This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Trade Quiet on US Holiday

May 27, 2025

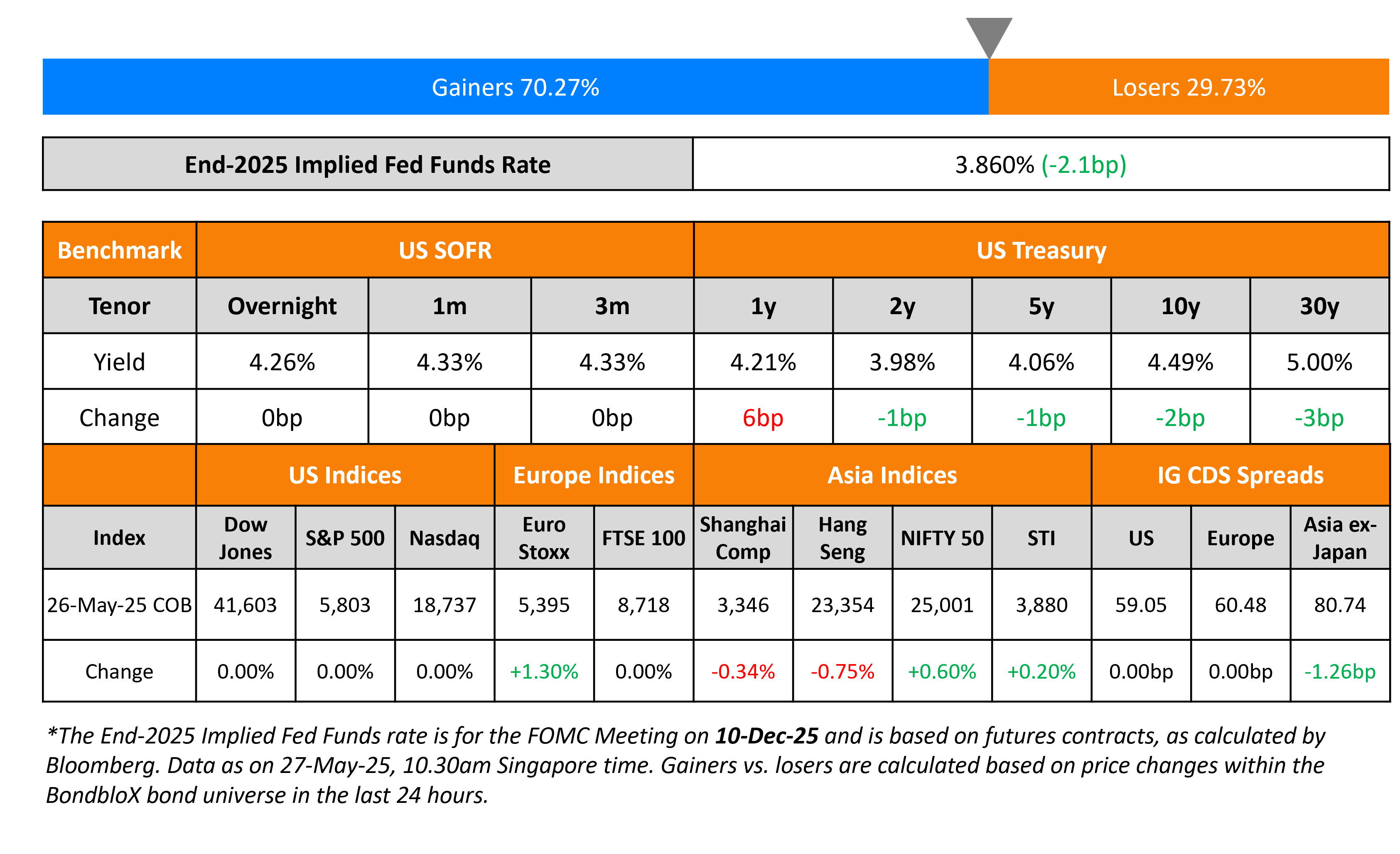

On Monday, US Treasury yields were broadly steady across the curve. However 1Y yield jumped up by 6bp. EU Trade Commissioner Maros Sefcovic said that EU remains ‘fully committed’ on reaching a trade agreement with US. US President Donald Trump said that US would reassert control over steel production to protect the domestic steel industry, adding that US Steel will continue to remain in US-based control. Minneapolis Fed President Neel Kashkari said that he was not sure if the policy path would be clear by September.

US equity and credit markets were closed yesterday on account of Memorial Day. Similarly, European credit markets were also closed due to the Spring Bank holiday. Asian equity markets have opened lower today. Asia ex-Japan IG CDS spreads tightened by 1.3bp.

New Bond Issues

.png)

Rating Changes

-

Moody’s Ratings upgrades Banco de Sabadell, S.A.’s subordinated debt rating to Baa3

-

Rating On Mitsubishi Heavy Industries Upgraded To ‘A-‘ On Improving Profitability and Financial Position; Outlook Stable

-

Fitch Revises Outlook on Zhuhai Huafa Group to Positive; Affirms ‘BBB’

Term of the Day: Bridge Financing

Bridge financing is a temporary form of financing used to cover the borrower’s short-term costs until the moment when regular long-term financing is secured. This form of financing ‘bridges’ the gap between when the borrower’s funds are set to dry up and its next long-term funding option.

Talking Heads

On Declining JGB Market Volatility, says Dai-Ichi Life CEO Tetsuya Kikuta

“There are a very limited number of long-only JGB investors and they are being replaced by short-term players…That’s pushing up the JGB market’s volatility…Japan’s potential economic growth rate is less than 1%. And inflation only affects shorter-term interest rates. So, fundamentally, I don’t think long-term rates should be where they are now…They are just overshooting temporarily, due partly to supply and demand.”

On ECB Facing Risks of Inflation Undershooting 2%, says Simkus

“I see scope for an interest-rate reduction…The risks that inflation will be below the goal in the future have increased”

On BIS Urging Governments to Curb ‘Relentless’ Rise in Debt, says BIS GM Agustin Carstens

“But the days of ultra-low rates are over. Fiscal authorities have a narrow window to put their house in order before the public’s trust in their commitments starts to fray…Markets are already waking up to the fact that some paths are not sustainable…That is why fiscal consolidation in many economies needs to start now. Muddling through is not enough…The result would be rising inflation and sharp exchange rate depreciations…In light of these considerations, it is essential for fiscal authorities to curb the relentless rise in public debt”

Top Gainers and Losers- 27-May-25*

Go back to Latest bond Market News

Related Posts:.png)