This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NFP Rises by 119k and Rate Cut Expectations Drop; FAB, Colombia, China Three Gorges Price Bonds

November 21, 2025

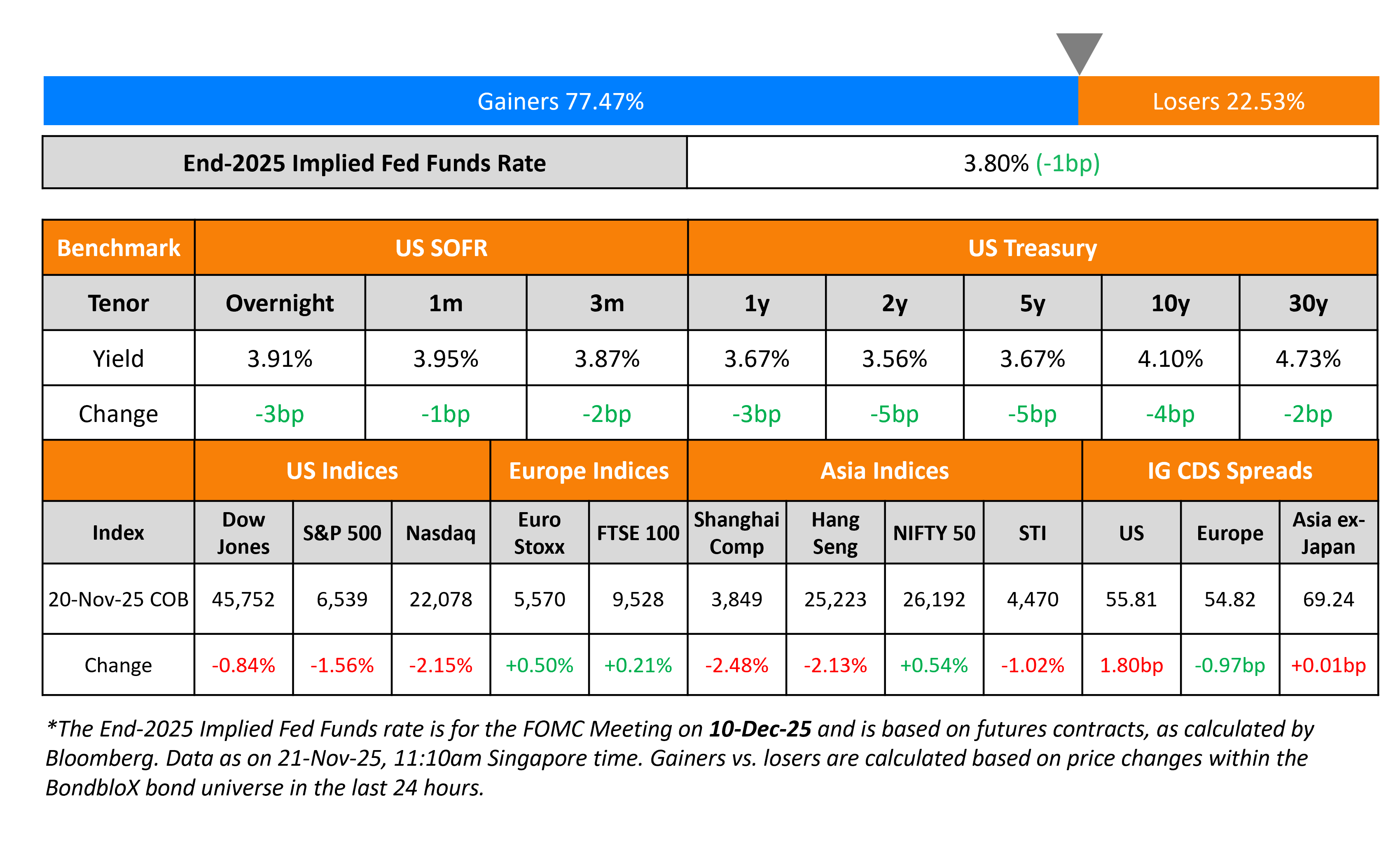

US Treasury yields eased by 4-5bp across the curve. The delayed US Non-Farm Payrolls (NFP) reading for September came-in at 119k, better than expectations of 53k. The Unemployment Rate rose to 4.4% from 4.3%, with an increase in labour force participation. Average Hourly Earnings (AHE) YoY rose by 3.8%, higher than the surveyed 3.7%. Separately, both Philadephia Fed President Anna Paulson and Fed Governor Michael Barr said that the central bank should proceed with caution going into the December FOMC meeting with regard to considering rate cuts. They highlighted concerns about labor market and inflation respectively, influencing their outlook. On the back of the labor market data and Fed speakers’ views, markets only view a 30% chance of a December rate cut vs. nearly 45% a week ago.

Looking at the equity markets, the S&P and Nasdaq closed lower by 1.6% and 2.2% respectively. US IG and HY CDS spreads were wider by 1.8bp and 10.3bp respectively. European equity indices ended higher. The iTraxx Main CDS and Crossover CDS spreads were 1bp and 1.3bp tighter respectively. Asian equity markets are trading in the red today, following the US bourses. Asia ex-Japan CDS spreads were flat.

New Bond Issues

First Abu Dhabi Bank (FAB) raised $1bn via a PerpNC6 AT1 bond at a yield of 5.875%, ~56.25bp inside initial guidance of 6.375-6.500% area. The junior subordinated note is rated Baa3 by Moody’s. If not called by 28 November 2031, the coupon will be reset to the US Treasury 6Y yield plus 208.6bp. Upon the occurrence of a non-viability event, the note can either be fully or partially written down at the regulator’s sole discretion.

The Republic of Colombia raised €2bn via a three-part offering. It raised:

- €500mn via a 5Y bond at a yield of 4.70%, 15bp inside initial guidance of 4.85% area.

- €700mn via a 9Y bond at a yield of 5.90%, 15bp inside initial guidance of 6.05% area.

- €800mn via a 13Y bond at a yield of 6.60%, 15bp inside initial guidance of 6.75% area.

The senior unsecured notes are rated Baa3/BB/BB+. Net proceeds will be used exclusively (a) to repay the aggregate purchase price for its outstanding bonds (including accrued interest) under its buyback offer (b) to repay existing external debt.

AgBank of China (Singapore branch) raised $300mn via a 3Y FRN at SOFR+43bp, 57bp inside initial guidance of SOFR+100bp area. The sustainability-linked loans financing bond is rated A1 by Moody’s. Net proceeds will be used, in whole or in part, to finance and/or refinance a pool of eligible sustainability-linked loans under its framework.

China Three Gorges raised €600mn via a 5Y green bond at a yield of 2.911%, 42bp inside initial guidance of MS+90bp area. The senior unsecured bond is rated A1/A- (Moody’s/Fitch). Net proceeds will be used for refinancing debt and in whole/in part, to finance and/or refinance eligible projects under its framework.

New Bonds Pipeline

- Arabian Centres (Cenomi) $ 5NC2 sukuk

- West China Cement $ bond

Rating Changes

- Moody’s Ratings upgrades Rolls-Royce plc to Baa1 from Baa2; outlook positive

- Skandinaviska Enskilda Banken AB (publ) Upgraded To ‘AA-/A-1+’ On Franchise Strength And Robust Earnings; Outlook Stable

- Moody’s Ratings upgrades Bendigo’s senior unsecured rating to A3; outlook stable

- Braskem Idesa Downgraded To ‘D’ From ‘CCC’ On Missed Interest Payment

- Fitch Downgrades New Fortress Energy’s IDR to ‘RD’ on Missed Interest Payment

- Fitch Downgrades Oriflame to ‘C’ on Missed Coupon Payment

- Moody’s Ratings downgrades Organon’s CFR to Ba3, negative outlook; concludes the review

- Moody’s Ratings downgrades Cornerstone’s CFR to Caa1, outlook stable

- CVR Energy Inc. Outlook Revised To Stable From Negative; Ratings Affirmed

- Alpek S.A.B. de C.V. Outlook Revised To Negative On Risk Of Sustained Weaker Business Position; ‘BBB-‘ Ratings Affirmed

- Fitch Revises Jamaica’s Outlook to Stable; Affirms IDR at ‘BB-‘

Term of the Day: Restricted Default (RD)

Fitch defines Restricted Default (RD) as the rating for an issuer that has defaulted on a bond, loan or other financial obligation but has not filed for bankruptcy or entered into liquidation or any other formal winding-up process, and which has not ceased operations. RD is different from Default (D) in that Fitch rates an issuer as default if, in its opinion, the issuer has entered into bankruptcy filings, liquidation or any other formal winding-up process.

Talking Heads

On Private-Credit Defaults Expected to Drive 2026 Stress – UBS Strategists

Private credit defaults could climb by as much as 3% in 2026. Defaults for the latter two sectors are expected to increase as much as 1% next year… The rise in PIK loans suggests “pressure on firms to preserve liquidity amid a higher interest rate and slower growth environment”.

On Deutsche Bank Warning of Japan Capital Flight in Echo of UK Crisis – George Saravelos

“Concerning that both the yen and the long end of the Japanese government bond nominal market is starting to decouple from any measure of fair value and that intraday correlations are accelerating… If domestic confidence in the government’s and BOJ’s s commitment to low inflation is lost, the reasons to buy JGBs disappear”

On Japan Saying Yen Intervention an Option in Ramped-Up Warning

Finance Minister Satsuki Katayama

“The government will take appropriate action against disorderly FX moves, including those driven by speculation as needed”

Rodrigo Catril, National Australia Bank

“The market is becoming desensitized to comments from Japanese officials, and there are solid macro arguments that justify a weaker yen… Inflation is running well above the BOJ’s target, yet it remains reluctant to hike.”

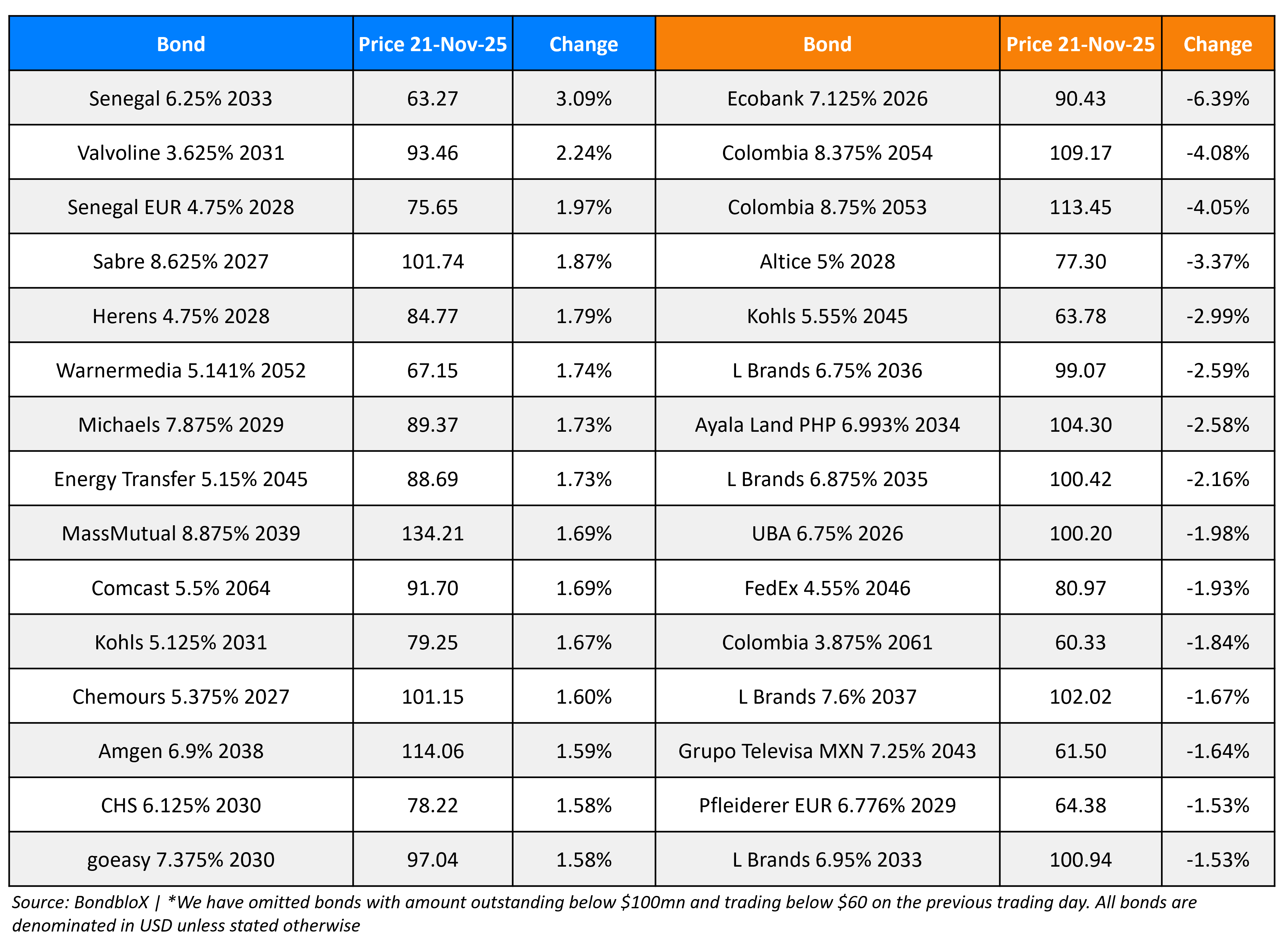

Top Gainers and Losers- 21-Nov-25*

Go back to Latest bond Market News

Related Posts:.png)