This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Mexico, FWD, Petron, Hyundai Capital Price Bonds

September 16, 2025

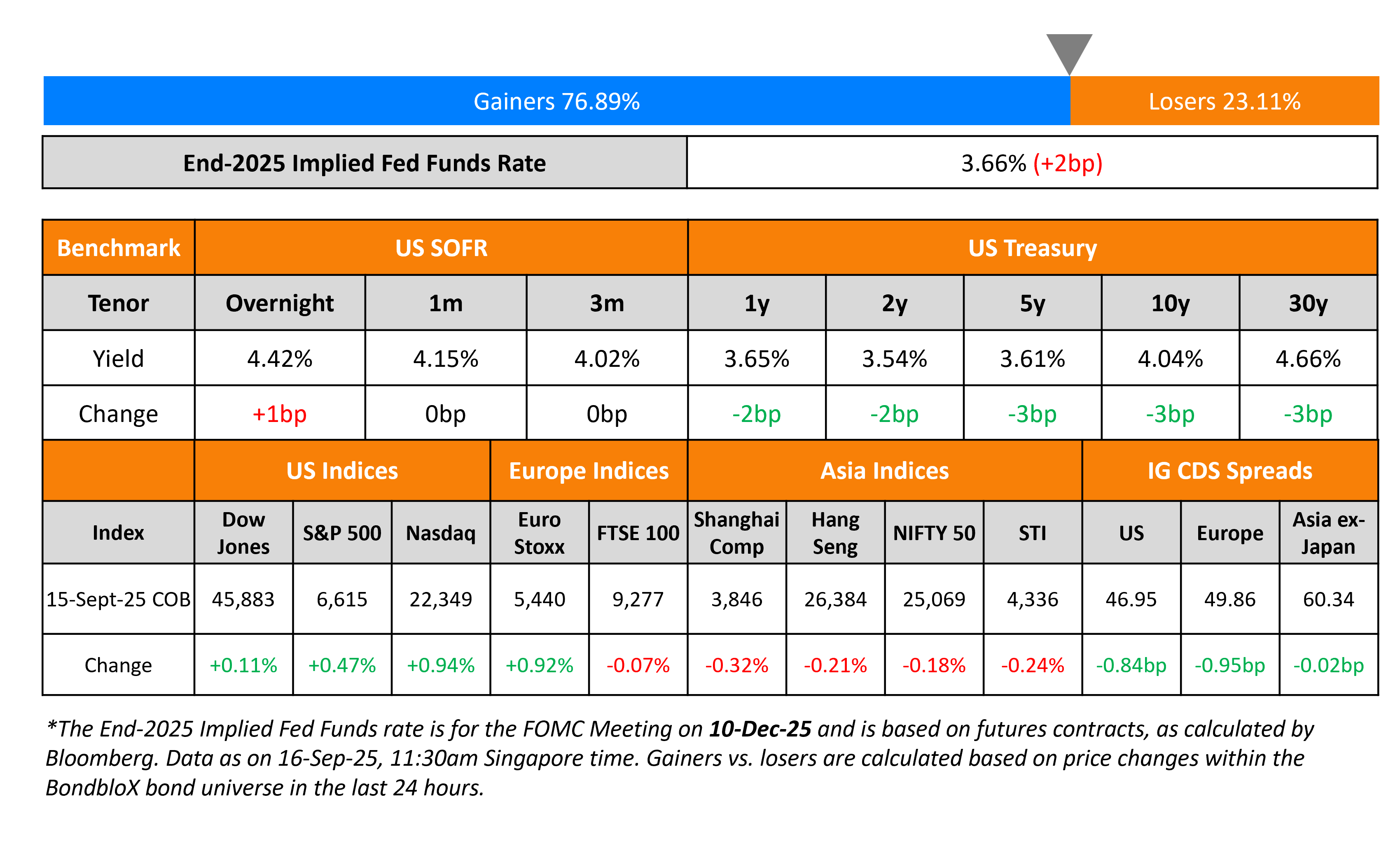

US Treasury yields moved lower by 2-3bp on Monday. A US appeals court has blocked President Donald Trump’s attempt to remove Fed Governor Lisa Cook. She will likely participate in the September FOMC meeting beginning later today. The market has already priced-in a 25bp rate cut. Focus will also be on Chairman Jerome Powell’s guidance, the Dot Plots and the Summary of Economic Projections (SEP).

Looking at US equity markets, the S&P and Nasdaq inched higher by 0.5% and 0.9% respectively. US IG and HY CDS spreads were tighter by 0.8bp and 5.3bp respectively. European equity markets ended mixed, with Euro Stoxx ending higher by 0.9% and FTSE closing almost flat. The iTraxx Main and Crossover CDS spreads were tighter by 1bp and 3.7bp respectively. Asian equity markets have broadly opened higher today. Asia ex-Japan CDS spreads remained unchanged.

New Bond Issues

-

Transurban $ 10.5Y at T+120bp area

Mexico raised €5bn via a three-trancher. It raised:

- €2.25bn via a 4Y bond at a yield of 3.539%, 30bp inside initial guidance of MS+155bp area.

- €1.5bn via a long 8Y bond at a yield of 4.523%, 30bp inside initial guidance of MS+225bp area. The bond is priced at a new issue premium of 20bp over its 1.45% 2033s currently yielding 4.32%.

- €1.25bn via a long 12Y bond at a yield of 5.164%, 30bp inside initial guidance of MS+270bp area. The bond is priced at a new issue premium of 18bp over its 5.125% 2037s currently yielding 4.98%.

The notes are rated Baa2/BBB/BBB-. Proceeds will be used for the general purposes of the government, as well as to make a capital contribution to Pemex. Pemex will in turn use the amount to partially repay, redeem and repurchase certain of its outstanding securities under its tender offer.

FWD Group raised $1.15bn via a two-part offering. It raised $575mn via a 5Y bond at a yield of 5.252%, 45bp inside initial guidance of T+210bp area. It raised $575mn via a 10Y bond at a yield of 5.836%, 50bp inside initial guidance of T+230bp area. The subordinated notes are rated Baa2/BBB+ (Moody’s/Fitch) as compared to the issuer’s ratings of Baa1/BBB+. Proceeds will be used for general corporate purposes and/or its subsidiaries, including but not limited to refinancing its $900mn 8.4% 2029s and its $750m 8.045% Perp.

Santander UK raised $2.75bn via a three-trancher. It raised:

- $400mn via a 4NC3 FRN at SOFR+107bp vs. initial guidance of SOFR equivalent area.

- $1.35bn via a 4NC3 bond at a yield of 4.32%, 28bp inside initial guidance of T+110bp area.

- $1bn via a 11NC10 bond at a yield of 5.136%, 30bp inside initial guidance of T+140bp area.

The senior unsecured notes are rated Baa1/BBB/A.

ABN Amro raised €750mn via a 7Y bond at a yield of 3.08%. The senior preferred note is rated Aa3/A/A+, and received orders of ~€1.8bn, 2.3x issue size.

UniCredit raised €1.25bn via a 6NC5 bond at a yield of 3.247%, 30bp inside initial guidance of MS+120bp area. The senior non-preferred note is rated Baa3/BBB/BBB.

Hyundai Capital raised $2bn via a four-trancher.

-2.png)

The notes are rated A3/A-/A-. Proceeds will be used for general corporate purposes.

Guocoland raised S$200mn via a 4Y bond at a yield of 2.3%, 20bp inside initial guidance of 2.5% area. The note is unrated, and issued by GLL IHT Pte Ltd. Proceeds will be used to finance general working capital purposes and corporate requirements of the group.

CaixaBank raised €500mn via a PerpNC10 AT1 bond at a yield 5.875%, 62.5bp inside initial guidance of 6.50% area. The junior subordinated note is rated Ba2/BB+. If not called by 25 September 2035, the coupon will reset to the 5Y Mid-Swap plus 334.8bp. A trigger event will occur if at any time, the CET1 ratio on a consolidated or individual basis falls below 5.125%.

Petron Corp raised $475mn via a PerpNC3 bond at a yield of 7.35%, 25bp inside initial guidance of 7.60% area. The senior unsecured note is unrated. The note has both, a dividend pusher and a dividend stopper. If not called by 22 September 2028, the coupon will reset to the 3Y US Treasury yield plus 382.5bp. There is a coupon step-up of 250bp. Proceeds will be used primarily for costs and expenses related to its concurrent tender offer.

KEXIM raised $1.5bn via a two-trancher. It raised $500mn via a 3Y FRN at SOFR+46bp, 24bp inside initial guidance of SOFR+70bp area. It also raised $1bn via a 5Y bond at a yield of 3.864%, 24bp inside initial guidance of T+50bp area. The senior unsecured note is rated Aa2/AA/AA-. Proceeds will be used for general operations, including extending foreign currency loans, repayment of maturing debt and other obligations.

Bank AlJazira raised $500mn via a PerpNC5.5 AT1 sukuk at a yield of 6.50%, 37.5bp inside initial guidance of 6.875% area. The junior subordinated note is unrated, and received orders of over $1.9bn, 3.8x issue size. If not called by 22 March 2031, the coupon will reset to the 5Y US Treasury yield plus 284.7bp. Proceeds will be used for general corporate purposes.

Permanent TSB raised €300mn via a 10.25NC5.25 Tier-2 green bond at a yield of 3.915%, 35bp inside initial guidance of MS+155bp area. The subordinated note received orders of over €3.45bn, 11.5x issue size. Net proceeds will be used for financing or refinancing eligible assets under its green bond framework.

New Bond Pipeline

-

Almarai $ 5Y Sukuk

-

Emirates Islamic Bank $ Long 5Y SLB sukuk

Rating Changes

Term of the Day: Catastrophe Bonds

Catastrophe bonds also referred as Cat bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies for the issuer against natural disasters, where they pay regular coupons (premium) in exchange for protection. In the event of a natural disaster trigger, issuers will receive a payout from the proceeds of the bond and the principal repayment and interest payments are either deferred or cancelled. If a trigger event doesn’t occur, the issuer continues to pay the coupons as scheduled, similar to a regular bonds and proceeds are returned to the investors at maturity. Cat bonds are generally purchased by governments, insurance and reinsurance companies. These bonds have gained traction as the frequency of natural disasters is on the rise.

Talking Heads

On Mounting Disconnect Between Debt and Stock Markets – BIS

“This is a time to be watchful of potential amplification channels that could propagate stress… government bond issuance was increasingly being absorbed by highly-leveraged investors such as hedge funds…The outsize holdings of U.S. assets by global investors…indicate that any significant portfolio shift away from U.S. assets is likely to be gradual”

On Investors Cutting Dollar Exposure at Record Pace – George Saravelos, Deutsche Bank

“The FX implications are clear: foreigners may have returned to buying US assets, but they don’t want the dollar exposure that goes with it…For every hedged dollar asset that is bought, an equivalent amount of currency is sold to remove the FX risk.”

On Treasuries Racing Past World Peers on Cusp of New Fed Easing Cycle

Prashant Newnaha, TD Securities

“The Fed isn’t cutting into a strong economy, it’s cutting into weakness, and this should form the basis for Treasuries to outperform,”

Andrew Ticehurst, Nomura Holdings

“We have seen fiscal and supply concerns hitting long ends in countries ranging from Japan to the UK and France…Conversely, soft US payrolls data and dovish signaling from the Fed seem to be dominating at present and boosting Treasuries,”

Benoit Anne, MFS Investment Management

“There is indeed virtually no further doubt that the Fed will deliver a rate cut this month…The weak US nonfarm payroll print has helped support the case for being long US duration, at least from a near-term perspective.”

Top Gainers and Losers- 16-Sep-25*

Go back to Latest bond Market News

Related Posts: