This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Meituan, PeakRe Launch $ Bonds; Turkiye, Barclays and others Price Bonds

October 28, 2025

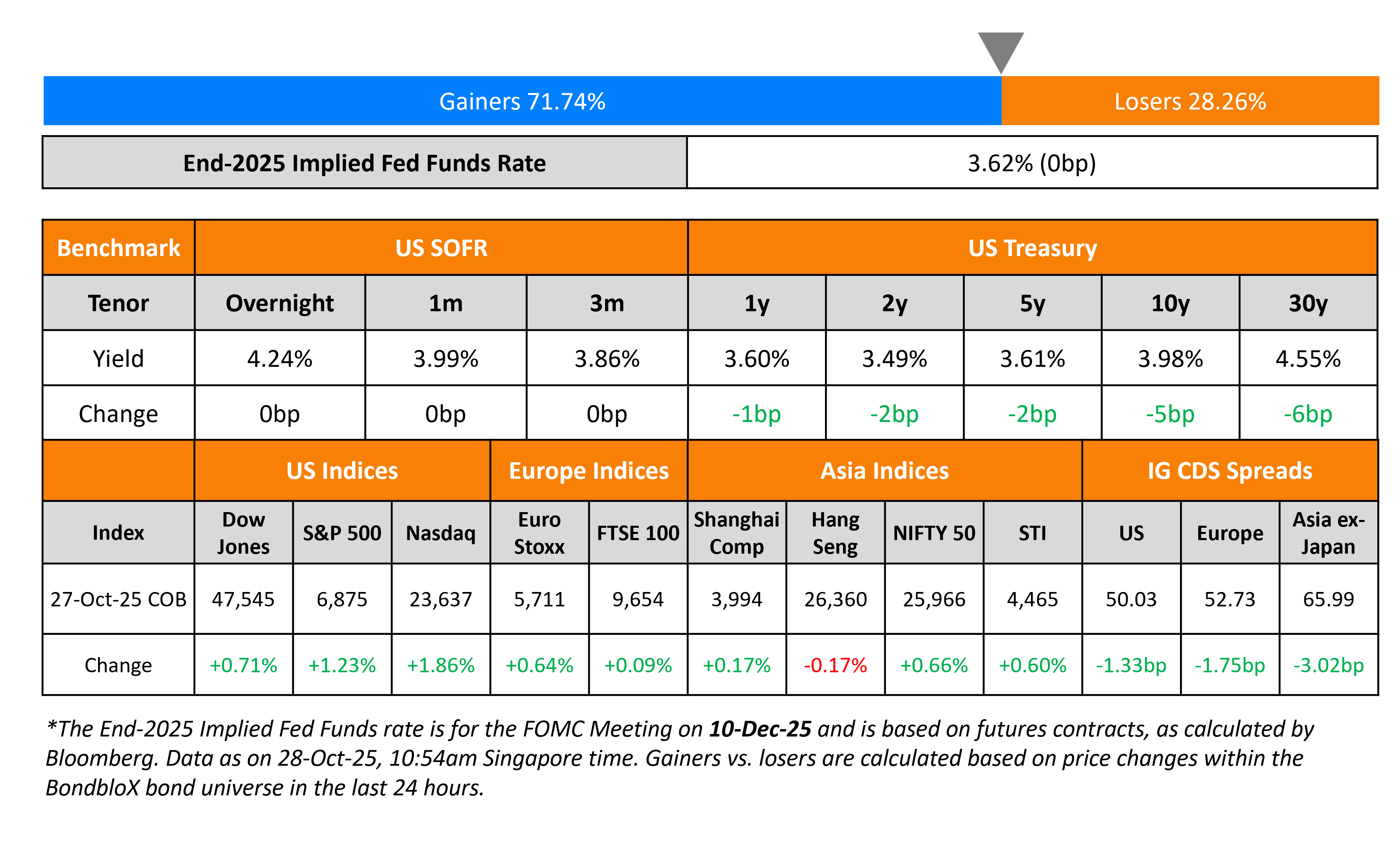

The US Treasury curve flattened, with short-end yields lower by 2bp while long-end yields fell by 5-6bp. The 10Y yield fell below the 4%-mark again. US President Donald Trump said that the US and China are set to “come away with” a trade deal, ahead of his meeting with Chinese President Xi Jinping later this week.

Looking at equity markets, the S&P and Nasdaq closed 1.2% and 1.9% higher at record highs. The US IG and HY CDS spreads tightened by 1.3bp and 6.8bp respectively. European equity indices ended higher too. The iTraxx Main and Crossover CDS spreads were 1.8bp and 8.7bp tighter respectively. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads tightened by 3bp.

New Bond Issues

-

Peak Reinsurance $ PerpNC5.25 at 6.1% area

-

Meituan $ 5.5Y/7Y/10Y at T+130/140/150bp areas

-

Wee Hur Holdings S$ 5Y at 5.1% area

- Republic of Finland $ 5Y at SOFR MS+40bp area

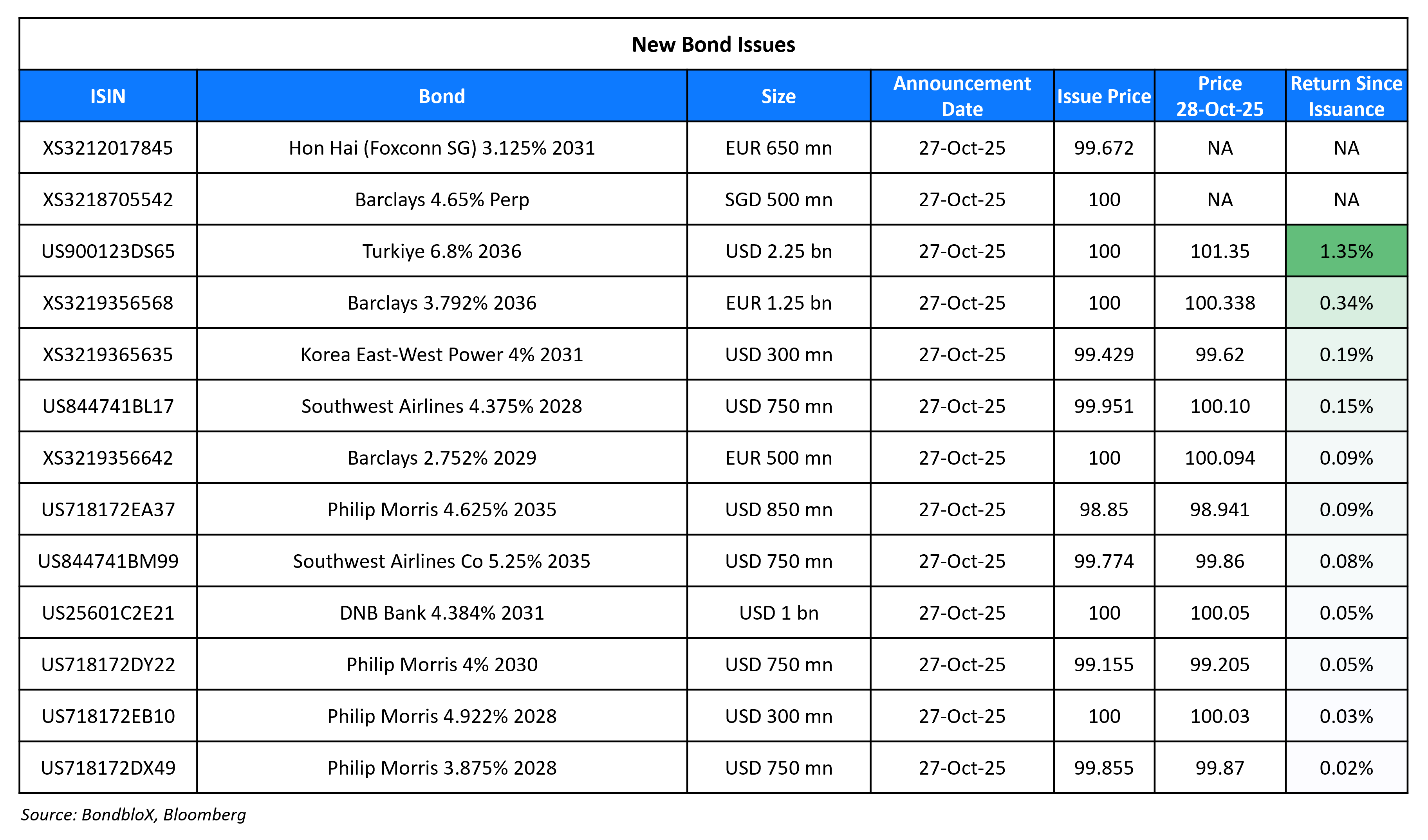

Turkiye raised $2.25bn via a 11Y bond at a yield of 6.80%, 35bp inside initial guidance of 7.15% area. The senior unsecured note is unrated. Proceeds will be used for general budgetary purposes. The new bond is priced at a new issue premium of 20bp over its existing 6.875% 2036s that currently yield 6.60%.

Barclays raised S$500mn via a PerpNC6 AT1 bond at a yield of 4.65%, 35bp inside initial guidance of 5.00%. If not called by 15 March 2032, the coupon will reset to the SORA OIS 5Y rate plus 308.3bp. The subordinated note is rated Ba1/BBB- (Moody’s/Fitch). A trigger event would occur if at any time the fully loaded CET1 Ratio is less than 7%. Barclays separately raised €1.75bn via a two-part issuance. It raised €500mn via a 4NC3 FRN at 3m Euribor plus 68bp, 27bp inside initial guidance of 3m Euribor plus 95bp area. It also raised €1.25bn via a 11NC10 bond at a yield of 3.792%, 27bp inside initial guidance of MS+145bp area. The senior unsecured notes are rated Baa1/BBB+/A. Proceeds from all the notes will be used for general corporate purposes, including strengthening the capital base of the issuer and/or its subsidiaries.

Foxconn Singapore (Hon Hai) raised €650mn via a 6Y bond at a yield of 3.186%, 45bp inside initial guidance of MS+125bp area. The senior unsecured note is rated A-, and received orders of over €3.5bn, 5.4x issue size. Proceeds will be used to finance capex, refinance debt obligations, for capital injection, investment and for other general corporate purposes.

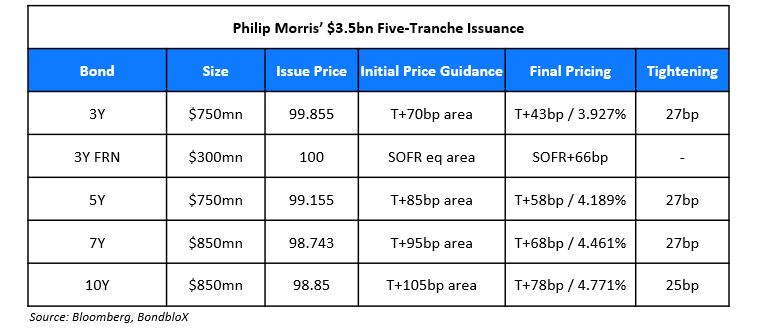

Philip Morris raised $3.5bn via a five-part issuance.

The senior unsecured notes are rated A2/A-/A. Proceeds will be used for general corporate purposes, to repay all or a portion of its outstanding commercial paper and to refinance its outstanding 4.875% 2026s, 2.75% 2026s or EUR-denominated 2.875% 2026s; or to meet the working capital requirements.

New Bonds Pipeline

-

Clifford Capital $ FRN bond

Rating Changes

- Fitch Upgrades DTEK Energy to ‘CCC-‘ from ‘CC’

- Moody’s Ratings upgrades Brinker’s CFR to Ba2; outlook remains positive

- Fitch Upgrades Credit Agricole Bank Polska S.A. Viability Rating to ‘bb’; Affirms IDR at ‘A+’

- Fitch Upgrades BNP Paribas Bank Polska’s VR to ‘bbb’; Affirms IDR at ‘A+’/Negative

- Fitch Places Genting Group on Rating Watch Negative on Genting Malaysia Takeover Proposal

- Brandywine Realty Trust Outlook Revised To Negative On Refinancing Risk and Weaker Credit Metrics; Ratings Affirmed

- Nestlé S.A. Outlook Revised To Negative On Slower Deleveraging Prospects; ‘AA-/A-1+’ Ratings Affirmed

- Moody’s Ratings changes Carter’s outlook to negative from stable; affirms Ba2 CFR

Term of the Day: Block Trades

Block trades are large, privately negotiated securities transactions that are executed away from the public markets to minimize disruption and avoid large spikes on either side of the trade. These can happen in the stock or bond markets. The party that initiates the trade discreetly finds a suitable counterparty, typically a large institutional investor willing to take the other side of the trade. After the deal is finalized, it is reported to the public market, typically with a delay, thus ensuring that the market is not affected by the trade’s full size until it is complete.

Talking Heads

On large rates market block trade envisioning end of Fed balance sheet unwind

Steven Zeng, Deutsche Bank

“It’s a trade that plays into the view that the Fed will stop QT (this week) and announce new policies to calm funding markets, allowing SOFR to come down from current levels relative to fed funds”

On Bessent Saying Japan’s Expansionary Policy Is Boosting Stocks

Satsuki Katayama, Finance Minister of Japan

“Bessent told me that ‘Sanaenomics,’ which carries on the spirit of Abenomics, seems to be working well and sending a very positive signal”

On Indonesian Bonds Being the Top Pick for Schroders on Purbaya, BI Bets

Julia Ho, Schroder

“We’re beginning to see the new finance minister coming across as quite prudent. They have a lot of cash on the central bank’s balance sheet. Why not use that to create more loans?”

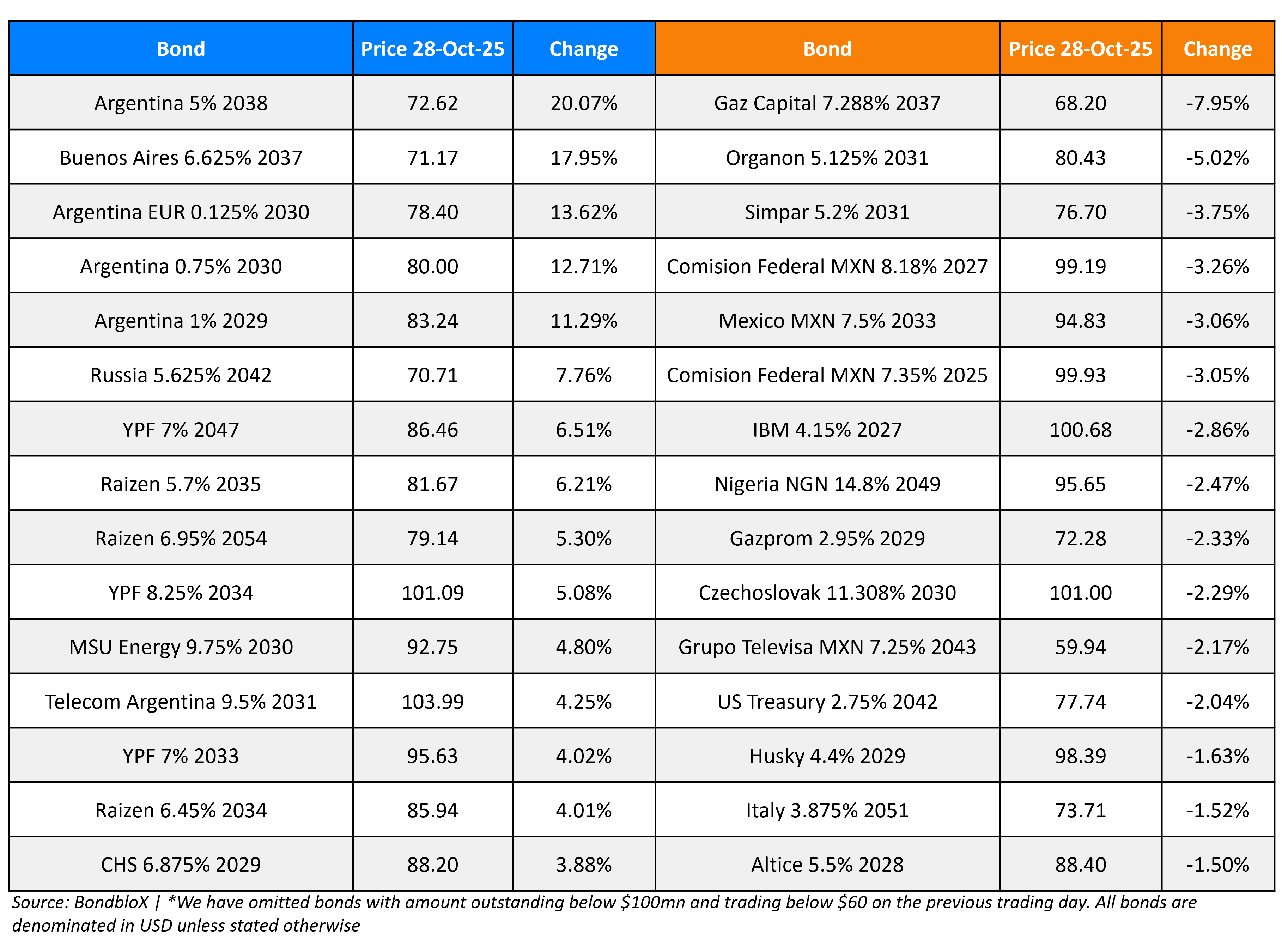

Top Gainers and Losers- 28-Oct-25*

Go back to Latest bond Market News

Related Posts: