This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

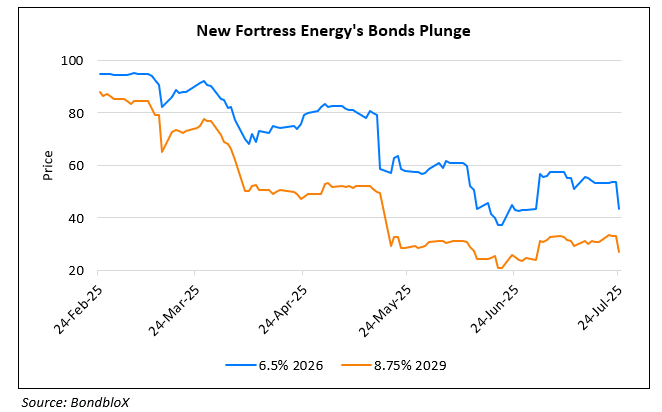

New Fortress Energy’s Dollar Bonds Plunge

July 24, 2025

Bonds of New Fortress Energy plunged by 5-10 points after Puerto Rico ended negotiations with the company on a ~$20bn, 15-year LNG supply contract. The development came after the company refused to accept revised terms and missed a key deadline, according to Recoms Group president Osvaldo Carlo Linares. The federally-appointed Oversight Board had objected to the deal, warning it would give New Fortress a near-monopoly and force Puerto Rico to accept LNG it may not need. Puerto Rico, facing frequent outages due to aging infrastructure and heavy reliance on fossil fuels, is now negotiating 30-day emergency LNG supply contracts with four other companies. This would likely require them to pay a fee to use New Fortress’ LNG terminal in San Juan. The names of these alternative suppliers were not disclosed. New Fortress shares fell as much as 12%, and its dollar bonds also fell as seen in the chart above.

For more details, click here.

Go back to Latest bond Market News

Related Posts: