This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

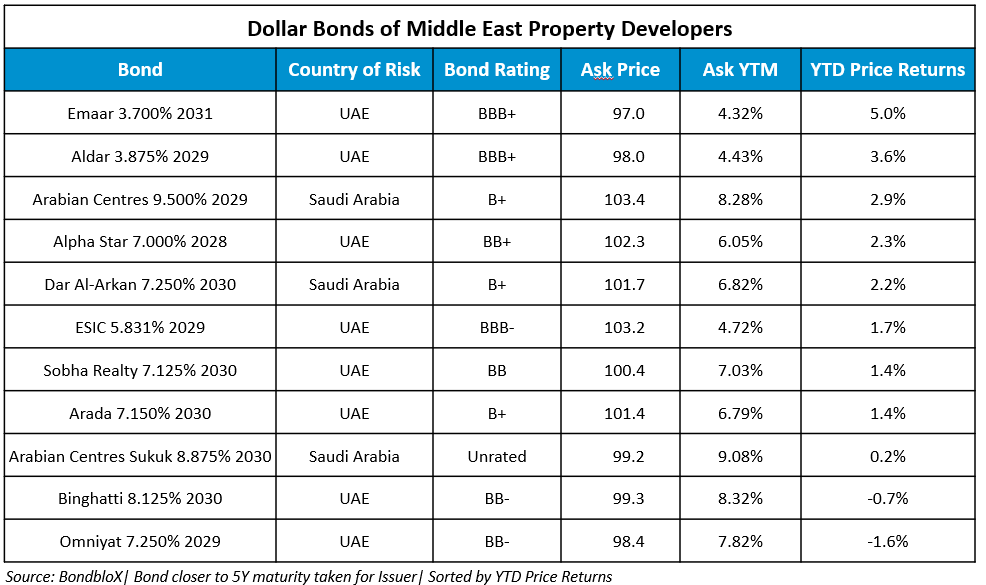

Middle East Property Market Continues to Strengthen; Most Dollar Bonds of Developers in the Green

December 12, 2025

The Middle East real estate developer landscape continues to strengthen, supported by exceptional momentum in Saudi Arabia and the UAE. In Saudi Arabia, Vision 2030 is driving broad-based expansion across hospitality, industrial, office, retail, and residential sectors. Q3 2025 performance was particularly strong: hotel occupancy reached 60.5% despite low season, industrial rents posted double-digit growth, and Riyadh’s prime office vacancy fell to just 0.5%, pushing rents up over 11% in KAFD. Residential demand remained robust, with Riyadh recording over 6,000 sales and apartment rents rising nearly 20% YoY. In the UAE, Sharjah posted its highest-ever monthly real estate transaction value of AED 9.5bn ($2.6bn) in November 2025, reflecting strong investor confidence supported by stable legislation, digital transformation, and diversified demand across 124 areas. This year, Middle East developers have been quite active in the bond markets as well. Below is a list of dollar bonds from popular Middle East developers and their YTD returns (ex-coupon).

Go back to Latest bond Market News

Related Posts: