This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NFP Cools as Short-Term Yields Fall

September 9, 2024

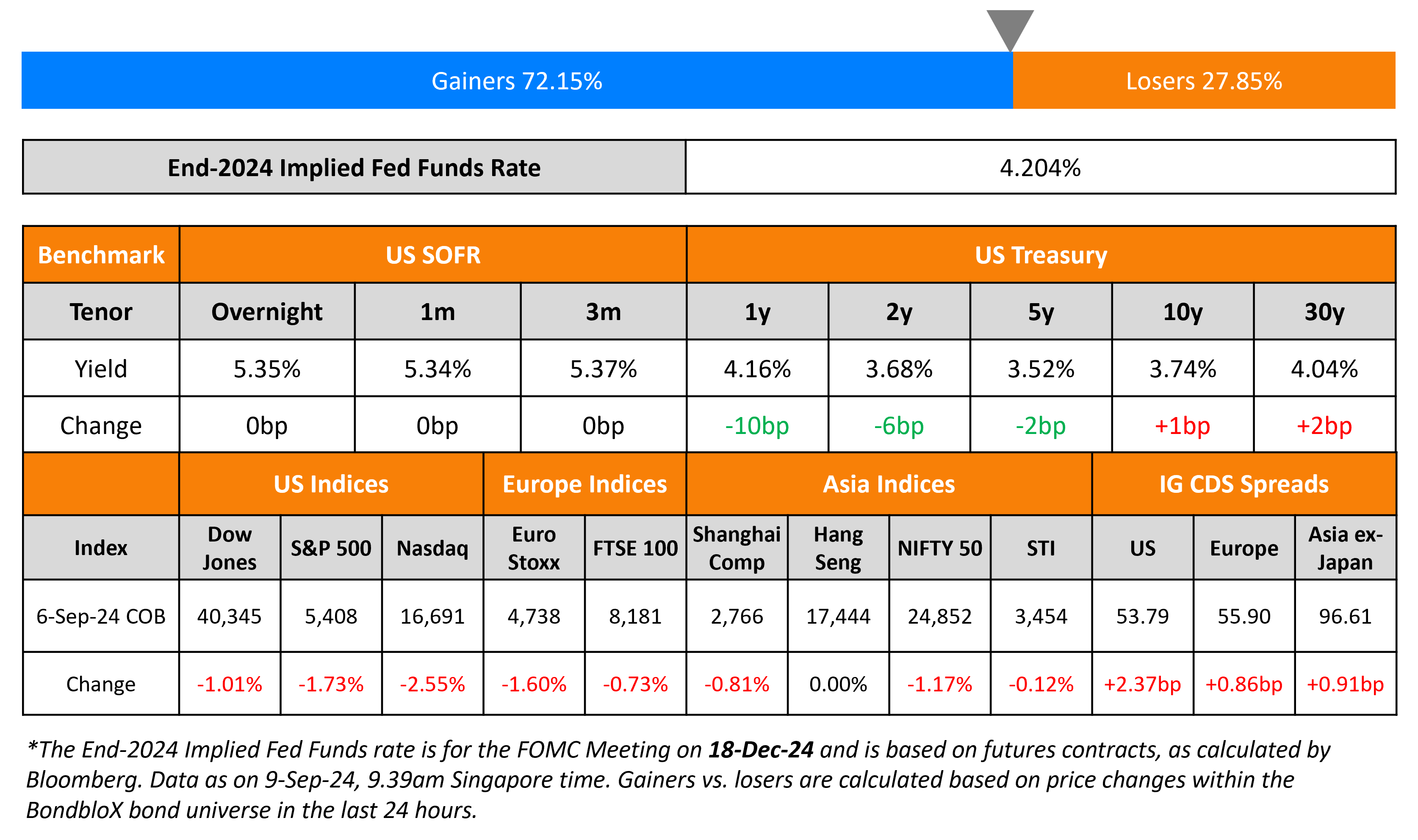

The US Treasury curve bull steepened as the 1Y and 2Y yields fell 10b and 6bp respectively while he 10Y yield held steady, after a soft jobs report. US NFP for August saw job additions of 142k, lower than expectations of 165k. The NFP reading for July was revised further lower to 89k from 114k. Average Hourly Earnings (AHE) YoY rose by 3.8%, higher than expectations of 3.7% while the Unemployment Rate eased to 4.2% (from 4.3% in July), in-line with expectations. US IG CDS spreads widened by 2.4bp and HY CDS spreads were wider by 10.7bp. Looking at US equity indices, the S&P was down 1.7% and the Nasdaq was down 2.6%.

European equity markets ended lower too. Looking at Europe’s CDS spreads, the iTraxx Main spreads were wider by 0.9bp while Crossover spreads widened by 4.3bp. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads widened by 0.9bp.

New Bond Issues

- Chongqing Intl Logistics $ 3Y at 6.5% area

- China Minsheng $ 3Y FRN at SOFR+110bp area

New Bonds Pipeline

- Vedanta hires for $ 5NC2/7NC3 bond

Rating Changes

- Fitch Upgrades Turkiye to ‘BB-‘; Outlook Stable

- Jordan Upgraded To ‘BB-‘ On Economic Resilience; Outlook Stable

- Moody’s Ratings upgrades Virgin Money UK’s long-term issuer rating to A3 and Clydesdale Bank PLC’s long-term deposit to A1

- Moody’s Ratings upgrades Cimpress’ CFR to Ba3; outlook stable

- Moody’s Ratings downgrades Hysan’s ratings to Baa2; changes outlook to stable from negative

- China Vanke Co. Ltd. Downgraded To ‘BB-‘ On Weakening Sales And Margins; Outlook Negative

- Fitch Downgrades DTEK Renewables to ‘RD’; Upgrades to ‘CC’

- Moody’s Ratings changes direction of Michael Kors’ ratings under review to uncertain from upgrade

Term of the Day

Debt-for-nature Swap

Debt-for-nature swaps are a transaction wherein an amount of debt owed by a developing country government is cancelled or reduced by a creditor, and swapped with a financial commitment earmarked for environmental conservation. Once the creditor reduces or cancels the debt repayment amount, both the creditor and debtor arrive at an agreed amount that would have otherwise been used for servicing the debt, to be used for environmental projects. These swaps typically involve countries that are distressed and find it difficult to repay offshore debt. The earnings generated through swaps are often administered by local conservation or environmental trust funds.

The world’s first debt-for-nature swap was between Bolivia and foreign creditors, who forgave $650k of its debt in exchange for setting aside 3.7mn acres of land adjacent to the Amazon Basin for conservation.

Talking Heads

On September’s Big Borrowing Spree Underscoring EM Fear

Alexander Karolev, JPMorgan Chase & Co.

“Most issuers have chosen very well to come to the market ahead of potential volatility. You will now see a significant decrease in issuance volumes in the next weeks because of risk events.”

Nick Eisinger, Vanguard Asset Services

“Obviously a large slowdown is bad for emerging markets. Now is a good time to move on issuance”

Carmen Altenkirch, Aviva Investors

“Issuers will be mindful of US elections around the corner, and the risk that if US growth concerns mount, spreads could move sharply wider”

On Fed Must Decide If Quarter-Point Cut Will Be Enough for Workers

Diane Swonk, KPMG

“Powell has got to be thinking about his legacy right now, and he’s really got to nail this soft landing”

Tim Duy, SGH Macro Advisors

“Powell is trying to pull the Fed in a dovish direction”

Neil Dutta, Renaissance Macro Research

“You should be going now when the increase in unemployment is somewhat more benign than waiting for it to become so obvious that you’re already too late”

On Jobs Weakness Makes It Closer Call on Fed Going 50 – Fmr. Treasury Secy. Larry Summers

“The numbers certainly didn’t show hugely pronounced weakness, but if you were concerned by the recent trend in the statistics, they certainly didn’t give you a clean bill of health for the economy”

Top Gainers & Losers-09-September-24*

Go back to Latest bond Market News

Related Posts: