This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

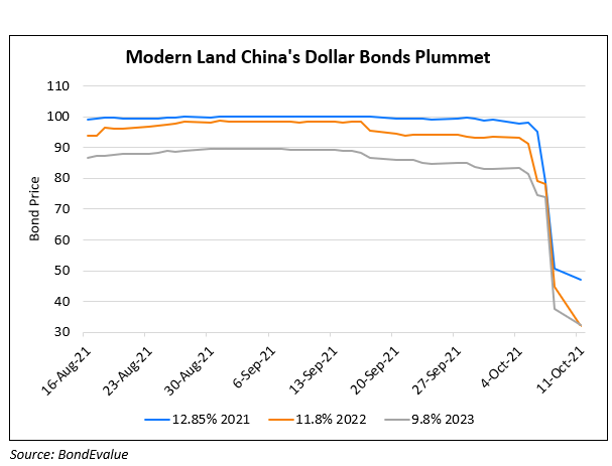

Modern Land (China) Calls off Consent Solicitation

October 21, 2021

Modern Land (China) called off its consent solicitation to extend the maturity on its 12.85% bonds due October 25 in an exchange filing. The developer stated that it “continues to experience liquidity issues” and determined that calling off the consent solicitation would be in the best interest of the company, stakeholders and bondholders. IFR notes that the decision by Modern Land may now see them look at debt restructuring. Modern Land said it was in talks with potential financial advisers to assess its capital structure and come up with a solution to its liquidity issues. Under the initial consent solicitation, it sought to extend the maturity on its 12.85% 2021s by three months and repay $87.5mn in principal.

Modern Land’s 12.85% 2021s were down 7.7 points to 58.76 cents on the dollar.

Go back to Latest bond Market News

Related Posts: