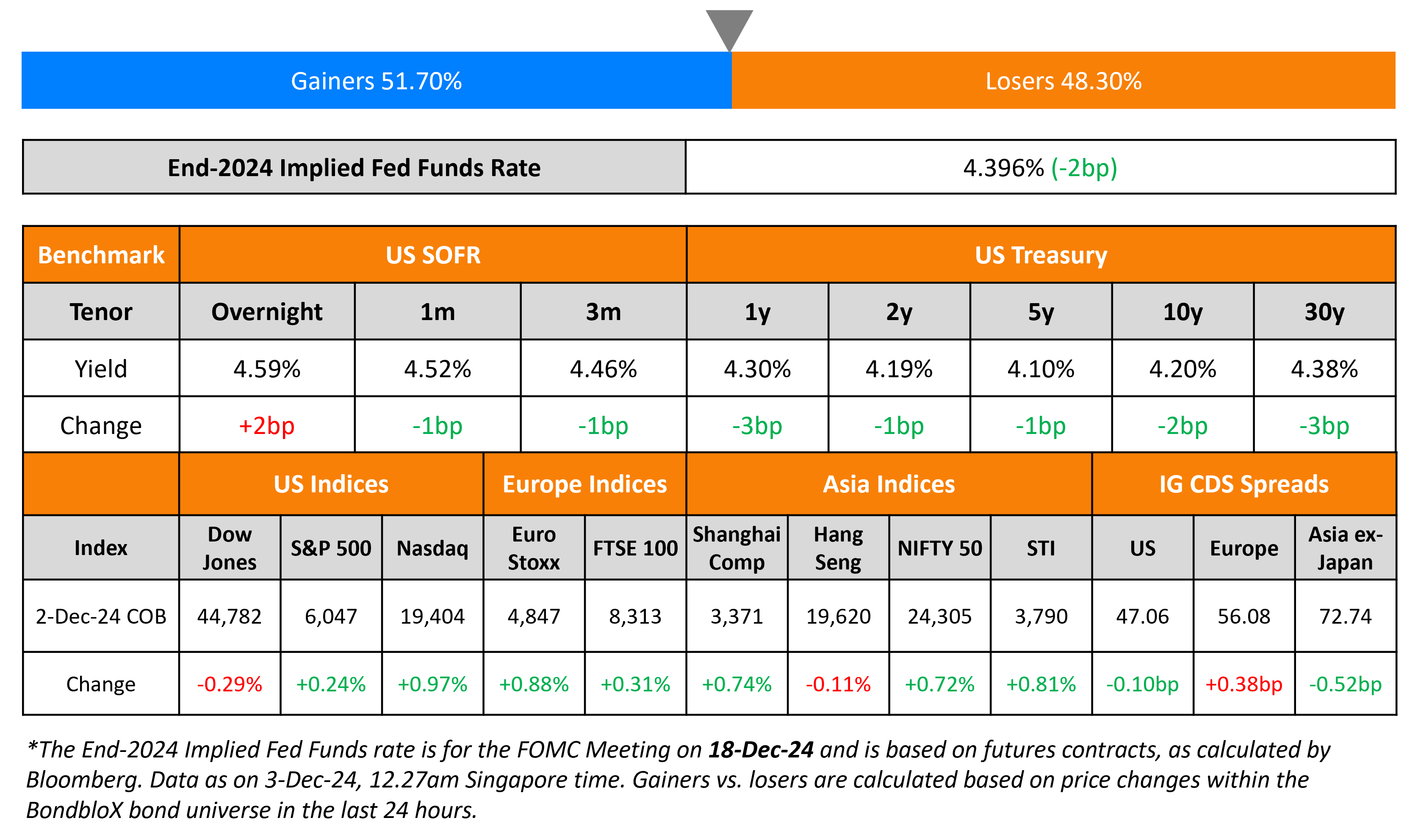

US Treasuries held steady across the curve yesterday. The ISM Manufacturing reading for November came-in at 48.4, better than expectations of 47.5 (and the prior month’s 46.5), albeit still showing a contraction. The inflationary Prices Paid sub-component came-in at 50.3, softer than expectations of 55.2 (and the prior month’s 54.8). However, the New Orders sub-component reading improved to 50.4, better than expectations of 48.0 (and the prior month’s 47.1). New York President John Williams indicated that lowering rates further may be needed to move to a neutral stance over time as risks to inflation and employment have become more balanced. Atlanta Fed President Raphael Bostic said that he was keeping “options open” for the December FOMC meeting.

US IG and HY CDS spreads tightened by 0.1bp and 2.7bp respectively. Looking at US equity markets, the S&P was higher by 0.2% and the Nasdaq rallied 1%. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.4bp and 2.9bp respectively. Asian equities have opened higher this morning. Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

- Nigeria $ 6.5Y/10Y at 10.125/10.625% area

Rating Changes

-

The Walt Disney Co. Upgraded To ‘A’ On Improved Leverage And Expectations For Healthy Growth In Fiscal 2025

-

Moody’s Ratings downgrades CVR Energy’s CFR to B2; assigns Ba3 rating to proposed term loan; negative outlook

-

Fitch Places Banco BPM on Rating Watch Positive on Exchange Offer Announcement

-

Fitch Affirms UniCredit at ‘BBB+’/Positive on Banco BPM Exchange Offer Announcement

New Bonds Pipeline

- Rakuten hires for $ PerpNC5 bond

Term of the Day

Consent Solicitation

Consent solicitation is an offer by the issuer to change the terms of the security agreement. These are applicable for changes to bonds or shares issued and can range from distribution payment changes and covenant changes in bonds to changes in the board of directors with regard to equities.

Talking Heads

On Trump’s Dollar Comment Seen as Needless BRICS Provocation

Brad Setser, senior fellow at the Council on Foreign Relations

“It isn’t a good look… indirectly elevates the stature of a non-threat and suggests a lack of confidence in the dollar”

Cindy Lau, Avanda Investment

“Doesn’t appear realistic and the probability is low… good reminder that President-elect Trump wants to keep the US dollar as a reserve currency and is unlikely to proactively devalue the dollar”

On BOJ Weighing Case for First Triple Hike Since Japan’s Bubble Burst

Ko Nakayama, chief economist at Okasan Securities

“The next rate hike is likely to be in December. BOJ has said it will do it if the economy goes along with the official projections… If the Fed moves and the BOJ doesn’t, that could shed light on the BOJ’s cautiousness and weaken the yen”

On ECB to Discuss Bigger Cut But Uncertainty High – ECB GC member Martins Kazaks

“Uncertainty is still very high… we still have to remain cautious… We see that the inflation problem will soon end, and that means that we can lower rates”

Top Gainers and Losers- 03-December-24*

Go back to Latest bond Market News

Related Posts:

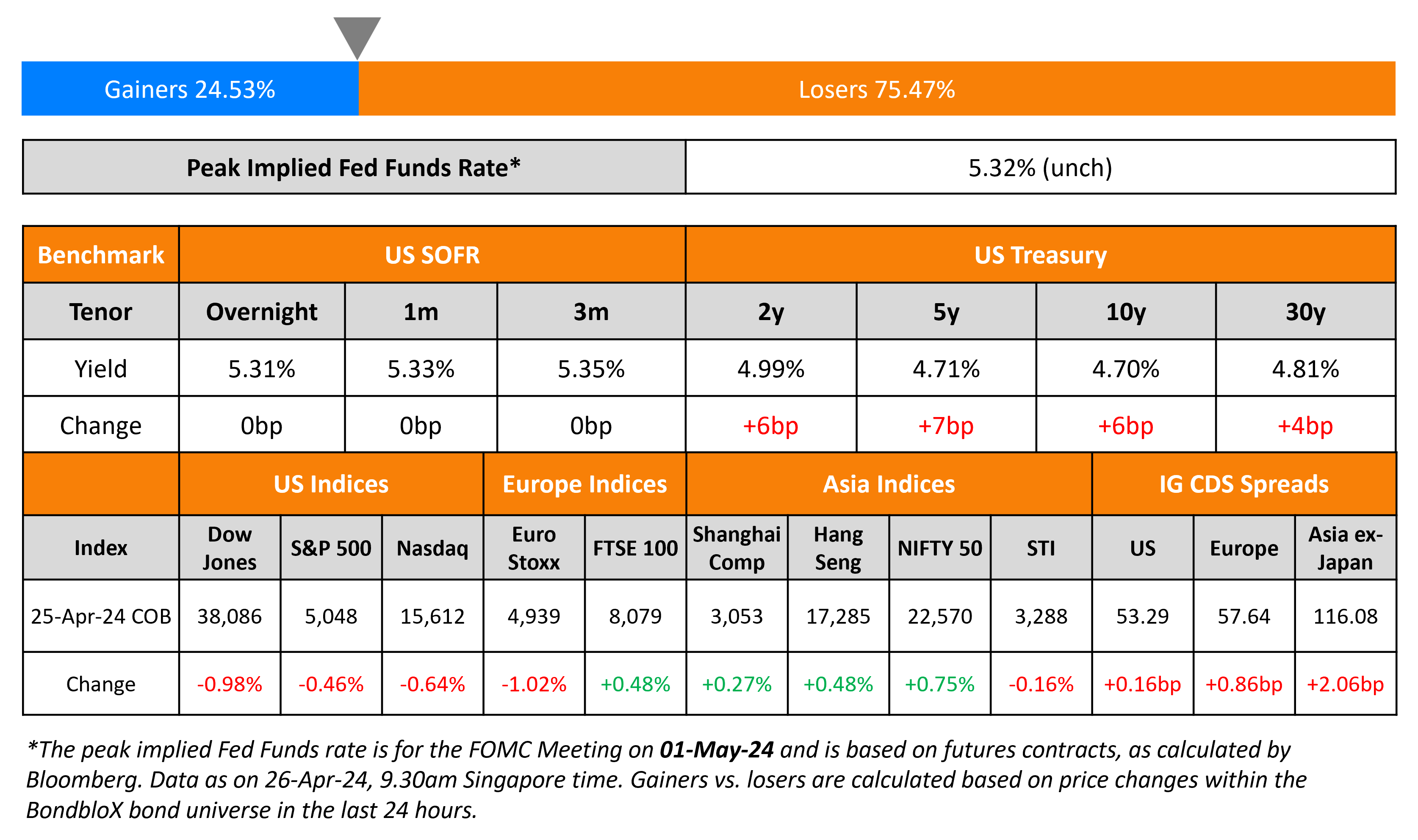

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024