This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

May 2025: High Yield Bonds Outperform as the UST Curve Shifts Higher

June 2, 2025

May 2025 was a mixed month for bond investors, with 61% of dollar bonds ending lower (price returns ex-coupons). About 72% Investment Grade (IG) dollar bonds ended in the red, while 77% of High Yield (HY) bonds ended in the green. This came on the back of the rise in US Treasury yields after US President Trump delayed his tariff policy, allowing for negotiations with different nations within a time period. Markets also repriced rate cut expectations by the Fed following this and stable economic data from the US. From pricing-in about 75bp in rate cuts for 2025 as of end-April, markets are now pricing-in about 50bp in cuts.

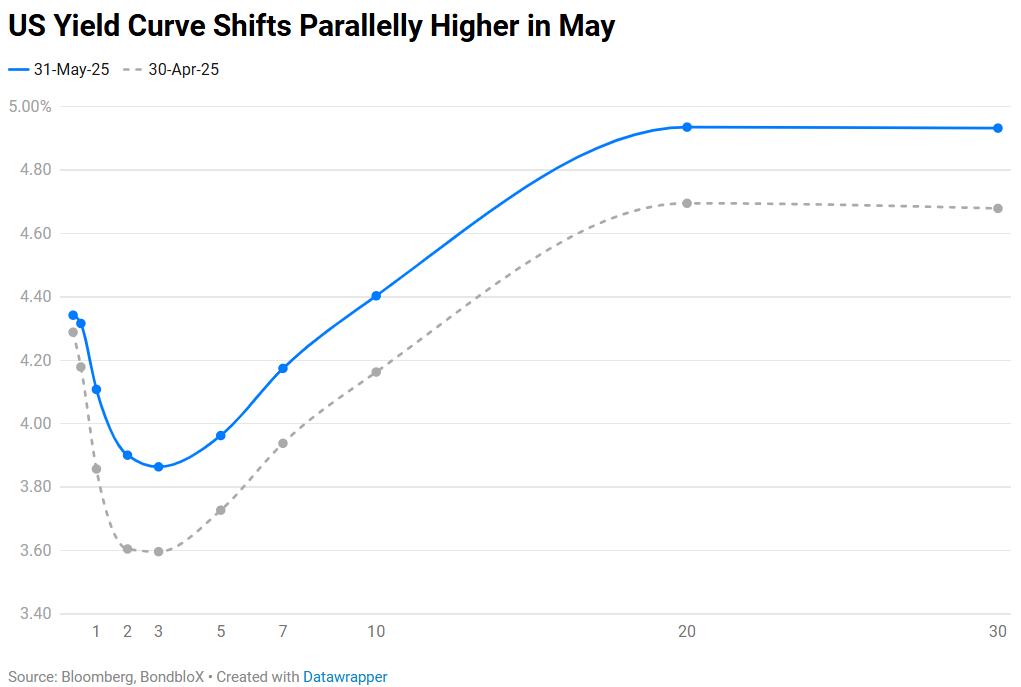

The month of May saw the Treasury yield curve shift further higher from April, with a parallel upward move of ~25bp across the curve. The move started with the strong Non-Farm Payrolls (NFP) print that saw a pick-up of 177k jobs, higher than the surveyed 138k. The Unemployment Rate held steady at 4.2%. US inflation continued to ease slightly, with April CPI up 2.3% YoY, softer than the expected 2.4%. Core CPI came at 2.8%, in-line with expectations. Meanwhile, both manufacturing and services sector activity continued to improve. Following the continued upbeat data and relaxation in tariff policy, FOMC members hinted at a delay in rate cuts, and the need to wait for the impact of the US administration’s policies.

In the top-rated AAA to A- bucket, longer dated bonds dropped by over 5% on the back of the rise in benchmark rates. Bonds of issuers such as WarnerMedia, Discovery Communications, Temasek led the decline.

Among the top gainers within the HY segment, Foot Locker’s bonds rallied by over 17% after Dick’s Sporting Goods laid out a plan to acquire the company for $2.4bn. Also, Lumen’s bonds rallied by over 15% after AT&T agreed to acquire their consumer fiber operations for $5.75bn in cash. Maldives’ dollar bonds were also among the top gainers after it announced plans to build an $8.8bn Maldives International Financial Centre (MIFC) in Malé to become a business hub by 2030. Besides, the nation also received $50mn in financial support from India. Among the losers, NWD’s dollar bonds plummeted in May by nearly 30% – while it was on track to secure support from banks for a ~$11.2bn refinancing, the developer ultimately chose to defer the coupon payments on its perpetual notes. Also, New Fortress Energy’s bonds fell over 28% as all segments delivered weak quarterly performance. Other losers included dollar bonds of Ukraine on the back of worsening tensions in the conflict with Russia.

Issuance Volumes

Global corporate dollar bond issuances stood at $276bn in May, 16% higher than April. As compared to April 2024, issuance volumes were up 8%. 82% of the issuance volumes came from IG issuers with HY comprising 15% and unrated issuers taking the remaining 3%.

Asia ex-Japan & Middle East G3 issuance stood at $23bn, up 15% MoM whilst being lower by 6% YoY. 72% of the volumes came from IG issuers with HY issuing 23% and unrated issuers taking the rest.

Largest Deals

The largest deals globally was led by Siemens’ €7bn six-part issuance, followed by HSBC’s ~€7.9bn mutli-currency deals. Other large issuances in May included KfW’s $5bn deal, Citibank, UPS and KfW’s $4bn four-tranchers each.

In the APAC and Middle East region, deal volumes were led by Aramco’s $5bn three-tranche deal, followed by Bahrain’s $1.75bn sukuk and Westpac’s €1.5bn issuance, DPW, CCB and Adnoc Murban raising $1.5bn each. Other large deals included ICBC’s $1.3bn two-tranche issuance, Alinma Bank’s $1bn deal , Masdar’s $1bn two-tranche deal.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024