This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NFP Rises by 227k With Unemployment Rate at 4.2%

December 9, 2024

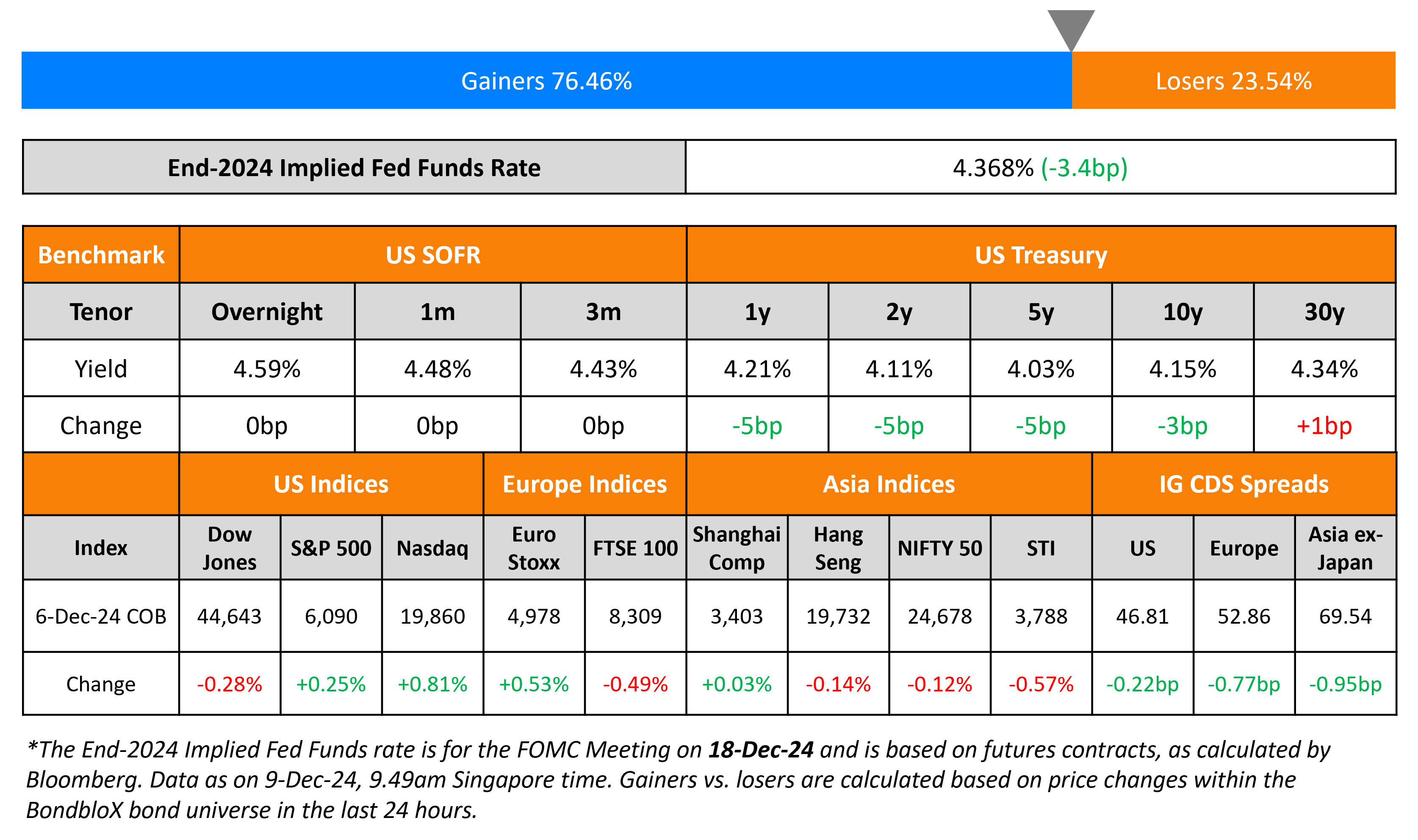

US Treasury yields eased by 3-5bp across the curve on Friday. US NFP rose by 227k, higher than expectations of 220k, with the unemployment rate at 4.2%, also higher than the expected 4.1%. Average hourly earnings YoY rose by 4.0%, higher than expectations of 3.9%, and unchanged from the prior month. At present, markets are pricing-in a 85% probability of a 25bp rate cut by the Fed in December.

US IG and HY CDS spreads tightened by 0.2bp and 0.5bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 0.3% and 0.8% higher. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.8bp and 2.7bp respectively. Asian equities have opened lower this morning. Asia ex-Japan CDS spreads were 1bp tighter.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Embraer S.A. to Baa3; outlook changed to stable from positive

-

Fitch Upgrades Cyprus to ‘A-‘; Outlook Stable

-

Fitch Downgrades Wanda Commercial and Wanda HK to ‘C’

-

Companhia Siderúrgica Nacional Downgraded To ‘BB-‘ From ‘BB’ On Elevated Leverage; Outlook Stable

-

Fitch Downgrades Sprint BidCo’s (Accell) IDR to ‘C’ on Distressed Debt Exchange

-

Moody’s Ratings confirms Volcan’s Caa1 ratings; outlook changed to positive

-

Moody’s Ratings affirms Dah Sing Bank’s A2/P-1 deposit ratings, changes outlook to negative

-

Fitch Revises Hungary’s Outlook to Stable; Affirms at ‘BBB’

New Bonds Pipeline

- Buenos Aires hires for $ bond

Term of the Day

Tier 2 Bonds

Tier 2 bonds are debt instruments issued by banks to meet their regulatory tier 2 capital requirements. Tier 2 capital (and thus tier 2 bonds) rank senior to tier 1 capital, which consists of common equity tier 1 (CET1) and additional tier 1 (AT1) capital. CET1 consists of a bank’s common shareholders’ equity while AT1 consists of preferred shares and hybrid securities or perpetual bonds. Tier 2 capital consists of upper tier 2 and lower tier 2 wherein the former is considered riskier to the latter. From a bond investor’s perspective, tier 2 bonds are senior, and therefore less risky, compared to AT1 bonds as AT1s would be the first to absorb losses in the event of a deterioration in bank capital.

Talking Heads

On Fed seen poised to cut rates this month, debate 2025 pause

TD Securities, Gennadiy Goldberg

“It’s not exactly a wonderful economy, but it’s also an economy that doesn’t seem to be decelerating as sharply as everyone expected a few months ago”

On Fed ‘At or Near’ Point of Slowing Rate Cuts – Cleveland Fed President, Beth Hammack

“I believe we are at or near the point where it makes sense to slow the pace of rate reductions… Moving slowly will allow us to calibrate policy to the appropriately restrictive level.. We may not be too far from a neutral setting today”

On Bond Traders Seeing Inflation as Key to Timing Next Rate Cut

Gang Hu, Winshore Capital

“Unless CPI surprises massively to the higher side, the Fed’s baseline is to cut this month”

Tracy Chen, Brandywine Global

“The US economy is very resilient… Fed is probably closer to a pause in its cutting cycle, with them pausing sometime early next year”

Amar Reganti, Hartford Funds

“Every indication is that there will be a cut in December, but inflation is still a pretty big thing so there’s some slight tail risk”

Top Gainers and Losers- 09-December-24*

Go back to Latest bond Market News

Related Posts: