This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NATO Leaders Agree to Increase Defense Spends to 5% of GDP by 2035; Dar Al-Arkan, CapitaLand India, Delek Price Bonds; NatWest Upgraded to A+

June 26, 2025

US President Donald Trump said that US will hold a meeting with Iran next week. During the NATO summit, NATO leaders agreed to increase defense spending to 5% of GDP by 2035, versus the current target of 2%. While Trump supported the increase in defense spending, he did not explicitly reaffirm Article 5, that states that an attack on one member is an attack on all. On the successor for Fed Chairman Jerome Powell, Trump said that he has already shortlisted 3-4 people and plans on revealing the name in due time.

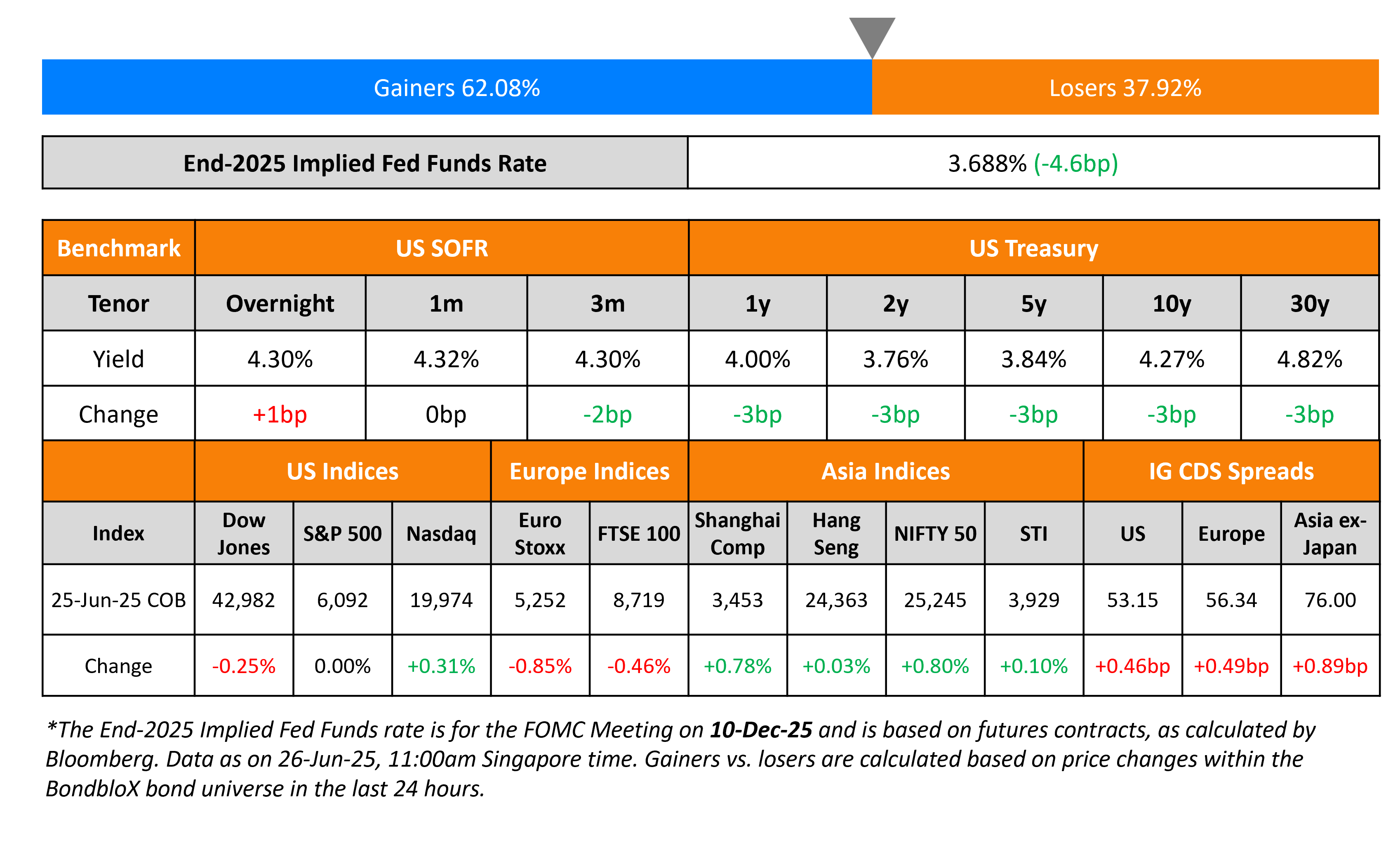

US Treasury yields fell by 3bp across the curve yesterday. New Home Sales for May came in at 623k, lower than expectations of 693k. The previous reading for April was revised from 743k to 722k. The Fed suggested lowering the enhanced supplementary leverage ratio (eSLR) to ease capital requirements and allow the large US banks to hold more treasuries. They plan to reduce the requirement from 5% to 3.5-4.5% for holding companies and from 6% to the same level for banking subsidiaries.

Looking at US equity markets, S&P closed flat whereas and Nasdaq jumped higher by 0.31%. In credit markets, US IG and HY CDS spreads widened by 0.5bp and 3.1bp respectively. European equity markets closed lower, with EuroStoxx sliding by 0.85%. The iTraxx Main CDS spreads and Crossover CDS spreads widened by 0.5bp and 1bp respectively. Asian equity markets have broadly opened higher today, with Nikkei up by 1.1% at the time of writing. Asia ex-Japan CDS spreads widened by 0.9bp.

New Bond Issues

Dar Al-Arkan Sukuk raised $750mn via a 5Y sukuk at a yield of 7.375%, 37.5bp inside initial guidance of 7.75% area. The senior unsecured sukuk is rated B1 by Moody’s and received orders of over $2.6bn, 3.4x the issue size.

CapitaLand India Trust raised S$100mn via a PerpNC5 bond at a yield of 4.4%, 25bp inside initial guidance of 4.65% area. The subordinated bond is unrated and received orders in excess of S$280mn, 2.8x the issue size. If not called by 2 July 2030, the coupon will reset to SGD 5Y Sora-OIS plus 265.5bp. The bond also has a dividend stopper clause. Proceeds will be used to refinance existing debt, or repayment of loans, and financing business activities, acquisitions and general working capital of CapitaLand India Trust Management.

Delek Logistics, a US oil refining and logistics company, raised $700mn via a 8NC3 bond at a yield of 7.375%, 12.5bp inside revised guidance of 7.5% area. The senior unsecured bond is rated B2/BB-/B+. Proceeds will be used to repay a portion of the outstanding borrowings under its revolving credit facility.

Türkiye Sınai Kalkınma Bankası (TSKB) raised $350mn via a 5Y bond at a yield of 7.50%, 50bp inside initial guidance of 8.00%. The senior unsecured bond is rated B1 by Moody’s. Proceeds will be used for general corporate purposes.

CaixaBank raised $3bn via a three-tranche deal. It raised:

- $1bn via 4NC3 bond at a yield of 4.634%, 30bp inside initial guidance of T+120bp.

- $1bn via 6NC5 bond at a yield of 4.885%, 30bp inside initial guidance of T+135bp. If not called by 3 July 2030, the coupon resets to SOFR+136bp.

- $1bn via 11NC10 bond at a yield of 5.581%, ~27.5bp inside initial guidance of T+155-160bp. If not called by 3 July 2035, the coupon resets to SOFR+179bp.

The senior non-preferred notes are rated Baa2/BBB+/A-. Proceeds will be used for general corporate purposes.

Sembcorp raised SGD 300mn via a 20.5Y bond at a yield of 3.55%, 25bp inside initial guidance of 3.80% area. The senior unsecured bond is unrated. Proceeds will be used for general corporate purposes.

Turkey’s Garanti Bank raised $500mn yesterday via a 10.5NC5.5 Tier-2 bond at a yield of 8.25%, 50bp inside initial guidance of 8.75% area. The subordinated bond is rated B2/B+ (Moody’s/Fitch). If not called by 8 Jan 2031, the coupon will reset to 5Y UST plus 432.5bp. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Shinhan Bank hires for $ 5Y bond

- LATAM Airlines hires for $ 5NC2 bond

- Port of Newcastle hires for A$ 8Y/10Y bond

- Mizuho hires for $ 6NC5/11NC10 bond

Rating Changes

-

Moody’s Ratings affirms Sun Hung Kai Properties’ A1 ratings; changes outlook to stable

-

Bolivia Long-Term Ratings Lowered To ‘CCC-‘ From ‘CCC+’ On Heightened Debt Service; Outlook Negative

-

Fitch Downgrades ams-OSRAM’s IDR and Senior Unsecured Debt to ‘B’; Outlook Stable

Term of the Day: Total Loss Absorbing Capacity (TLAC)

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires that 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On SGS bond demand to stay high as safe havens – RHB

“SGS bonds have enjoyed a rally “largely supported by traders’ flight from US assets”… the SGS 10-year yield has dropped by 57 basis points to 2.28 per cent…SGS will continue to attract risk-averse capital inflows”

On Middle East War Resetting Dollar’s Inverse Link to Stocks – Goldman Sachs

“We think this partially reflects a recent shift in the source of global growth and risk shocks away from the US, and toward rest of world, like Middle East”

On Private Credit Froth and High-Yield Debt – George Gatch, JPMorgan

“There’s a lot of money and investors chasing finite opportunities in the private credit market. You also have liquidity tradeoffs…I would put my marginal dollar in public high-yield rather than private credit”

On Risk-On Appetite Boosting African Bonds After Middle East Truce

Anders Faergemann, PineBridge Investments

“There is a general relief in EM and investors are adding risk…Egypt was under mild pressure last week in part due to the country’s proximity to the regional tensions…is now well placed to take advantage from demand for EM high yield”

Top Gainers and Losers- 26-Jun-25*

Go back to Latest bond Market News

Related Posts: