This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NFP Comes at 151k; Powell Indicates No Rush to Cut Rates

March 10, 2025

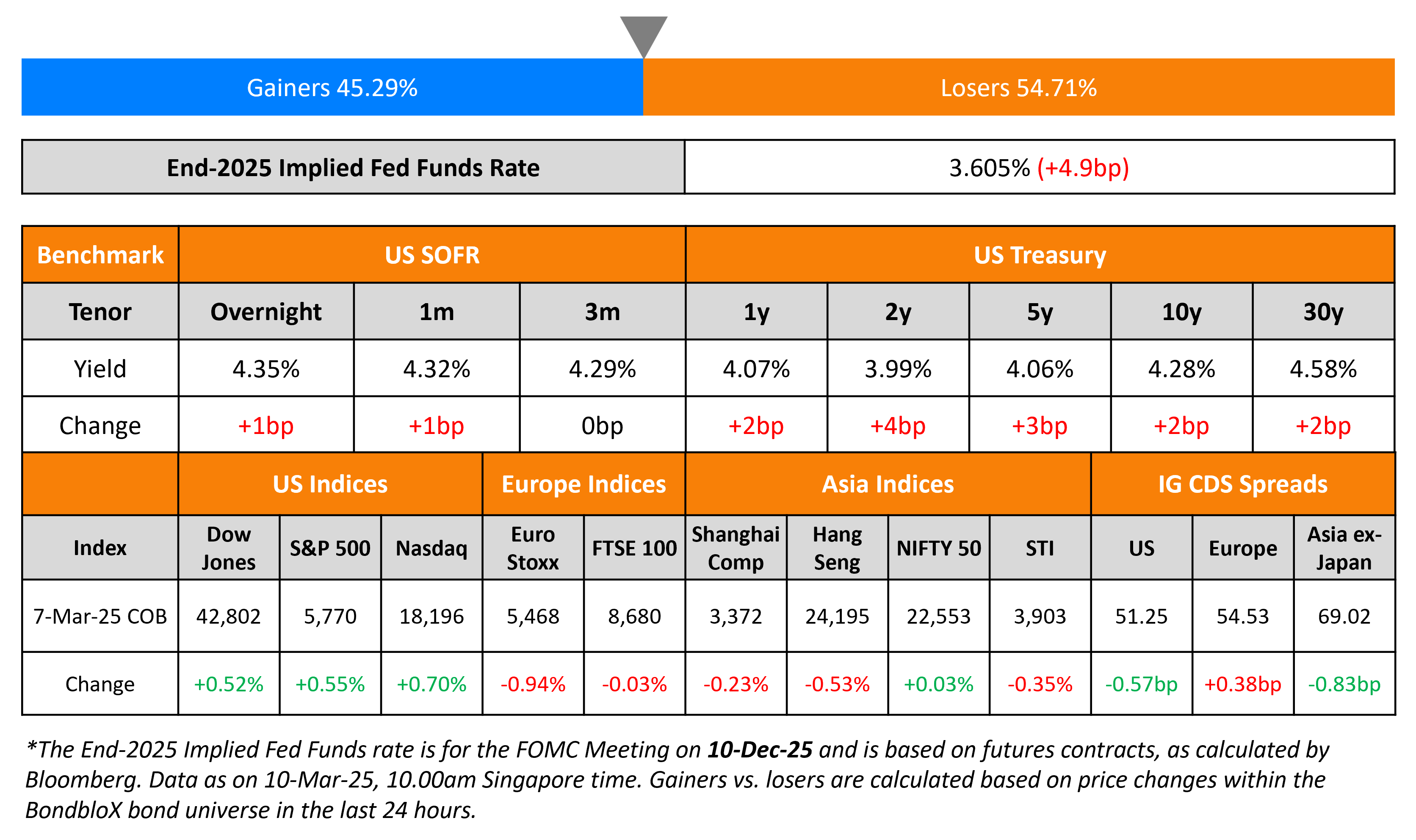

US Treasury yields inched higher by 3-4bp across the curve. US NFP in February came at 151k, lower than expectations of 160k, but higher than the prior month’s revised 125k reading. Average Hourly Earnings (AHE) YoY rose by 4%, lower than the surveyed 4.1%, but higher than the prior 3.9% reading. Unemployment Rate was at 4.1%, higher than expectations and the prior month’s 4% print. Fed Chairman Jerome Powell said that they were not in a rush to cut rates and that the economy was in a “good place”.

US equity markets saw the S&P and Nasdaq move higher by 0.6-0.7%. Looking at credit markets, US IG and HY spreads CDS spreads tightened 0.6bp and 2.4bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 0.4bp and 3.8bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 0.8bp. China’s CPI YoY for February came-in at -0.7%, worse than expectations of -0.4% and the prior month’s 0.5% print. This was its first negative reading on the headline print since January 2024. Core CPI also fell to -0.1% vs. a 0.6% rise in January, its first negative reading since January 2021.

New Bond Issues

New Bonds Pipeline

- Indonesia hires for $ 5Y Tier 2 bond

Rating Changes

-

Fitch Upgrades United Airlines to ‘BB’/Positive

-

Fitch Downgrades QVC to ‘B-‘; Outlook Stable

-

Melco Resorts And Studio City Outlook Revised To Stable From Positive On Slow EBITDA Growth; Ratings Affirmed

-

Fitch Places NOVA Chemicals Corporation’s Ratings on Rating Watch Positive

-

Walgreens Boots Alliance Inc. Ratings Placed On CreditWatch Negative On Take-Private Announcement

-

Moody’s Ratings places Walgreens’ ratings under review for downgrade following agreement to be acquired by Sycamore

-

Moody’s Ratings reviews for upgrade Avolon Holdings’ Baa3 senior unsecured rating

Term of the Day: Wealth Effects

Wealth effect refers to a theory which suggests that people tend to spend more when their wealth increases, even if income does not rise. This includes increases in the value of assets like stocks and real estate. However critics claim that increasing asset wealth should not have a significant impact on consumer spending as this does not translate directly into a higher disposable income.

Talking Heads

On Misfiring Wall Street Wealth Machine Being an Anxious Omen for Economy

Doug Ramsey, 30Y Wall Street veteran

“The stock market is good at forecasting the future because it helps create it. We doubt this economic expansion can survive a stock market correction of more than 12-15%”

Mark Zandi, Moody’s Analytics

“There is a very strong link between the stock market — its ups and downs — and the strength of consumer spending and the economy”

On ‘Impossible Trinity’ Conundrum Causing a Cash Crunch in Asia

Philip McNicholas, Robeco

“Under the impossible trinity, if a central bank opts to hold the currency stable and one assumes an unchanged capital account regime, rates have to be the adjustment mechanism.”

Madhavi Arora, Emkay Global

“The currency volatility could continue amid ongoing global trade and tariff wars and will imply emerging market central banks”

On Fed expected to cut rates in June as jobs data raises potential red flags

Julia Coronado, MacroPolicy Perspectives

“The February employment report showed some softening in conditions even before the impact of the larger cuts to federal hiring and contractors takes effect… expect reduced immigration, federal job losses, and the chilling effect of uncertainty from DOGE payment defaults and tariff policy to substantially slow hiring”

Top Gainers and Losers- 10-March-25*

.png)

Go back to Latest bond Market News

Related Posts: