This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

MTR, Hanwha Life, Enbridge, Lumen Price $ Bonds; Simpar, Movida, JSL Downgraded

June 17, 2025

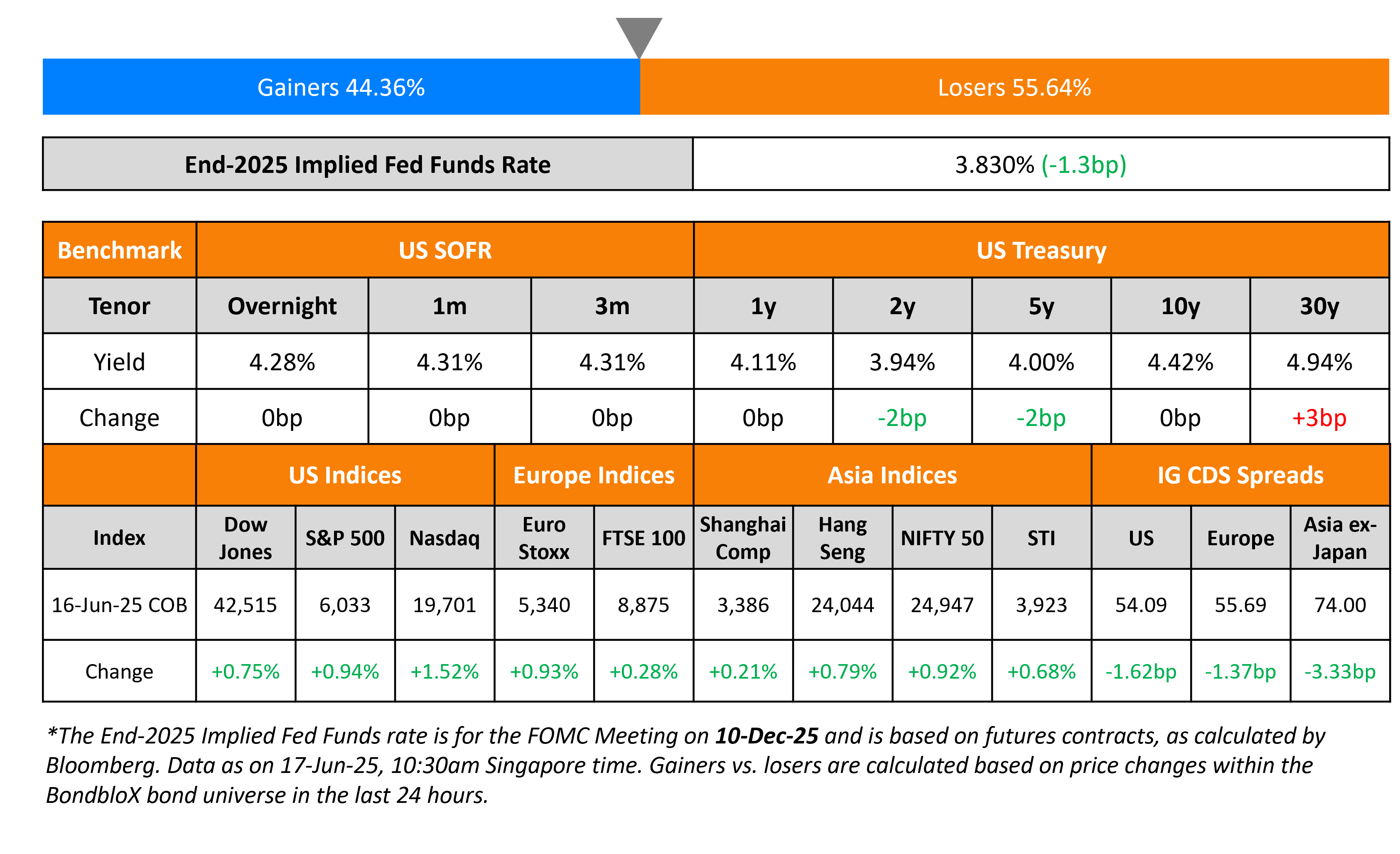

US Treasury yields held steady across the curve. In geopolitical news, US President Donald Trump exited the G7 meeting early and called for the evacuation of Tehran. Meanwhile, Iran has asked several Gulf states to mediate a ceasefire with Israel.

After ending the previous week on a risk-off sentiment, the S&P and Nasdaq were both higher by 0.9% and 1.5% respectively on Monday. In credit markets, US IG CDS spreads were tighter by 1.6bp and HY CDS spreads tightened 8.9bp. European equity markets ended higher too. The iTraxx Main CDS spreads tighter by 1.4bp and Crossover CDS spreads tightened by 7.1bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 3.3bp.

New Bond Issues

- Hyundai Capital $ 2Y/3Y/5Y/7Y at T+125/135/145/160bp area

- Hyundai Capital € 2Y FRN/3Y FRN/5Y FRN at SOFR Equiv

MTR raised $3bn via a two-tranche perpetual note issuance:

- It raised $1.5bn via a PerpNC5.5 bond at a yield of 4.875%, 50bp inside initial guidance of 5.375% area. If not called before 24 December 2030, the bond’s coupon resets to the US 5Y Treasury yield plus 111bp. There is a coupon step-up of 25bp if not called by 24 December 2035. If not called before 24 December 2050, the coupon will step-up by an additional 75bp.

- It also raised $1.5bn via a PerpNC10.5 bond at a yield of 5.625%, 50bp inside initial guidance of 6.125% area. If not called before 24 December 2035, the bond’s coupon resets to the US 5Y Treasury yield plus 145.7bp. If not called before 24 December 2055, the coupon step-up by 75bp.

The subordinated notes are rated A2/A, as compared to the issuer’s ratings of Aa3/AA+.

Hanwha Life raised $1bn via a 30NC5 Tier 2 bond at a yield of 6.30%, 45bp inside initial guidance of 6.75% area. The subordinated note is rated A3/A-. If not called by 24 June 2030, the coupon resets to US 5Y Treasury yield plus 229.2bp. If not called by 24 June 2035, the coupon will step-up by 100bp. Proceeds will be used for general corporate purposes.

Enbridge raised $2.25bn debt via a four-tranche deal:

The senior unsecured notes are rated Baa2/BBB+/BBB+. Proceeds will be used to reduce existing debt, finance future growth opportunities and for general corporate purposes.

Level 3 Financing, a wholly-owned subsidiary of Lumen, raised $2bn via a 8NC3 bond at a yield of 6.875%, roughly in-line with initial guidance of 6.75-7.00% area. The senior secured bond is rated B1/B+/B+. Proceeds, along with cash on hand, will be used to redeem all of its $924.52mn first lien 10.5% 2030s.

Rating Changes

-

PTT Global Chemical Ratings Lowered To ‘BBB-‘ On Weaker Group Dynamics; Outlook Stable

-

Thai Oil Ratings Lowered To ‘BBB-‘ On Weaker Group Dynamics; Outlook Negative

Term of the Day: Expression of Interest (EOI)

An Expression of Interest (EOI) is one of the initial documents in a merger/acquisition process that a potential buyer shares with the seller. As the name suggests, it is a serious indication of interest by the buyer and covers aspects like the purchase price, valuation basis, due diligence, structure of the transaction including expenses, transition support, management retention plans and other aspects.

Talking Heads

On ECB Mustn’t Commit Either to a Pause or a Rate Cut – Joachim Nagel, President, Bundesbank

“Since crucial factors can change quickly in the current environment, we are well advised to remain flexible…pre-determining the future – neither a further interest-rate cut nor a pause in monetary policy – is not sensible…With the current key interest rates, monetary policy certainly no longer appears restrictive.”

On BOJ Considering Slower Bond Taper As Fresh Global Risks Emerge – Kazuo Ueda, BOJ Governor

“Although developments in trade policies since early spring have had a larger impact on Japan’s economy than we had expected, progress towards achieving our price target continues to gain momentum”

On Foreign Demand for Treasuries Showing ‘Cracks’ – BofA

The decline is “unusual” because central banks typically buy Treasuries when the dollar is weak, as it has been this year…”This flow likely reflects official sector diversification away from USD holdings…remain worried about the outlook for foreign demand”

Top Gainers and Losers- 17-Jun-25*

Go back to Latest bond Market News

Related Posts: