This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NFP Stronger, Wages Softer; Treasury Yields Rise

May 5, 2025

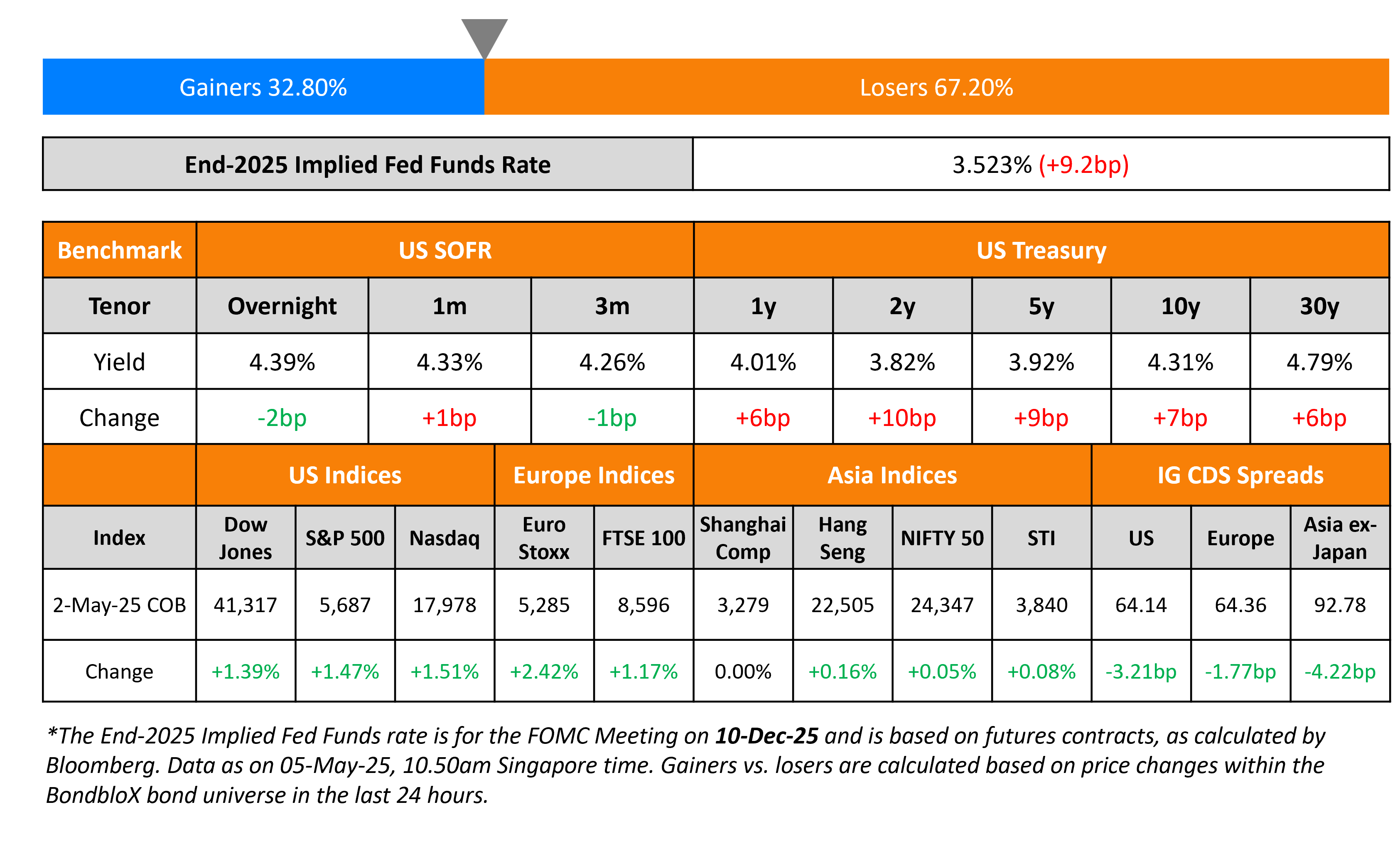

US Treasury yields jumped higher, led by the front-end, with the 2Y and 5Y yields higher by 9-10bp while the 10Y yield rose by 7bp. US Non-Farm Payrolls (NFP) for April came-in at 177k, higher than estimates of 138k. However, the prior month’s print was revised lower to 185k from 228k. The unemployment rate held steady at 4.2%, in-line with estimates. Average Hourly Earnings (AHE) YoY rose by 3.8%, similar to the month prior to it, but slightly lower than expectations of 3.9%.

Looking at equity markets, the S&P and Nasdaq were both higher by 1.5% each. Looking at credit markets, US IG CDS spreads were tighter by 3.2bp, while HY CDS spreads tightened by 17.1bp. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads tightened by 1.8bp and 9.7bp respectively. Several major Asian equity markets are closed due to a holiday today. Asia ex-Japan CDS spreads were tighter by 4.2bp.

New Bond Issues

- First Sponsor Group S$ 5Y at 3.495% area

Rating Changes

-

Community Health Systems Upgraded To ‘CCC+’ From ‘SD’, Outlook Negative; New Senior Secured Debt Rated ‘B-‘

-

Intrum AB Ratings Lowered To ‘D’ From ‘SD’ On Correction Of Criteria Misapplication

-

Playtech PLC Downgraded To ‘BB-‘ On Completed Snaitech Disposal; Outlook Stable

-

Fitch Revises Outlook on Mumbai International Airport’s USD Notes to Positive; Affirms at ‘BB+’

Term of the Day: Non-Farm Payrolls (NFP)

Non-Farm Payrolls (NFP) is a key data point that is released by the US Bureau of Labor Statistics (BLS) usually on the first Friday of every month. NFP measures net changes in employment excluding agricultural, local government, private household and not-for-profit sectors over the past month and is a key economic indicator in the United States. A high reading of the NFP is considered a positive sign for the US economy while a negative reading is considered a sign of a slowdown in the US jobs market. The NFP indicator is closely watched by traders, especially as it is one of the first monthly economic indicators to be released, and because of the direct relationship between job creation and economic growth.

Talking Heads

On Indian Bonds Hit by Worst Outflow Since JPMorgan Index Inclusion

Rajeev De Mello, Gama Asset

“Investors sharply reduced their portfolio risk exposure following the April 2 US tariff announcement, diminishing foreign investment in Indian government bonds”

Yifei Ding, Invesco

“It’s natural for investors to take some profits”

On World’s Riskiest Bonds Luring Traders Back After Tariff Turmoil

Carlos de Sousa, a portfolio manager at Vontobel

“We had ammunition to come back during the selloff”

Thys Louw, Ninety One

“We’ve seen some pockets of value in EM, especially within HY where generally fundamentals have remained resilient and reform progress has been broadly positive”

On Referendum May Be Needed for Reform Plan – French Premier, Francois Bayrou

“Our country faces two massive challenges, the biggest in our recent history: production that is too weak and overwhelming debt… when debt becomes overwhelming, deficits become unbearable… referendum can only be decided by the president”

Top Gainers and Losers- 5-May-25*

Go back to Latest bond Market News

Related Posts: