This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Muthoot, MS, AT&T, IBM Price $ Bonds

January 30, 2026

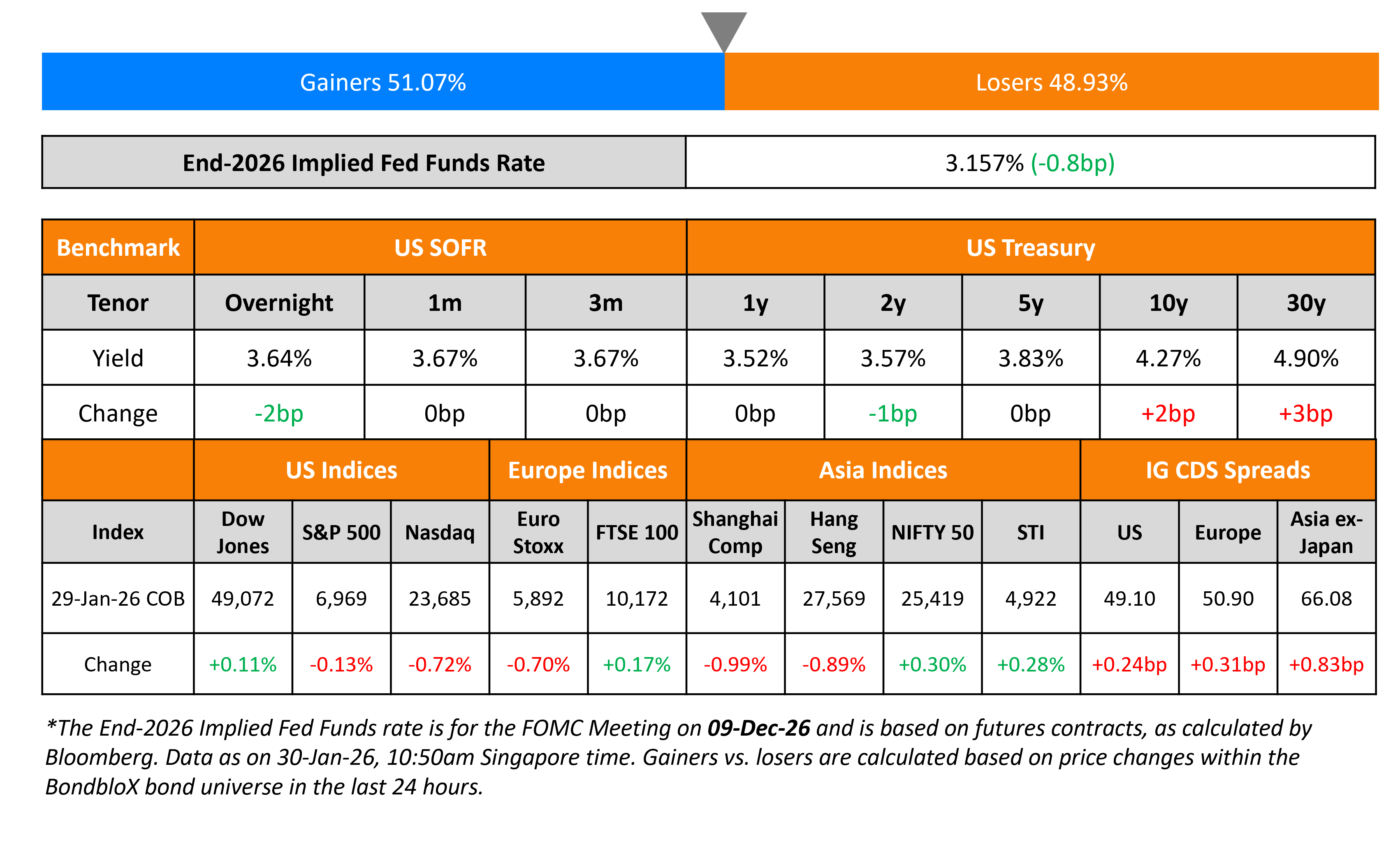

US Treasury yield curve steepened further with the 30Y widening by 3bp to 4.9%. Initial jobless claims for the prior week came in at 209k versus expectations of 205k and previous reading of 200k. US trade deficit for the month of November widened by 94.6%, to $56.8bn amid a surge in capital goods imports. Separately, US President Donald Trump said that he intends to announce his pick for the next Fed chair on Friday, with speculation intensifying that the nomination will go to former Fed Governor Kevin Warsh.

Looking at US equity markets, the S&P ended 0.1% lower while Nasdaq was 0.7% lower. US IG CDS spreads widened by 0.2bp while HY CDS spreads were 1.4bp wider. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.3bp wider and the Crossover CDS spreads were 2.5bp wider. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads widened by 0.8bp.

New Bond Issues

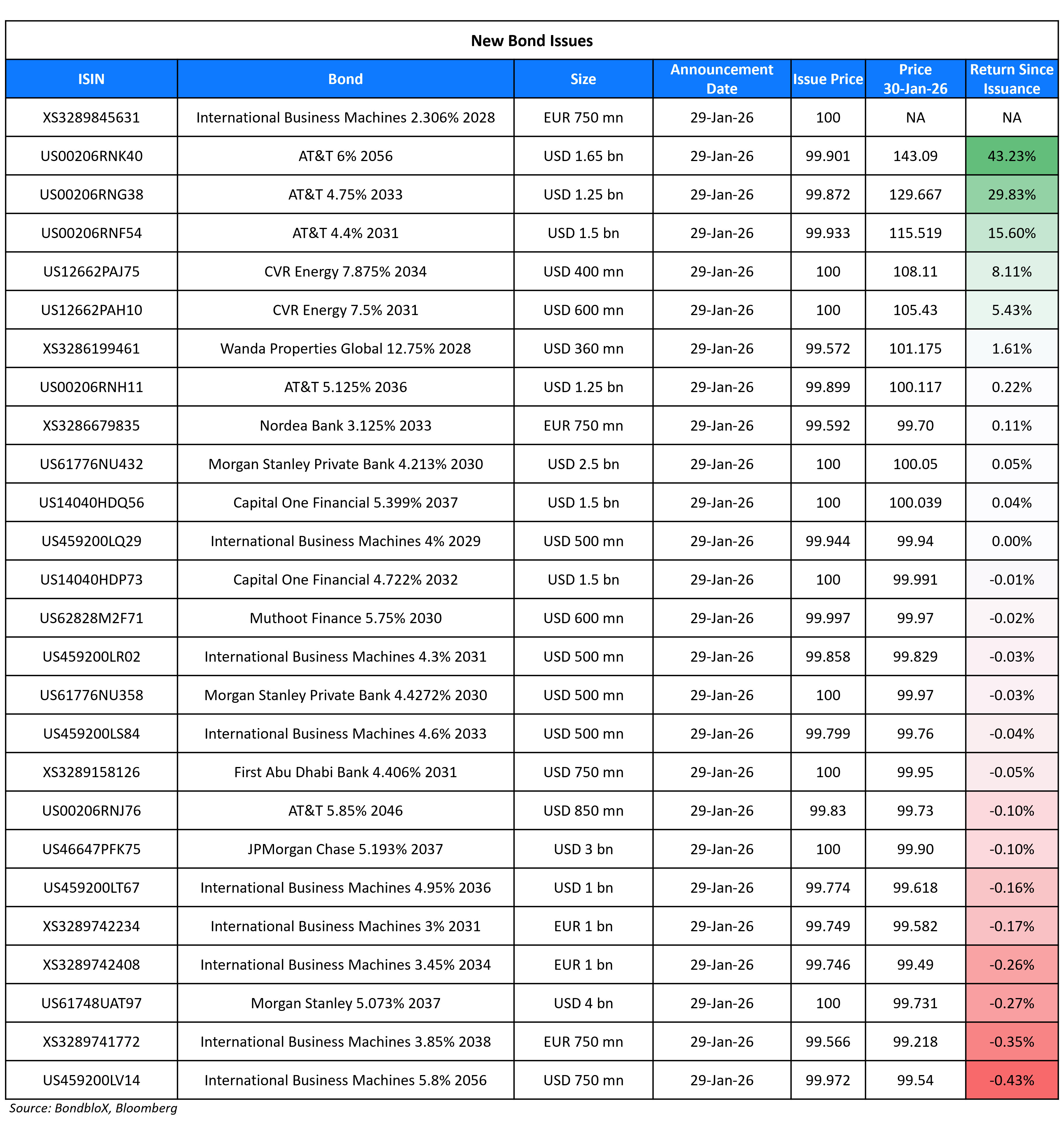

Muthoot Finance raised $600mn via a 4.5Y bond at a yield of 5.75%, 37.5bp inside initial guidance of 6.125% area. The senior secured bond is rated Ba1/BB+ (Moody’s/S&P). Proceeds will be used for permitted purposes including onward lending, in line with RBI approvals, ECB guidelines and applicable regulations. The bond was priced at a new issue premium of 10bp over its 6.375% 2030s that currently yield 5.65%.

JPMorgan raised $3bn via an 11NC10 subordinated bond at a yield of 5.193%, 25bp inside initial guidance of T+120–125bp area. Proceeds will be used for general corporate purposes.

Morgan Stanley raised $7bn via a three-trancher. It raised:

- $2.5bn via a 4NC3 bond at a yield of 4.213%, 20bp inside initial guidance of T+80bp area. The senior bank note is rated Aa3/A+/AA-

- $500mn via a 4NC3 FRN at SOFR+77bp vs. initial guidance of SOFR equivalent area. The senior bank note is rated Aa3/A+/AA-

- $4bn via a 11NC10 bond at a yield of 5.073%, 20bp inside initial guidance of T+105bp area. The senior unsecured bond is rated A1/A-/A+

Proceeds will be used for general corporate purposes.

First Abu Dhabi Bank raised $750mn via a 5Y FRN at SOFR+75bp, in line with final guidance of SOFR+75bp. The senior unsecured bond is rated Aa3 (Moody’s). Proceeds will be used for general corporate purposes.

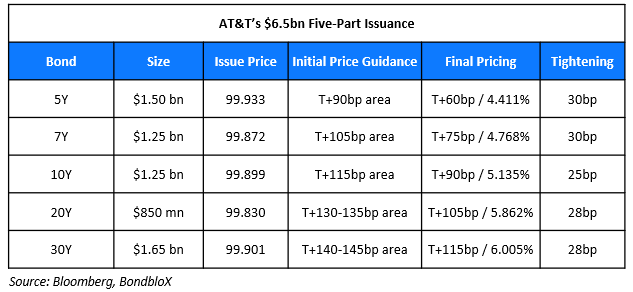

AT&T raised $6.5bn via a five-tranche issuance. It raised:

The senior unsecured bonds are rated Baa2/BBB/BBB+. Proceeds will be used for general corporate purposes, which may include debt repayments and pending acquisitions.

Capital One raised $3bn via a two-trancher. It raised $1.5bn via a 6NC5 bond at a yield of 4.722%, 25bp inside initial guidance of T+115-120bp area. It also raised $1.5bn via a 11NC10 bond at a yield of 5.399%, 25bp inside initial guidance of T+140-145bp area. The senior unsecured bonds are rated Baa1/BBB/A-. Proceeds will be used for general corporate purposes.

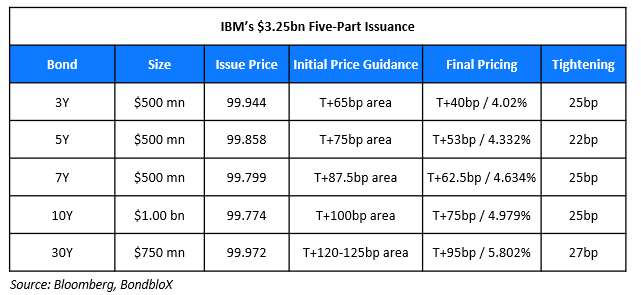

IBM raised $3.25bn via a five-part deal. It raised:

The senior unsecured bonds are rated A3/A-/A-. Proceeds will be used for general corporate purposes.

Wanda Properties raised $360mn via a 2Y bond at a yield of 13%, in line with the initial guidance of 13%. The senior guaranteed bond is unrated. Wanda Properties Global Co. Ltd is the issuer and Dalian Wanda Commercial Management Group is the Keepwell provider. Proceeds will be used to refinance existing indebtedness.

Nordea Bank raised €750mn via a 7Y bond at a yield of 3.191%, 28bp inside initial guidance of MS+80bp area. The senior preferred bond is rated Aa2/AA-/AA. Proceeds will be used for general banking and other corporate purposes of the Nordea Group.

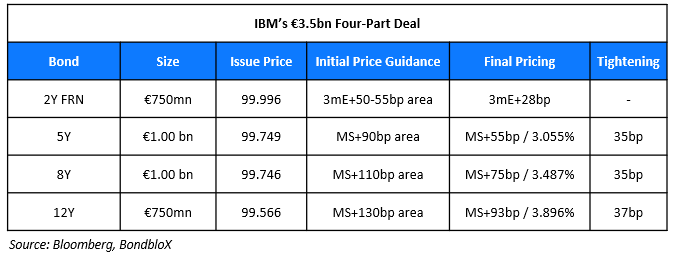

IBM also raised €3.5bn via a four-trancher. It raised:

The senior unsecured bonds are rated A3/A-/A-. Proceeds will be used for general corporate purposes.

CVR Energy raised $1bn via a two-part offering. It raised $600mn via a 5NC2 bond at a yield of 7.5%, 12.5bp inside initial guidance of 7.625% area. It also raised $400mn via a 8NC3 bond at a yield of 7.875%, in line with initial guidance of 7.875% area. The senior unsecured bonds are rated B3/B+/BB-. Proceeds, together with cash on hand or borrowings under the Petroleum ABL, will be used to repay the senior secured term loan facility and to redeem all outstanding 8.5% 2029s, as well as $217m of outstanding 5.750% 2028s.

Rating Changes

Term of the Day: Keepwell Provision

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Talking Heads

On African Governments Looking to Islamic Finance

Nicole Kearse, African Legal Support Facility

“We’ve seen a lot of countries coming to us asking for strategies…trying to understand better how these work and who the players are in the market. Sukuk have become a big area of interest.”

Gatien Bon, Rothschild

“This creates more diversification in terms of format and therefore in terms of the investor base in Africa.”

On Private Credit Buyers Being Blind to Risks

Christian Stracke, PIMCO

“There’s a lot of additional credit risk that people are often taking in some of these private situations that you kind of turn a blind eye to. It is not a good sign that you have all of these problems emerging in terms of loan performance at a time when the economy is about as good as it gets. There is a fairly large overhang of problem loans that were made in years earlier this decade that will take years to burn through.”

On Dollar Slide Being A Sign of Global Hedging

John Sidawi, Federated Hermes

“What foreign investors appear to be doing is hedging their American holdings rather than selling them outright. This has been one of our cornerstone considerations for our ongoing bearish outlook on the dollar. Should the weak dollar trend enter its second year, it could potentially indicate an erosion of the dollar’s long-held dominance.”

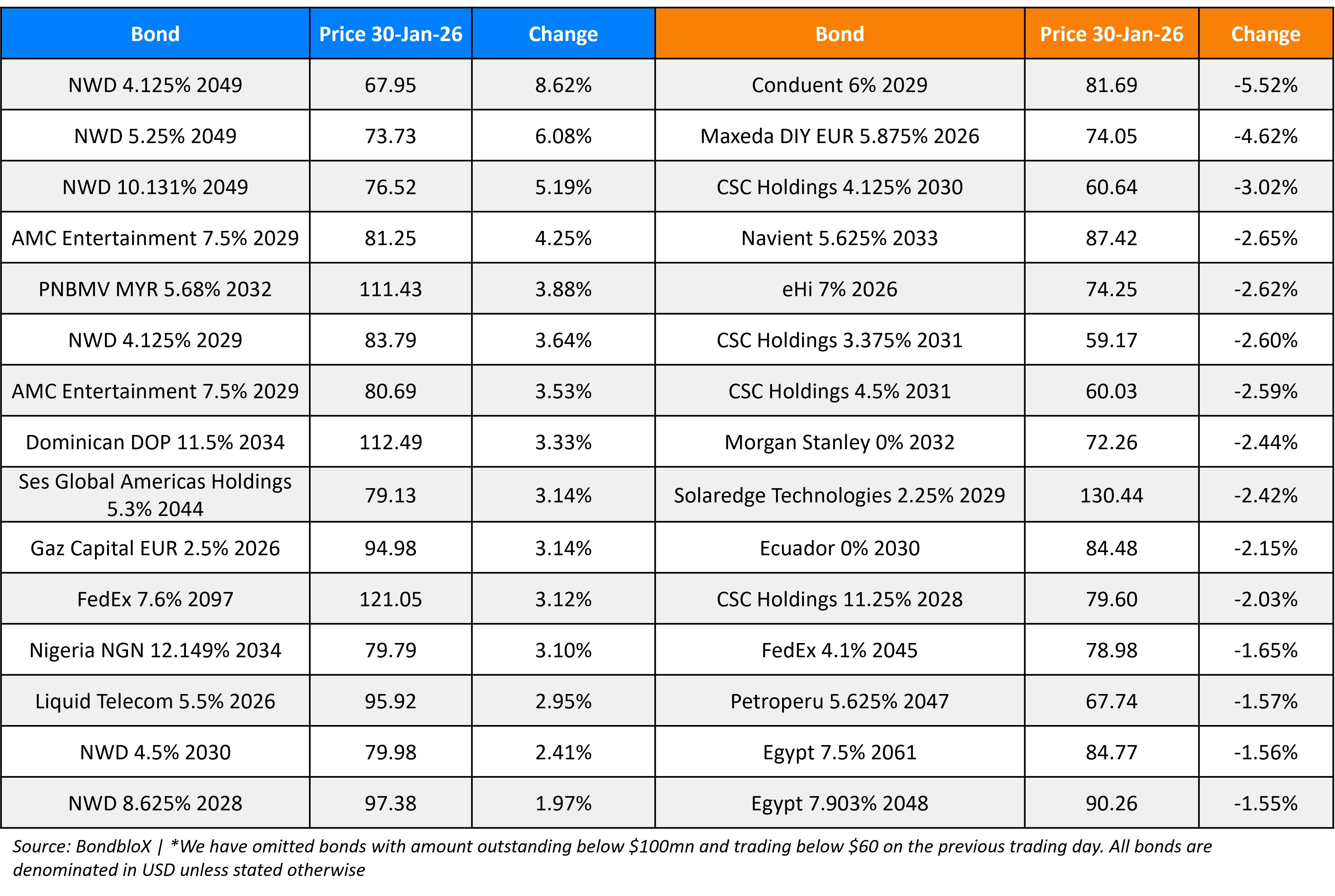

Top Gainers and Losers- 30-Jan-26*

Go back to Latest bond Market News

Related Posts: