This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Michigan Consumer Sentiment Drops; Fed Speakers Give Views on Policy

May 13, 2024

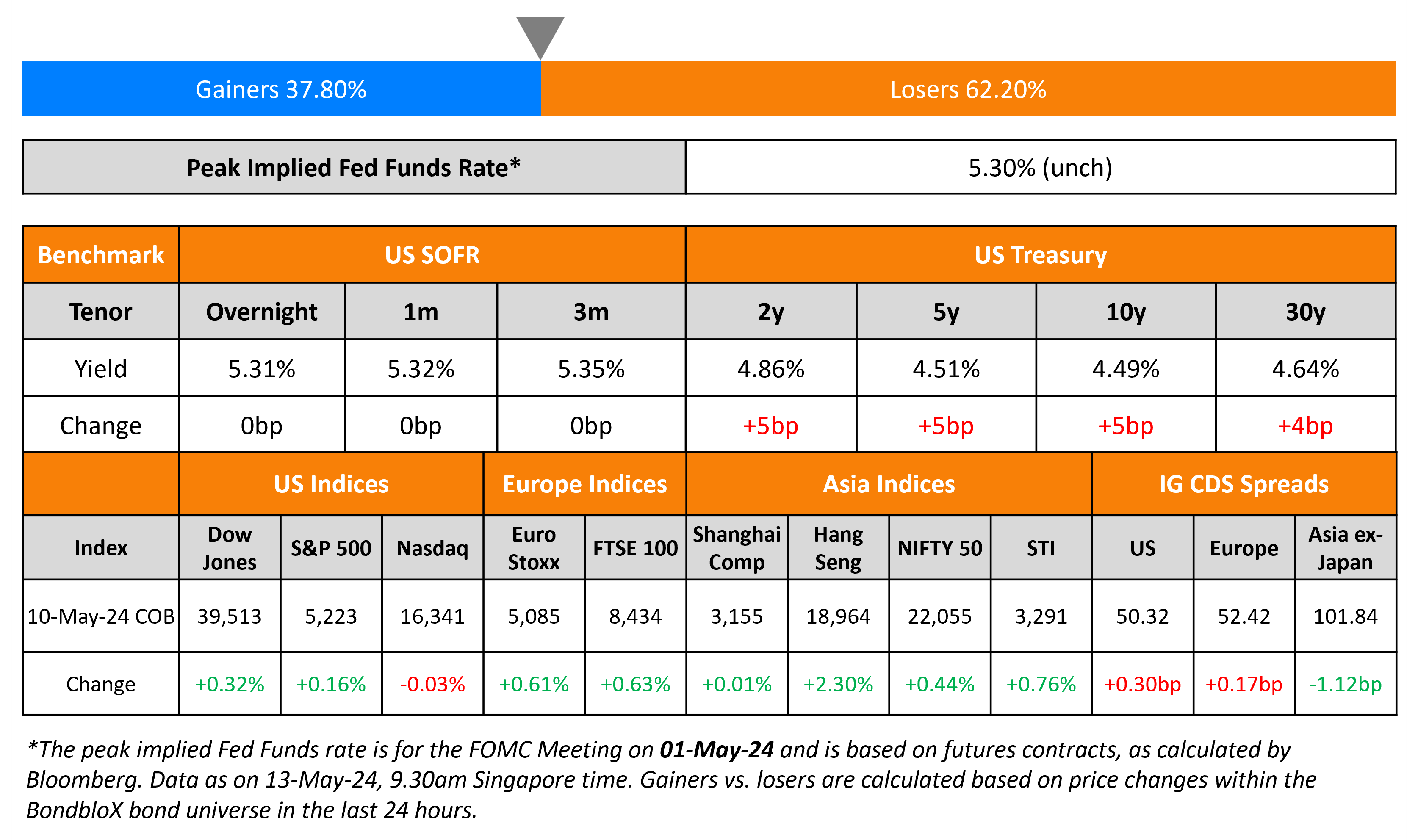

US Treasury yields were 4-5bp higher across the curve on Friday. On the data front, the Michigan Consumer Sentiment Index came at 67.4, lower than expectations of 76.2. Several Fed speakers came out with their take on policy. Atlanta Fed President Raphael Bostic said that he still believes they can cut interest rates this year, with the timing and quantum being uncertain. On the other hand, Fed Governor Michelle Bowman said that she has “not written in any cuts” for 2024, adding that she expects rates to stay at current levels for longer. Dallas Fed President Lorie Logan echoed a similar view, noting that it is “too early to think about cutting rates”, whilst keeping policy flexibility intact. She added that the neutral rates may have risen from earlier levels. Minneapolis Fed President Neel Kashkari reiterated his earlier stance saying that they will not be forced to adjust rates if inflation remains stubborn and the labor market continues to stay strong. S&P was up 0.2% while Nasdaq was almost unchanged. US IG CDS spreads widened 0.3bp and HY spreads were 1.9bp wider.

European equity markets were higher. Europe’s iTraxx main CDS spreads were 0.2bp wider and crossover spreads were flat. Asian equity indices have opened flat this morning. Asia ex-Japan CDS spreads were 1.1bp tighter.

New Bond Issues

- OCBC $ 10NC5 Tier 2 at T+145bp area

Al Rajhi raised $1bn via a PerpNC5.5 AT1 sustainable bond at a yield of 6.375%, 50bp inside initial guidance of 6.875% area. The subordinated bonds are rated Baa3, and received orders of over $3.5bn, 3.5x issue size. The profit rate is fixed until the first reset date of 1 November 2029, and if not called, it resets to the 5Y UST plus 195.3bp. The notes also have a dividend stopper.

New Bond Pipeline

- SMIC SG Holdings hires for $ bond

- Turk Telekom hires for $ bond

Rating Changes

- Turkcell Iletisim Hizmetleri A.S. Upgraded To ‘BB-‘ Following Similar Action On Sovereign; Outlook Positive

- Fitch Upgrades Precision Drilling Corp.’s IDR and Unsecured Ratings to ‘BB-‘; Outlook Stable

- Fitch Downgrades Canacol Energy Ltd’s IDRs to ‘CCC’

- Staples Inc. Outlook Revised To Stable On Proposed Refinancing And Earnings Expectation; ‘B-‘ Rating Affirmed

Term of the Day

Keepwell Provision

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Talking Heads

On financiers worrying about leverage on leverage’ in private credit

David Hunt, CEO of PGIM

“Now that we’ve had a real hiatus in their ability to exit a lot of these (portfolio companies), they’ve had cash flow difficulties… in order to deal with that, they have now been adding leverage to the fund level… leverage over leverage”

Christopher Ailman, outgoing CIO of California State Teachers’ Retirement System

“The GPs (general partners) are doing this to themselves… They’re used to that 2% management fee and that market is just frozen”

On US 2Y Yield Rising to Week’s High on Inflation Anxiety

Stefan D’Annibale, Odeon Capital

“Front-end Treasuries are not reacting well to the higher inflation expectation readings and Fed comments that reinforced the patience narrative”

Roger Hallam, global head of rates at Vanguard Asset

“The Fed has said the bar to a rate hike is high — while the bar to easing, especially if employment softens, is not that high… is a case for pricing in some cuts”

On Investors Digging In on Favored EM-Bet Roiled by Fed

Victoria Courmes at Grantham Mayo Van Otterloo & Co.

“Rates are still very high and that gap versus the US real yields has widened some more… looks like actually EM rates are more attractive”

Carlos de Sousa, investor at Vontobel Asset

“We’re probably closer to an inflection point (weakeing in the dollar). The probability of that scenario finally materializing is a little bit higher than it was a couple months ago”.

Top Gainers & Losers- 13-May-24*

Go back to Latest bond Market News

Related Posts: